Advertisement

Five of Hong Kong’s virtual banks miss target launch date as coronavirus slows preparations

- ZA Bank is fully operational; Ant Bank and Airstar Bank run trials

- Ping An Insurance co-CEO says waiting for coronavirus outbreak to abate

Reading Time:3 minutes

Why you can trust SCMP

Five of Hong Kong’s virtual banks have missed a target launch date as the coronavirus pandemic drags on preparations, giving breathing space to the city’s incumbent banks.

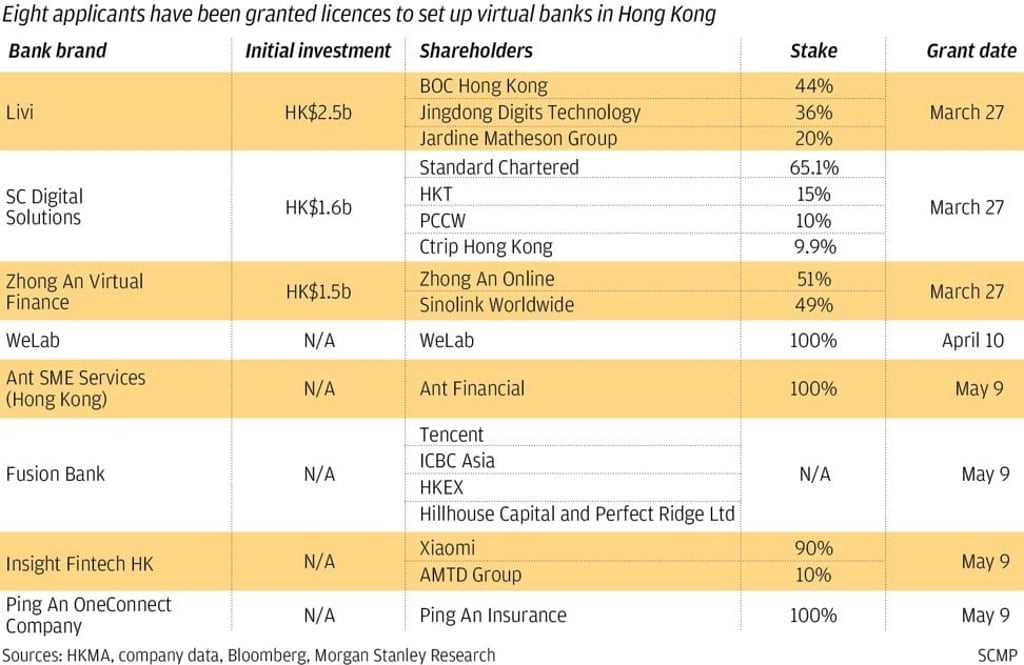

Hong Kong Monetary Authority (HKMA) issued eight virtual bank licences between March and May last year and said that the digital banks would start offering services online within nine months.

The de facto central bank wants to spur financial innovation in the city and catch up with more tech-savvy financial hubs in the US, Europe, Japan and mainland China. When the HKMA was seeking to establish more customer-friendly lenders offering high-interest rates, easy account opening and around the clock service.

Advertisement

However, only ZA Bank, which is owned by mainland online insurer ZhongAn Online P&C Insurance and Sinolink Group, is operational after completing a three-month trial last month.

Advertisement

“The outbreak of Covid-19 has inevitably affected the virtual banks’ preparation for the launch of the business,” said an HKMA spokeswoman in a written statement.

Advertisement

Select Voice

Select Speed

1.00x