Bridgewater reports mixed returns after pruning Alibaba, adding bets on Li Auto, Baidu

The value of US-listed Chinese stocks in Bridgewater’s 13F filing fell by 23 per cent last quarter to about US$267 million

Bridgewater Associates trimmed most of its holdings in US-listed Chinese stocks last quarter, including bets on Alibaba Group Holding and Trip.com Group, partly missing a market rally fuelled by Beijing’s stimulus blitz and DeepSeek’s artificial intelligence (AI) breakthrough.

The world’s biggest hedge fund cut half of its position in Alibaba from the preceding three months, 14 per cent of its stake in Tencent Music, and 25 per cent of its bet on video streamer iQiyi, according to its 13F filing on Thursday. The firm also reduced its holdings in e-commerce platform operator PDD Holdings, travel operator Trip.com Group and restaurant chain operator Yum China.

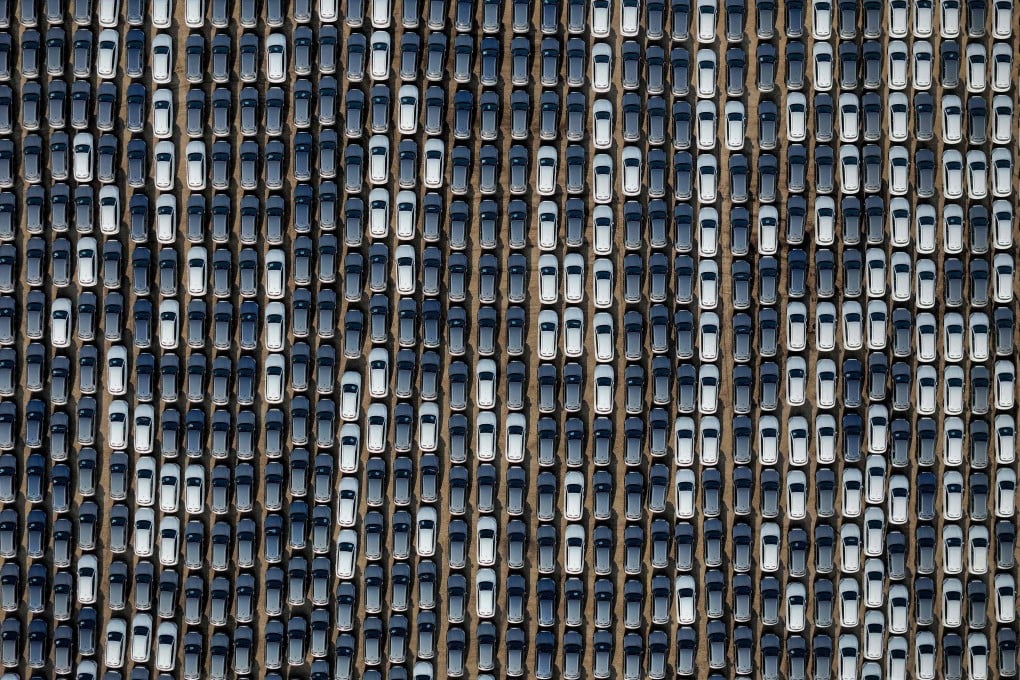

The firm instead scored big wins by boosting its purchases of electric vehicle (EV) maker Li Auto by 131 per cent and search-engine firm Baidu by 72 per cent as their market value surged in New York. A 29 per cent top-up in EV maker Nio failed to pay off as the stock slipped.

Bridgewater disclosed a total of 691 positions in public equities worth US$21.8 billion in the 13F filing, which was part of its US$172 billion of assets under management globally. The firm owned US$2.2 billion worth of shares in the “Magnificent Seven” US tech giants, whose combined value was little changed from the September quarter.

Benchmarks tracking Chinese markets recorded world-beating gains last quarter as bullish funds including Appaloosa Management and Michael Burry’s Scion Asset Management loaded up on JD.com, Alibaba and Baidu. Bridgewater’s mixed returns came amid a cautious outlook and concerns over a trade war with the US.