Advertisement

Explainer | How China’s Greater Bay Area wealth management connect could help millionaires move their money across borders

- Size of quota, launch date as well as decisions on movement of people and capital still need to be fleshed out, say industry practitioners

- Cross-border banking partnerships seen as key to implementation

Reading Time:5 minutes

Why you can trust SCMP

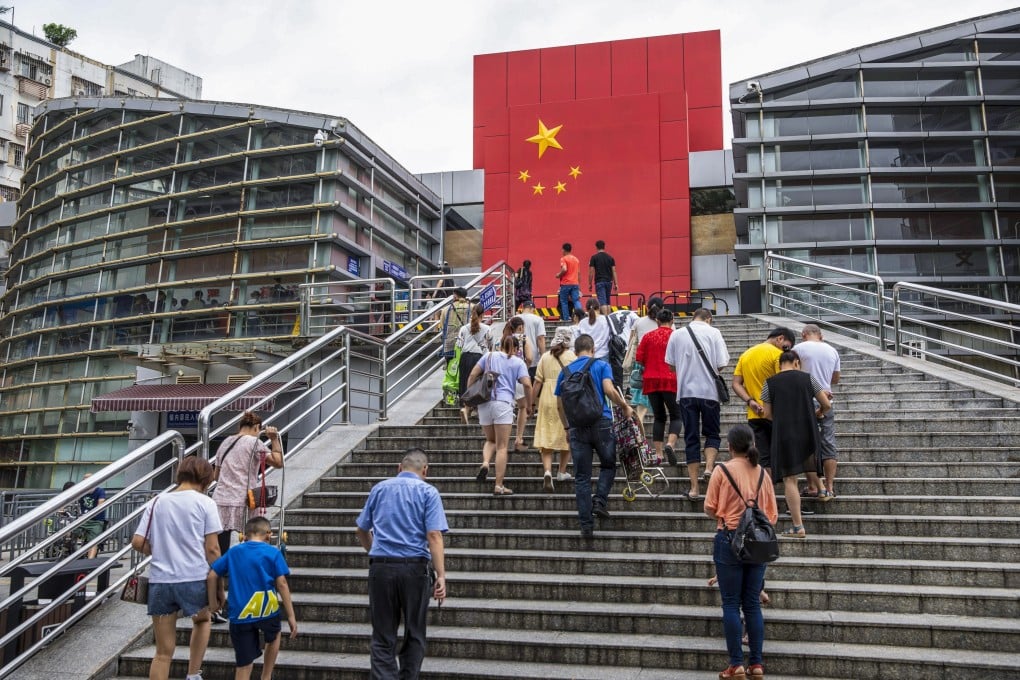

After China unveiled its latest plan to promote the Greater Bay Area as a wealth management hub on June 29, confusion reigned in financial circles.

Under the pilot scheme, dubbed Wealth Management Connect, Hong Kong and Macau residents can buy onshore wealth management products sold by Chinese banks, while bay area residents can invest in products sold by Hong Kong and Macau’s banks.

This broad outline left asset managers puzzling over what it would mean for China’s capital controls and travelling fund salespeople. So far, they agreed, the Wealth Management Connect is more of a concept than a road map.

Advertisement

Behind the scenes, regulators and industry professionals are fleshing out the details and have come up with a working plan for marketing products, regulation of mis-selling, and the type of products allowed, the South China Morning Post has learned.

China has much at stake. If the long-awaited scheme is a success, the bay area’s wealthy will be able to grow their nest eggs at a faster clip by using a wider array of instruments. The region will burnish its credentials as a wealth management hub, and less money will flow to rival destination, Singapore.

Advertisement

The bay area is home to about 480,000 high-net-worth individuals, broadly defined as wealthy people with financial assets in excess of US$1 million, according to consultancy KPMG’s 2018 report.

Advertisement

Select Voice

Select Speed

1.00x