Unpacking crypto’s potential could take digital assets mainstream, shape future of investing

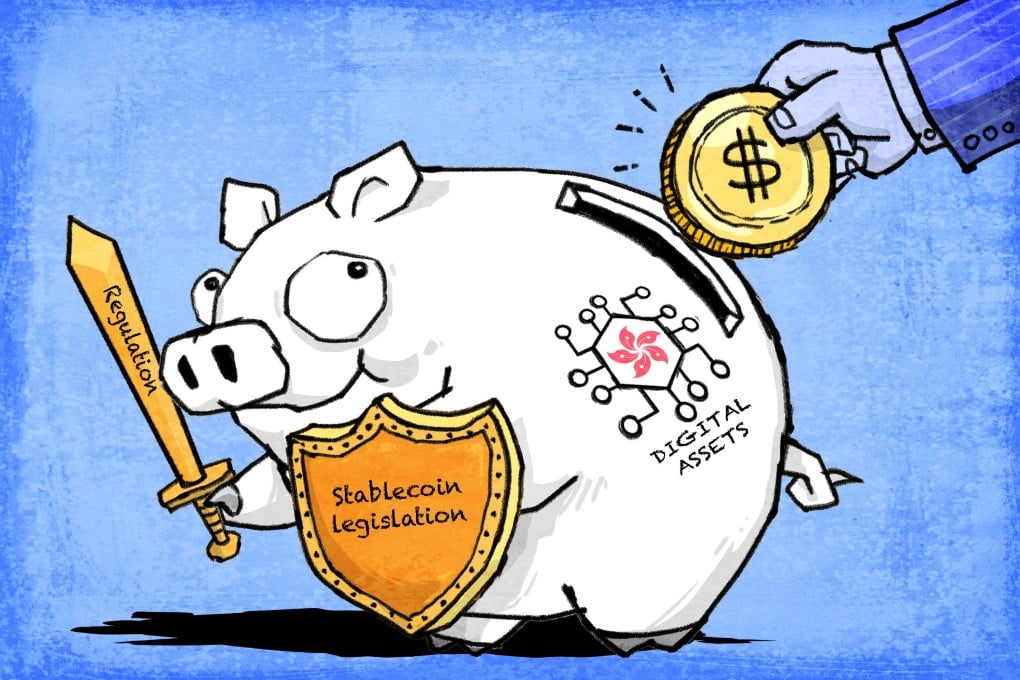

Hong Kong’s regulatory lead signals a new era for digital assets, as crypto attracts global investors and reshapes the future of finance

Greater participation from institutional investors would help reduce cryptocurrency volatility, Khuong said. With increasing regulatory oversight globally, including in Hong Kong and the US, he expected cryptoassets to gain greater utility, which would feed a positive outlook.

“This is just the beginning of the regulatory integration of cryptoassets with traditional finance,” Khuong said.

Another survey by BNY Wealth showed that family offices’ allocations to cryptocurrencies and other digital assets stood at around 7 per cent, boosted by a 75 per cent surge in allocations by non-US family offices over the past 12 months.