Advertisement

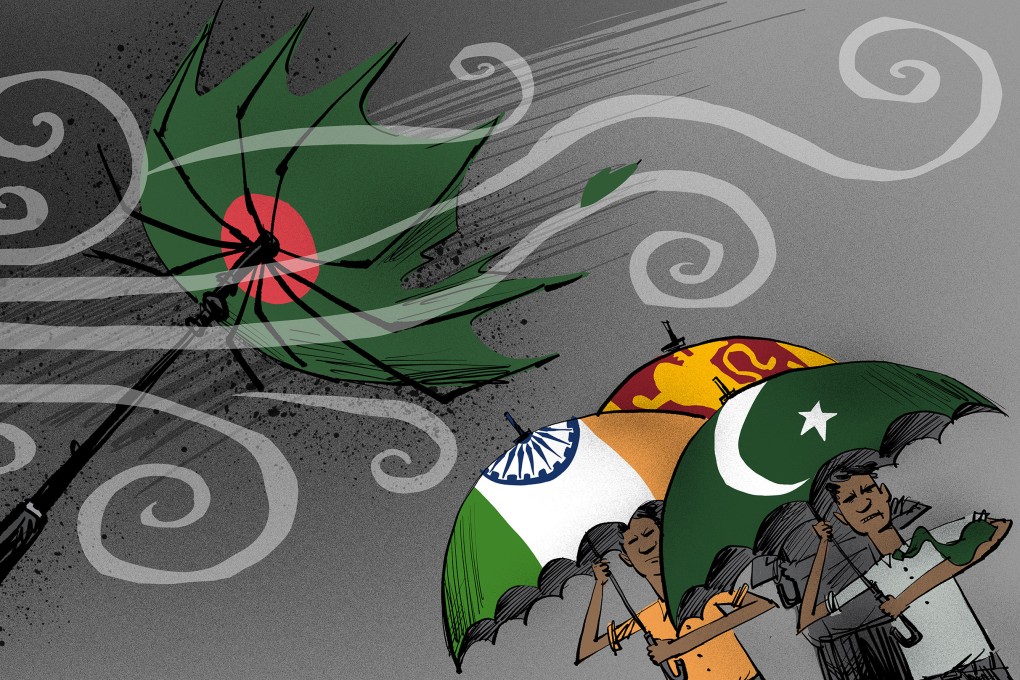

Opinion | Bangladesh unrest signals troubling headwinds for Global South

- To surpass the West, the so-called ‘rest’ must first reckon with economic mismanagement, youth unemployment and shifting public opinion

Reading Time:4 minutes

Why you can trust SCMP

3

The year of elections has claimed its first casualty. Bangladeshi Prime Minister Sheikh Hasina who was re-elected for her fourth consecutive term in January fled the country earlier this month after her position became untenable amid growing anti-government protests.

The unrest that prompted Hasina’s departure related to the issue of public sector job quotas for families of war veterans. However, developments in Bangladesh can also be seen as a harbinger of broader trends in South Asia and the Global South.

The instability in Bangladesh bears an eerie resemblance to recent developments in other South Asian countries. It was only two years ago that Sri Lanka saw anti-government demonstrations that led to then-president Gotabaya Rajapaksa to flee the country. The images of anti-government demonstrators storming the prime minister’s residence in Dhaka parallels what happened in Sri Lanka in 2022 after protesters overran the presidential palace and prime minister’s residence in Colombo.

Advertisement

Similar scenes were seen in Pakistan in 2023, when anti-government protesters attacked an army garrison and corps commander’s residence. This followed the arrest of former prime minister Imran Khan after his removal from power.

In every case a common theme is economic distress. Bangladesh, Sri Lanka and Pakistan are all in the midst of International Monetary Fund bailouts. Pakistan has just secured its 24th IMF bailout, a world record. Sri Lanka is barely on the road to recovery from its 2022 sovereign default. Bangladesh is in the midst of a US$4.7 billion IMF bailout.

Advertisement

The West has often attributed this economic distress to China’s opaque lending practices and coercive economic activities. China accounts for over two-thirds of Pakistan’s external bilateral debt, over 60 per cent for the Maldives, over 50 per cent for Sri Lanka and around a quarter of Bangladesh’s foreign debt. Sri Lanka’s Hambantota port project has become synonymous with China’s alleged debt-trap diplomacy narrative after Beijing secured a 99-year lease for the project.

Advertisement

Select Voice

Select Speed

1.00x