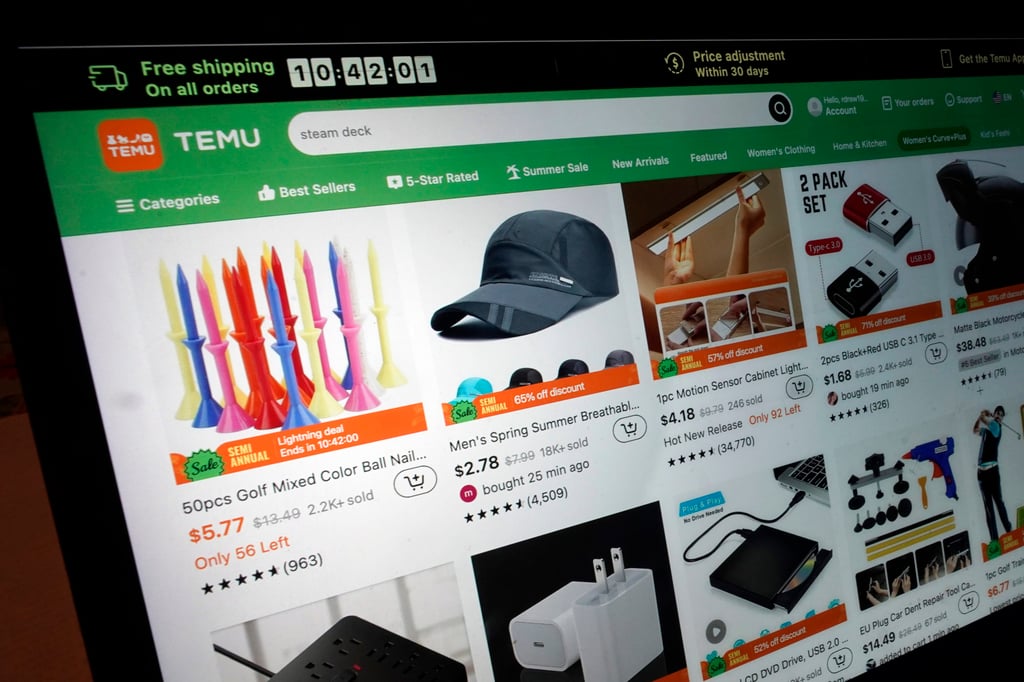

Logistics property: Chinese cross-border e-commerce firms fuel demand, investment prospects in Greater Bay Area

- Temu, Shein, AliExpress and TikTok Shop boost the sector as they scramble to secure space to fuel their growth

- Five bay area cities – Guangzhou, Shenzhen, Dongguan, Foshan and Huizhou – accounted for an outsize proportion of 2023 warehouse uptake, JLL says

For example, PDD Holdings-owned Temu ended the year with more than 30 warehouses in Guangdong province, up from single digits at the start of the year – before the company’s successful Super Bowl campaign.

Five bay area cities – Guangzhou, Shenzhen, Dongguan, Foshan and Huizhou – recorded net absorption of 2.35 million square metres of warehouse space in 2023, accounting for 32 per cent of the net absorption across 24 tracked cities in China, according to JLL. A key gauge of market performance, net absorption equals the amount of space that gets occupied during a specific time period minus the amount that becomes vacant.

Logistics property in the bay area “bucked the headwinds” of a surge in new supply, said Silvia Zeng, head of research for south China at JLL. Southern China recorded a single-digit vacancy rate, versus double-digit rates in the other cities, she added.

Overall net absorption in China soared 44 per cent year on year in 2023 to 7.22 million sq m, the second highest level after a peak in 2021, even though the vacancy rate rose 21.8 per cent amid an unprecedented influx of 12 million sq m of new supply, according to international property consultancy CBRE.