Ping An posts biggest jump in interim net profit since 2015, helped by a one-time tax benefit and a stock market rally in China

- Net income soared 68 per cent to 97.7 billion yuan in the six months ended June 30, beating the 19 per cent increased expected in a Bloomberg survey of analysts

- Revenue rose 17 per cent to 690.25 billion yuan

Net income soared 68 per cent to 97.7 billion yuan in the six months ended June 30, beating the 19 per cent increased expected in a Bloomberg survey of analysts. Revenue rose 17 per cent to 690.25 billion yuan (US$98 billion), while basic earnings per share rose 23.7 per cent to 4.12 yuan.

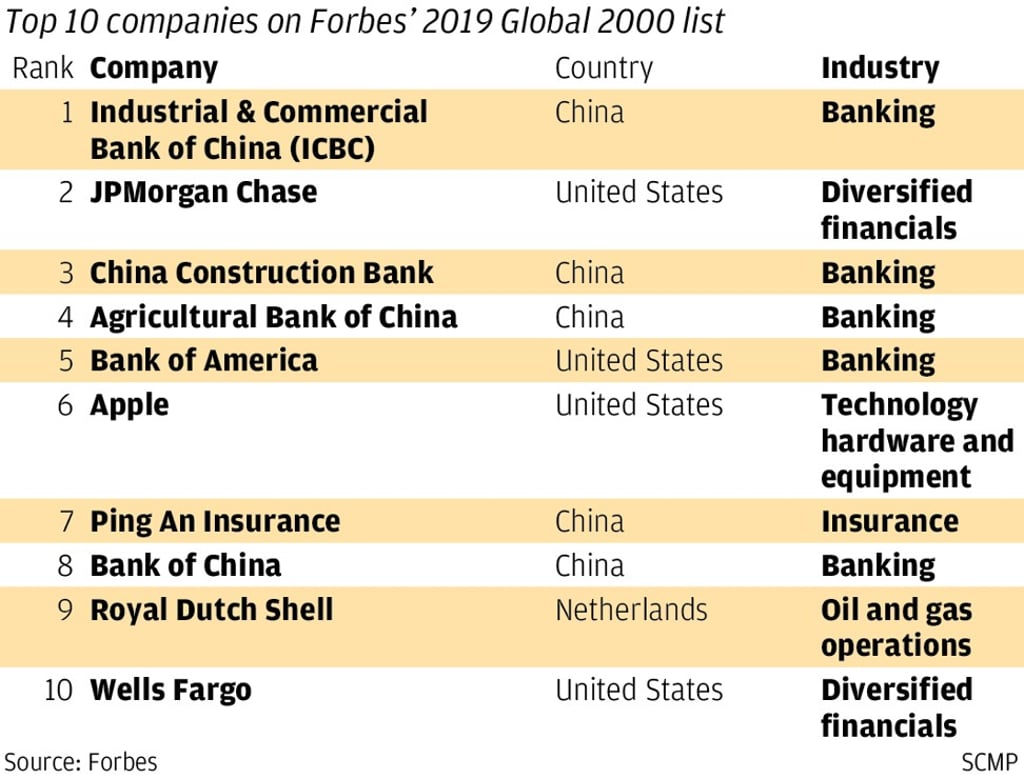

The company, established three decades ago in China’s technology hub of Shenzhen, is also one of China’s largest financial conglomerates, involved in a range of businesses on top of insurance, including banking, wealth management, technology, health care online lending and virtual banking. According to Forbes’ 2019 Global 2000 list, Ping An is the world’s seventh-largest company by capitalisation, behind Apple and ahead of Royal Dutch Shell.

The insurer made a one-time gain of 10.45 billion yuan from tax incentives on its life and property insurance businesses, which benefited from a new tax regime that kicked in three months ago.