Sentiment improves after US President Donald Trump says he will cut tariffs on India and gold and silver stabilise.

Telecommunications firms drop after Chinese authorities raise value-added taxes, denting profit expectations.

CEO Wang Ning reveals firm’s latest expansion plan at Friday’s closed-door meeting with UK Prime Minister Keir Starmer.

Despite the setback, the Hang Seng Index is set for its best monthly performance since September 2025.

Zijin, CNOOC, PetroChina, Longfor and China Overseas Land lift Hang Seng Index from early slump.

Busy Ming Group, China’s largest snack and drinks retailer, gains 69 per cent on its Hong Kong debut.

Profit at China’s industrial firms rose 5.3 per cent year on year in December, versus a drop of more than 13 per cent in November.

Gold crosses US$5,000 for the first time amid mounting geopolitical uncertainty and growing investor aversion to major currencies.

Pop Mart CEO’s rare state media remarks and a hit collectible boost shares as China’s consumer stocks gain momentum.

The move is aimed at strengthening the links between the futures, spot and derivatives markets for non-ferrous metals and Shanghai’s role.

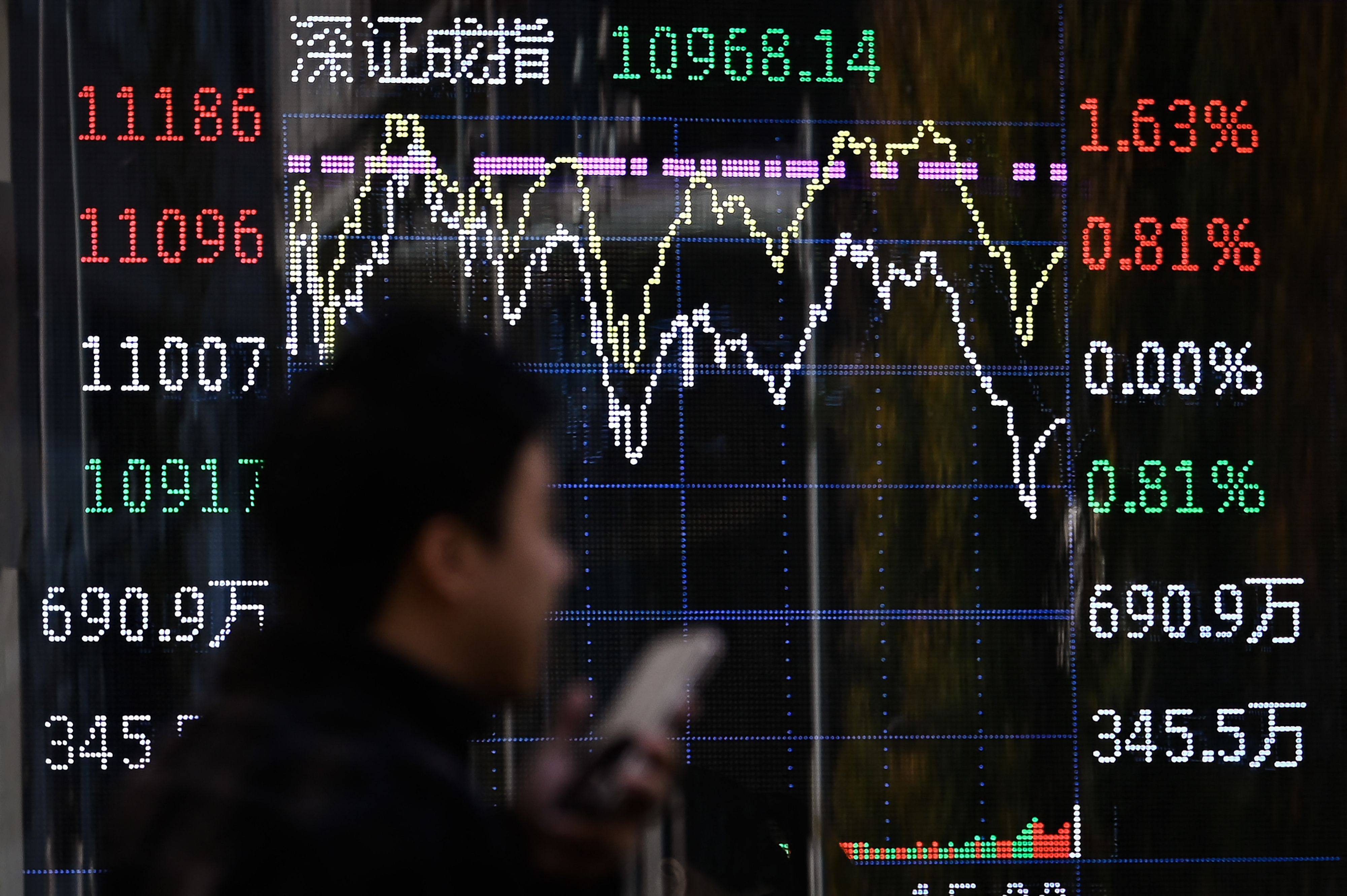

CSRC signals it wants a slower but longer stock market rally after trading volumes and margin financing hit record highs.

Hang Seng Index retreats despite TSMC’s earnings outlook bolstering confidence in AI-related demand and lifting risk appetite globally.

Online travel-booking agency Trip.com slumps 19 per cent after China opens antitrust probe into the company.

Hang Seng Index poised to reach 30,000 as Chinese stocks’ valuations make them difficult for global investors to ignore, Tiger Brokers says.

Hang Seng Index extends rally as regional markets find support amid rising tensions between the US and Iran.

CSRC reforms revive fundraising momentum with 115 firms generating US$18.3 billion across mainland China’s exchanges.

Investors expect Beijing’s ‘policy pivot’ to continue, with a focus on demand-side stimulus and stabilising the housing market, analyst says.

Start of Shanghai-based company’s share sale follows launch of rival Zhipu’s US$560 million IPO a day earlier.

Co-founder and vice-chairman Lin Bin plans to offload no more than US$500 million in any 12-month period starting in December 2026.

Chinese equities edged higher on Friday, led by BYD, after the offshore yuan climbed through 7 per dollar for the first time since 2024.

Mainland stocks closed higher after paring earlier losses as investors read the central bank’s latest messaging as supportive but restrained.

Investors shrug off weaker US Federal Reserve easing hopes and bet on resilient corporate profits into 2026.

Losses in tech heavyweights like Kuaishou, Tencent and Xiaomi pull Hang Seng Index lower after advancing in the morning session.

Hong Kong’s market will close early on Wednesday and remain shut on December 25 and 26.

Vanke, responding to queries from investors, says top managers have not notified it about their intentions so far.

19 Dec 2025 - 7:15PM videocam

From biotech to AI, December’s listings – including at least 15 down the stretch – crown the city’s revival in equity fundraising.

Despite renewed ‘bubble’ talk around AI valuations after a November sell-off, Standard Chartered says the cycle is different this time.

Investors anticipate further easing on monetary, fiscal and property fronts after Beijing vowed to strengthen domestic market.

Investors should shift focus to AI-driven sectors with more rising stars, under-covered companies and pair-trading opportunities.

Investors look to CEWC for growth target, property sector stabilisation and measures to boost domestic demand.