Exchanges take shape in Macau, Guangzhou to turbocharge southern China’s Greater Bay into Asia’s largest financial market

- Second instalment on Hong Kong’s role in the Greater Bay Area looks at how the city, Macau, Guangzhou and Shenzhen could form Asia’s top financial marketplace

- The up-and-coming Macau exchange is a Nasdaq-like market that helps start-ups raise capital, while Guangzhou’s explores carbon emission futures trading

Two new financial markets are taking shape on the drawing boards in southern China, with the potential to turbocharge the Greater Bay Area (GBA)’s economic growth engine. This is the making of Asia’s largest and peerless capital market.

A carbon futures exchange is due for commencement this year in Guangzhou, augmenting the brisk transactions of emission certificates that had been ongoing in the Guangdong provincial capital since 2013. Across the Pearl River in the special administrative region of Macau, state planners are huddling with consultants to kick start a Nasdaq-like stock exchange that can help start-ups and growth companies raise capital.

The up-and-coming Guangzhou and Macau bourses would add to the US$8.84 trillion of combined market capitalisation of Hong Kong and Shenzhen, where the equities and corporate bonds of 4,769 companies change hands, making the region Asia’s largest capital pool.

“Each market will have its unique role and clear financial product differentiation,” said Christopher Hui Ching-yu, Hong Kong’s Secretary for Financial Services and the Treasury, during a recent interview. “With the development of the Greater Bay Area, financial business will grow and it can support multiple exchanges. The US and many other overseas markets also have several exchanges and financial centres.”

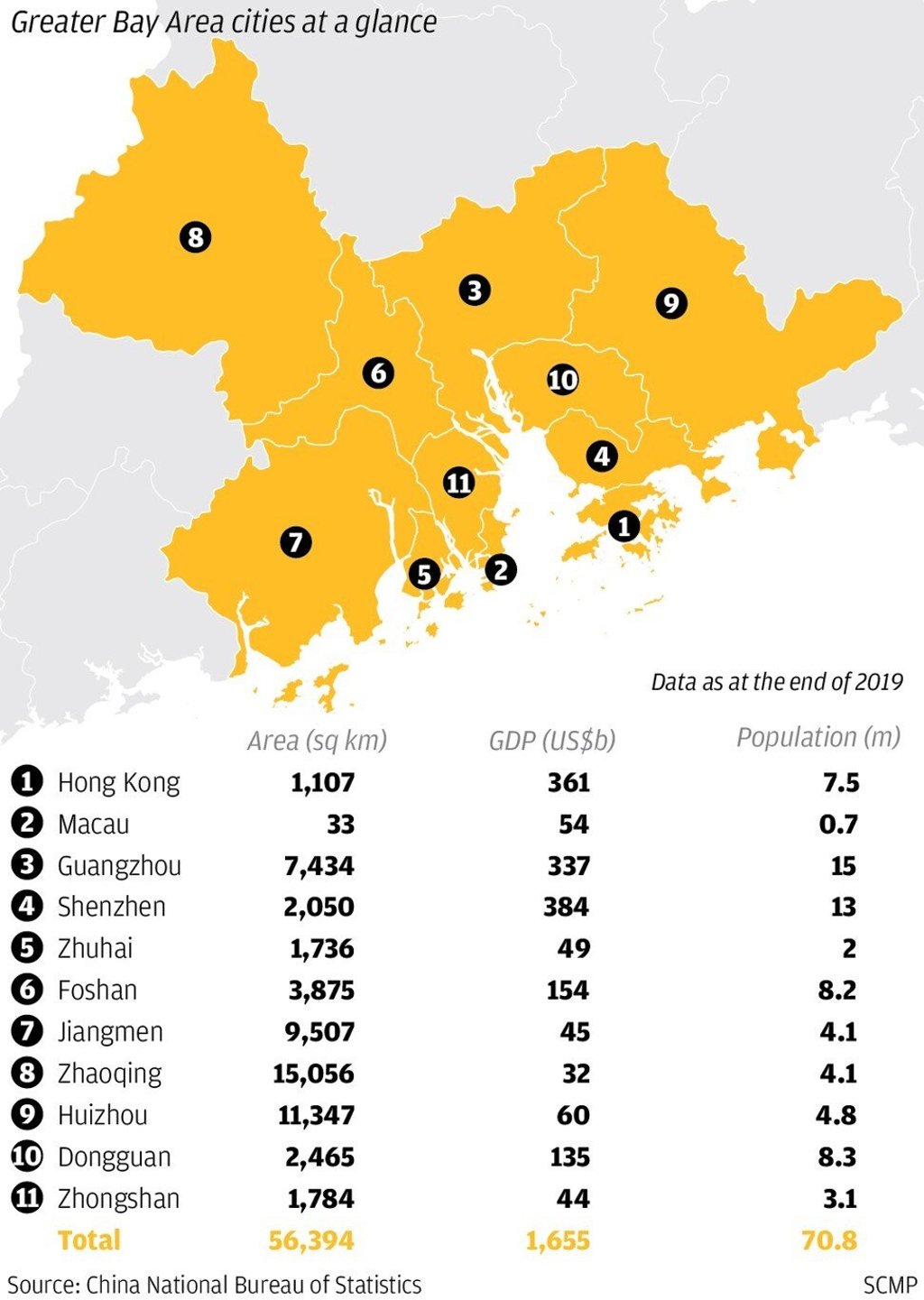

The plan underscores the long-term ambition and prospects for the GBA, which can be considered the world’s 11th largest economy ahead of Russia and behind Canada, if the US$1.65 trillion combined output from its 11 cities including Hong Kong and Macau were counted as a stand-alone entity.

With the Chinese government’s imprimatur and financial heft behind it, the GBA’s population is poised to expand by 43 per cent to 100 million over the next 15 years, according to one official forecast.