The Hang Seng Index fell 1.1 per cent on the first day of trading of the new year, while local gold prices rose 0.6 per cent.

Bank of China (Hong Kong) is giving away hampers, ZA Bank is paying a HK$10,000 bonus, while HSBC and Hang Seng are offering HK$500.

HSBC, Hang Seng Bank, Standard Chartered, Citibank and DBS offer the metal to select clients while it hovers near a record high.

Volatility looms in the Year of the Horse, analysts forecast, after the Year of the Snake delivered estimated earnings of US$32 billion.

Profit growth slows to 7.3 per cent from 8.4 per cent a year earlier as bad loans exceed two-decade average, HKMA says.

City should pitch Southeast Asia, Middle East to draw global listings and issue long-term bonds to attract patient capital, think tank says.

The two financial hubs are best choices for global investors seeking to diversify their portfolios amid geopolitical risks, Tan Su Shan says.

The units on offer included 153 two-bedroom and 65 three-bedroom units, ranging from HK$4.6 million to HK$10.2 million.

Global investors want more than equities, prompting HKEX to expand into bonds and commodities, says CEO.

The city’s largest developer says it is looking into news reports related to Maureen Fung and ‘will follow up as may be appropriate’.

SFC warns over deal-chasing, staff shortages and unchecked use of AI undermining IPO preparations.

Monetary authority signals tougher scrutiny of tech risks after shutdown, as it also moves closer to issuing stablecoin licences.

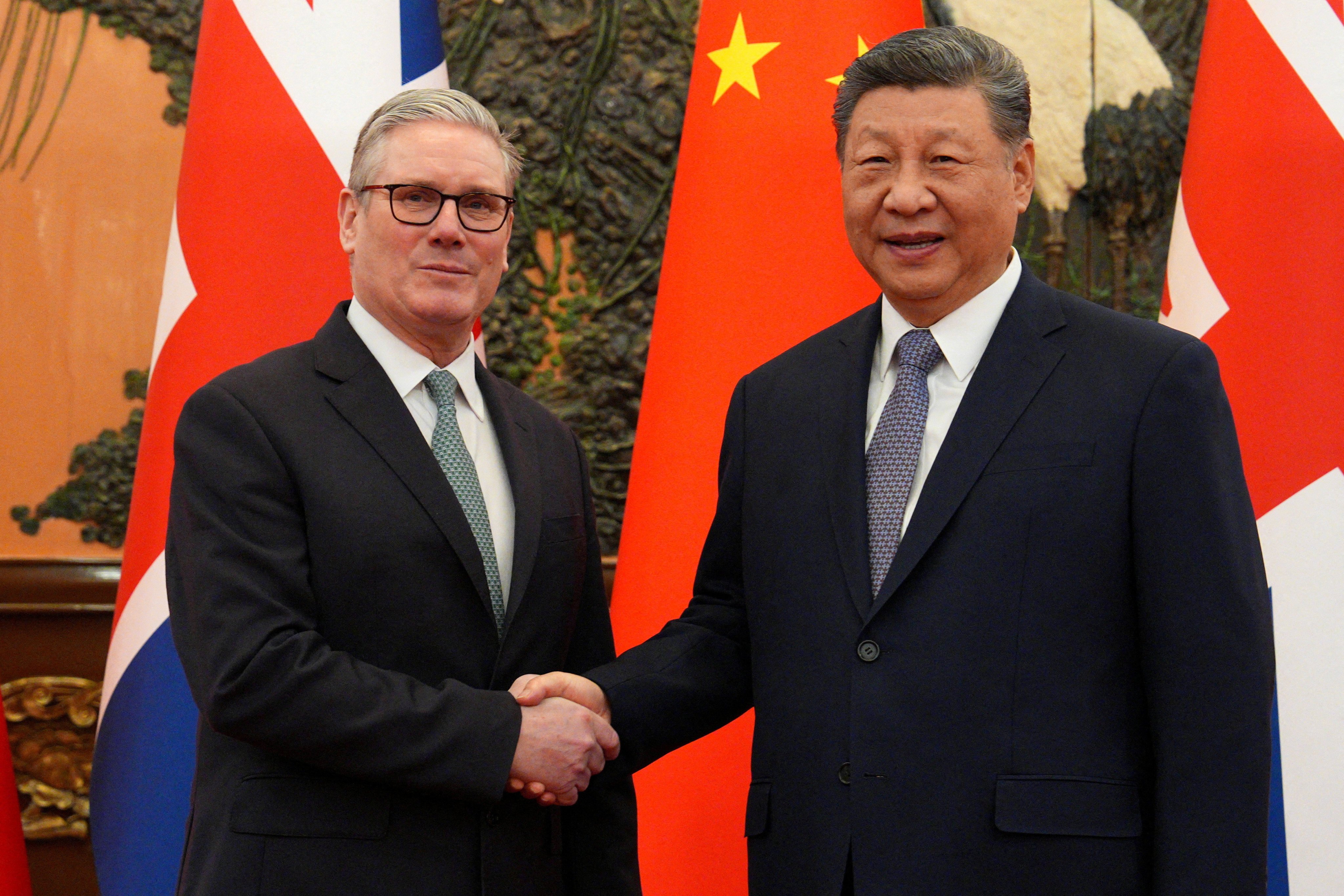

The British leader’s trip has so far yielded tariff cuts and agreements on trade and investment.

30 Jan 2026 - 8:02PM videocam

The bank’s mobile app and in-person services at several branches were unavailable for up to several hours for some customers during the outage.

30 Jan 2026 - 11:03PM videocam

Ashley Alder, chairman of the Financial Conduct Authority, joins the British delegation, with UK-China links high on the agenda.

Analysts see the first US rate cut in June, with a falling Hong Kong interbank rate set to bring relief to borrowers.

The Exchange Fund’s full-year earnings jumped 51 per cent to HK$331 billion (US$42 billion), from HK$218.8 billion in 2024.

City can unlock opportunities providing capital for companies and Belt and Road Initiative infrastructure projects, advisory council says.

As Hong Kong and Shanghai deepen cooperation in the gold market, officials are hailing the agreement as ‘the dawn of a new chapter’.

PBOC to increase yuan facility to US$28.68 billion and issue more sovereign yuan bonds to enhance city’s role as yuan hub, official says.

Most new mortgages, many corporate loans are based on interbank rates, which will continue to fall, monetary authority’s deputy chief says.

John Lee highlights ‘unprecedented achievements’, unveils landmark pact to develop gold trading ecosystem, including clearing platform with Shanghai.

At least three other local insurers, including local unit of Canada’s insurer Sun Life, are planning the same move, industry players say.

Fundraising on the Hong Kong stock exchange reached US$37.22 billion last year, the highest since US$42.97 billion in 2021.

SGX CEO also hopes to launch an international board with Nasdaq later this year and expand cross-trading schemes with mainland China.

The industry wrote US$34 billion worth of life policies in the first nine months of last year.

The monetary authority requires lenders to improve banking apps, branch premises and sales processes to suit the city’s ageing population.

11 companies raised US$4 billion in Hong Kong in the first three weeks of 2026, with hundreds more lining up to list, Bonnie Chan says.

State-owned insurer expects 215 to 225 per cent jump in 2025 net profit due to a gain in investment income, one-off tax impact.

Titled Co-creating New Horizons amid an Evolving Landscape, the annual government flagship event will run from January 26 to 27.