- The other sections of this year's Business, Accounting and Financial Studies paper were relatively easy though

- Some questions tested concepts from different topics, which was rare in past exams

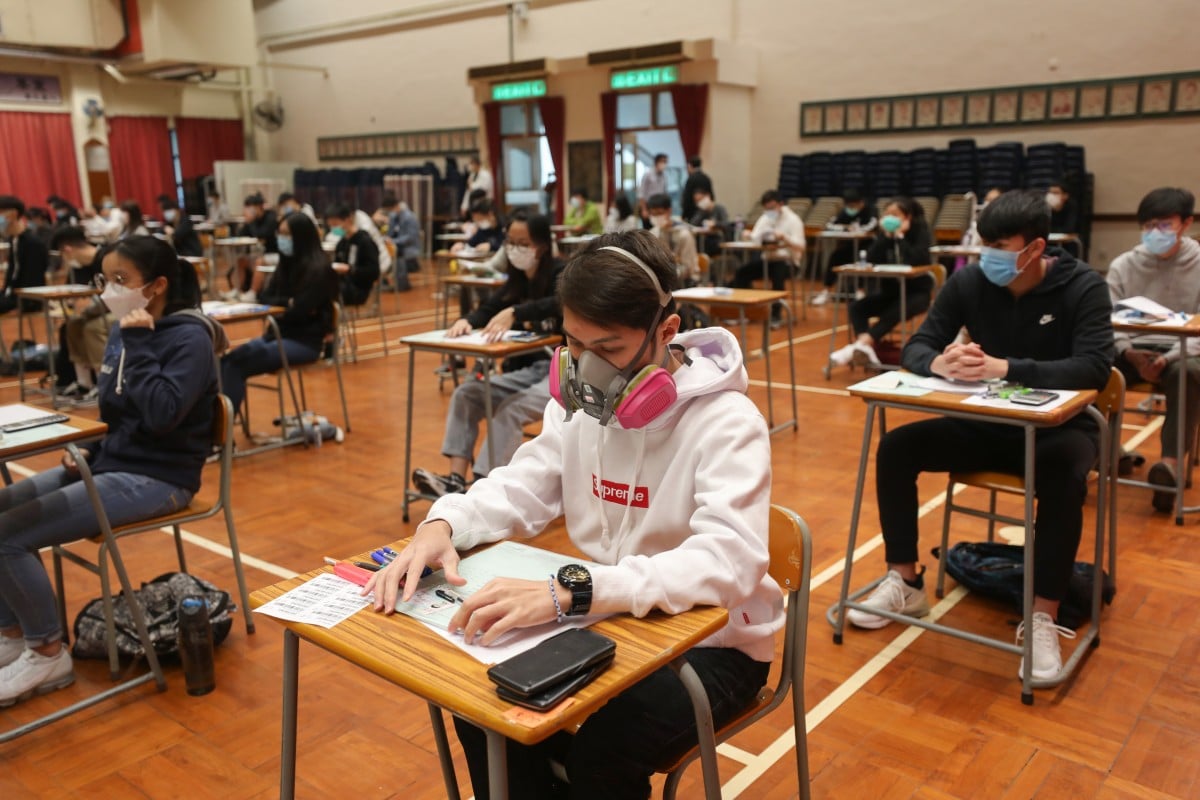

The BAFS public exam of the HKDSE took place on May 16, 2020.

The BAFS public exam of the HKDSE took place on May 16, 2020.Tutors said this year’s Business, Accounting and Financial Studies paper featured the most difficult multiple choice questions in the entire history of the exam, while other sections were relatively easy. More than 9,900 candidates took part in the exam on Saturday, as the annual university entrance assessments continue.

“I think the difficulty of this year’s multiple choice questions was the highest of all time. It incorporated many new things that students had not encountered before in the textbooks. It was also hard for them to deduce the answers with logic alone,” said Andy Yeung, a tutor at Beacon College.

Question 19 in Paper One Section A, which had 30 multiple choice questions in total, asked about the rights of an investor in debenture. Since there are multiple ways to handle different types of debentures, Yeung estimated that 80 per cent of the candidates would not be able to tackle this question.

Leo Lau, a tutor at the iCon Education, agreed that Question 19 was too advanced for candidates. One of multiple choice options was that the investor could cancel the investment transaction in the cooling off period.

HKDSE 2020: To ace the economics exam, 'go in with a plan', say tutors

“The cooling off period is such a specific concept and may be unfamiliar to most students. On top of that, the question itself was very ambiguous. In the market, there are listed and unlisted debentures and the way to handle their cooling-off periods is different. Also, was it asking about the pre-investment or post-investment cooling off period? It really didn’t specify it,” said Lau.

Question 2 was very vague as well. It asked about the role of management in a business. While statements one and three, “optimise utilisation of organisational resources” and “achieve organisational goals effectively” were clearly correct statements, statement two sounded a bit strange, Lau said.

“It was ‘establish sound organisational structure’. While it is an expected measure in the process, it does not necessarily amount to the significance of management to a business. Candidates might find it a bit tricky because this question was poorly designed,” said Lau.

The multiple choice questions were the hardest in the BAFS exam's history, tutors said.Lau also said Question 22 was not as easy as it seemed. The question was, “Which of the following companies does not fulfil its social responsibility?” Many students might be stuck between option C and D, which were “a company charges a higher price than its competitors selling the same type of product”, and “a company does not provide training and development opportunities for its employees” respectively.

“Some students might think C is correct because they consider customers as one of the stakeholders. But they also need to understand that the costs for different businesses are variable and companies do have complete freedom in setting the prices, so the correct answer should be D instead.”

However, both tutors agreed that most of the questions in Paper One Section B and Paper Two were not hard to handle.

In Question 5 of Paper One Section B, candidates were asked to explain one difference between a partnership and a joint venturs. Although the answer was not difficult (partnerships are established between people and joint ventures are between companies), this cross-over between two topics was unprecedented, Yeung said.

HKDSE 2020: Geography exam tips and last-minute advice to approach the syllabus

He added, “Out of the three main topics in Paper One, questions about Compulsory Accounting were fairly easy. Personal Finance was becoming increasingly important as it was incorporated in a lot of both multiple choice and short questions, while questions about Business Environment and Management took up the majority of marks.”

For Paper Two in the Accounting Module, Lau said a lot of students do not revise enough about financial analysis and might not have been able to handle Question 5.

“A lot of students tend to neglect this part during their review, but this question was worth 12 marks. It is a reminder for candidates in the coming years to pay attention to the accounting ratio,” said Lau.

He also pointed out that many students tend to focus the more advanced topics and neglect the foundation topics such as depreciation, allowance for doubtful debts, accruals and prepayments, and inventory valuation. These are the concepts that they should be extremely familiar with, especially when sometimes questions merge concepts from different topics.

Both tutors said that Paper Two was relatively easy. For example, Question 1 was about filling in the blanks in day books, and was almost identical to the first question in the 2016 exam. Question 2 was also a “very straightforward” question about depreciation, said Yeung, as the usage-based method appeared in 2017 as well.

Yeung said the short questions were comparable to previous years, though questions that tested concepts from different topics were new. He suggested that candidates go over the exam authority’s official syllabus instead of the one provided in typical textbooks for guidance about what to revise.

Lau also said that the candidates in the upcoming years need to really understand what types of mistakes people are making. “They should also ponder on how the exam authority might tweak the questions a little bit so they could be reused in the following years, as that was usually the general practice.”

Matthew Leung, a 17-year-old candidate from Sing Yin Secondary School said that this year’s paper was simple and straightforward. He said he did not have any difficulty in completing the multiple choice questions.

“If you’ve done enough exercises and you’re careful enough during the exam, you would find everything quite easy. Everything was straightforward and there really weren't any surprises,” he said.