Advertisement

Opinion | The Indian government cannot be trusted to tell the truth about its finances

- Creative accounting has shifted chunks of government debt off the books, making it hard to gauge the size of India’s budget deficit. Two things are for certain, the fiscal hole is deeper than officially announced and the government is not telling the whole truth

Reading Time:3 minutes

Why you can trust SCMP

0

Few things can hold back an economy as effectively as a bloated public sector and mismanaged government finances. India has both of these problems. Even the government’s own auditor, the comptroller and auditor general, has pointed out problems in the budget.

Let us start with the oversized public sector. The government runs numerous “businesses” called public-sector undertakings, which operate in industries such as telecommunications, banking, construction and petroleum. Almost all make losses and waste taxpayers’ money. Perhaps the most notorious is Air India, whose losses run into hundreds of millions of dollars annually and owes more than US$8 billion. More than US$4 billion has been poured into it in the past seven years alone.

Such inefficient firms also create opportunity costs. Air India’s fleet of planes could be better utilised by private airlines. It takes up space and runway time at airports, meaning fewer private flights get to operate. It is the same story with other public-sector undertakings, which take up prime real estate, and employ people who could be in more productive jobs in the private sector.

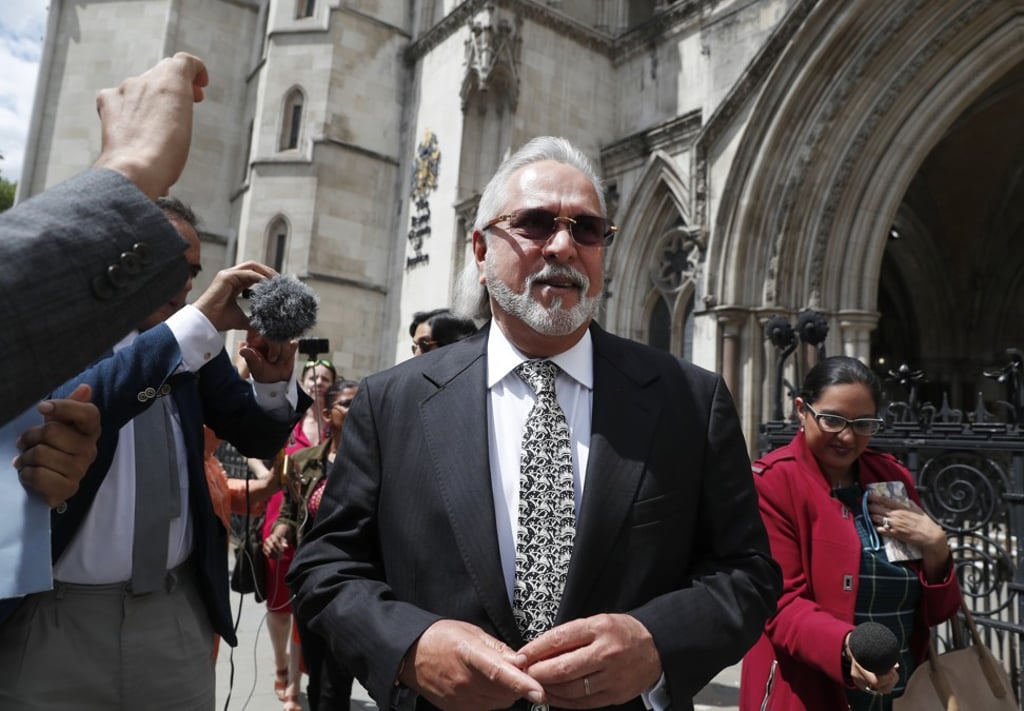

The government also operates at least 18 banks, which impede India’s credit market. While private banks assess borrower credibility and business risks, government banks tend to lend based on political considerations. Fugitive businessmen such as Vijay Mallya and Nirav Modi obtained multibillion-dollar loans from government banks because of their political connections.

These public-sector banks also lend to farmers who have little chance of repaying. Come election time, these loans are waived to garner votes. Unsurprisingly, as much as 15-20 per cent of the loans by government banks turn bad. These banks account for around 60 per cent of Indians’ savings, leading to tremendous waste and misallocation of capital.

This looks bad for a government that portrays itself as reformist and pro-market. So, it has embarked on a programme of “disinvestment”, selling stakes in its public sector undertakings worth US$40.92 billion in the past five years. But what has really happened is that some public-sector undertakings have “acquired” other public-sector undertakings. For instance, Hindustan Petroleum Corporation was “sold” to Oil and Natural Gas Corp, while IDBI, a government bank, was “sold” to Life Insurance Corporation.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x