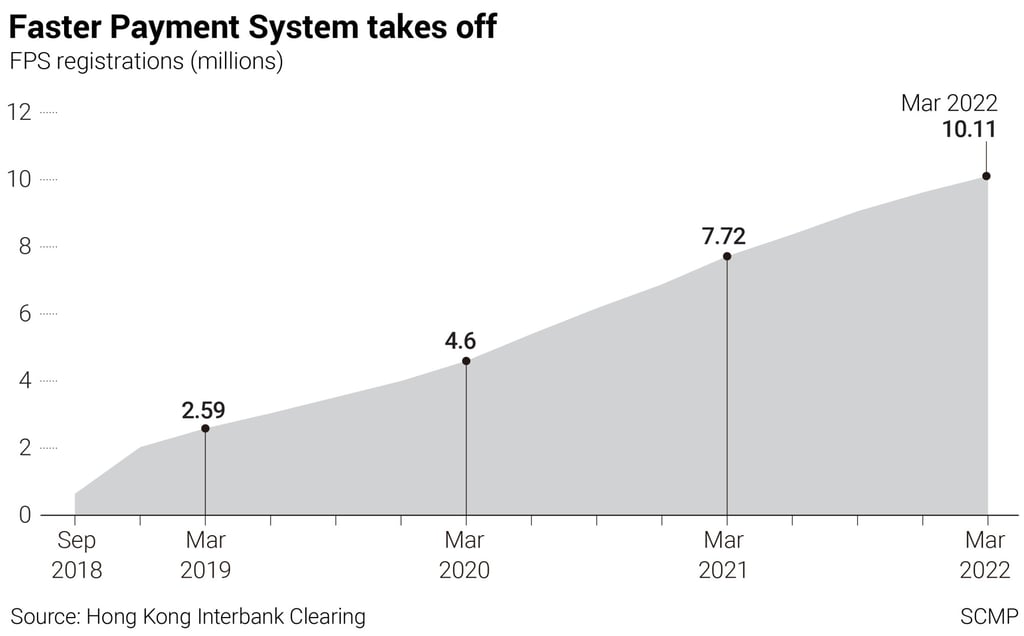

Covid-19 spurs Hong Kong’s rush to dump notes and coins as Faster Payment System tops 10 million registrations in city’s embrace of digital banking

- Faster Payment System (FPS) reached 10.1 million registrations in March

- The pandemic has accelerated digitisation, CEO of virtual bank Livi says

HKMA has been promoting smart and digital banking services since 2017, to save costs for both customers and banks and to improve banking services. Covid-19, which forced people to work from home and many bank branches to close, has inadvertently given its digital push a big boost – FPS gained about 6 million new registrations over a period of two years that coincided with Hong Kong’s worst outbreaks of the coronavirus.

The number of registrations last month was 30 per cent higher than March 2021’s 7.7 million registrations and more than double of the 4 million registrations recorded in January 2020, when the pandemic first hit the city. Before the pandemic started, FPS registrations were growing at a slower pace, with 2 million new registrations in 2019.