Transaction volume under Project mBridge surged over 2,500-fold from the early 2022 pilot levels to more than US$55 billion by November 2025.

Beyond banks, asset managers, fintechs and crypto firms are racing to launch innovative tokenised gold products for investors.

Chinese contract drug maker forecasts 46.3 per cent profit rise and signals continued growth despite US political scrutiny.

Confident companies and investors, solid economic growth, low inflation and ample capital drive outlook, bank’s global M&A co-head says.

Chinese-owned agritech group’s mooted float could rank among Hong Kong’s biggest listing in years.

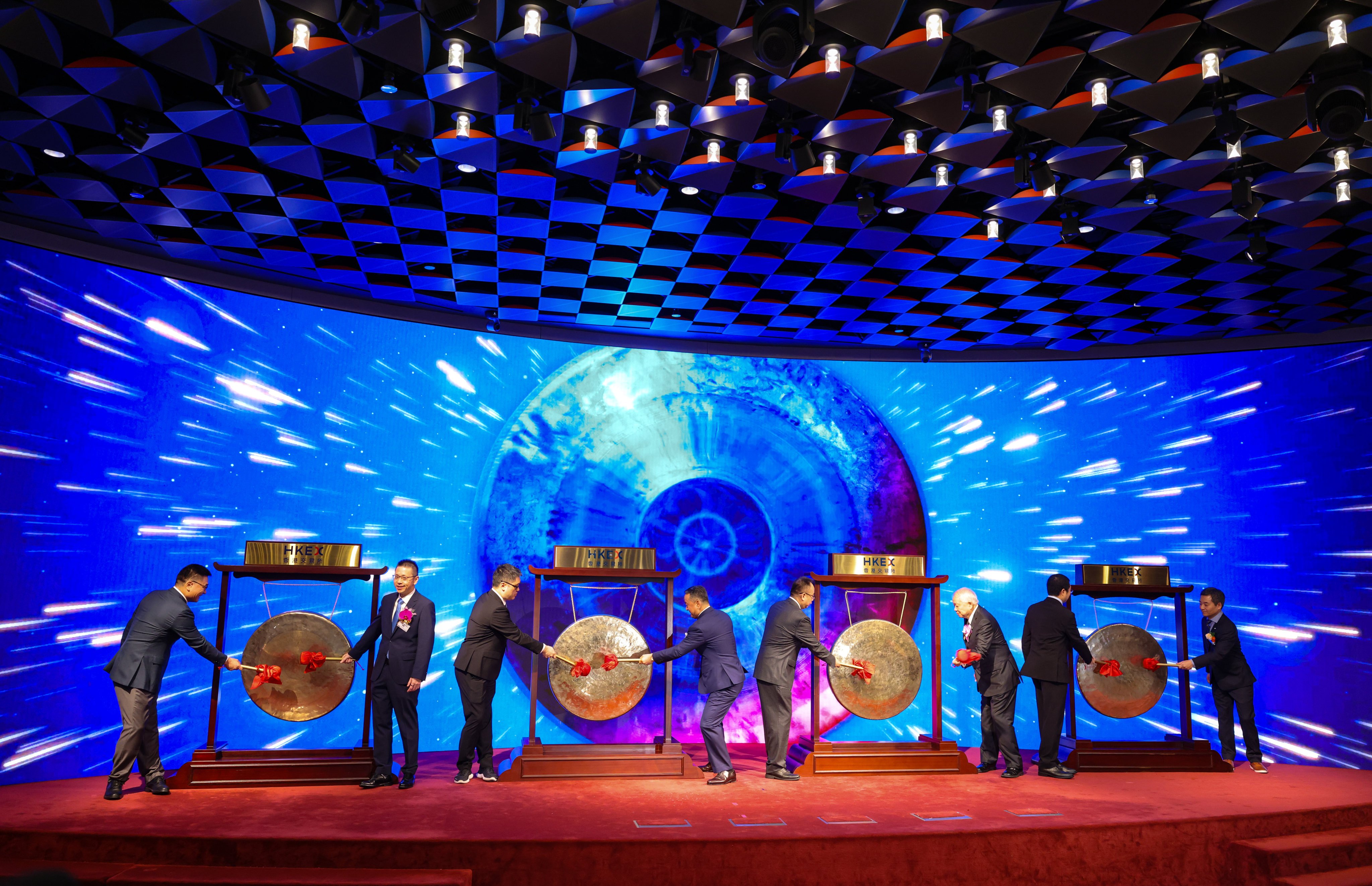

Firm’s US$1.4 billion IPO records lower oversubscription rate than other recent listings, reflecting a cooling of the red-hot market.

Uses of yuan borrowing broaden to include working capital and capex, supported by Hong Kong’s liquidity boost, bankers say.

Muyuan Foods, Shenzhen Han’s and Distinct Healthcare started taking orders for their Hong Kong listings on Thursday.

The Hong Kong Investment Corporation will use the city’s advantages amid global competition, geopolitical challenges, CEO Clara Chan says.

China rated the strongest country in converting AI capacity into production use, while Hong Kong trailed New York and London as finance hub.

Yen hits two-month high amid fears US and Japan will intervene to prop up the currency ahead of Japan’s election next month.

Shanghai-listed firm is selling 40.9 million shares for HK$248 each, which would give it a market cap of about US$21 billion.

Fosun Adgenvax (Chengdu) joins an IPO wave that raised more than US$1.5 billion last year for biotech companies.

Japan’s yield spike is testing safe-haven assumptions, with markets debating whether the movement is local or systemic.

Snack and drink retailer aims to raise up to US$428 million, but listing plan comes amid weak mainland domestic demand.

Issuers and investors flock to Hong Kong dollar and yuan bonds, backed by deep liquidity and diverse yield curves.

In a rare media interaction, the chairman of New World Development’s parent company talks about his family’s unusual investment playbook.

Inflows fall 58 per cent as sovereign wealth funds grow cautious, yet outlook signals selective opportunities ahead, experts say.

GigaDevice shares surge as investors chase Beijing’s self-sufficiency theme, with retail demand oversubscribed more than 540 times.

HSBC’s historic US$13.6 billion buyout of Hang Seng Bank aims to cut costs, tackle bad debts and fuel growth, but challenges abound.

The shares jump as much as 113.2 per cent to HK$351.80 before ending the day 109.1 per cent higher at HK$345.

HSBC receives strong backing from Hang Seng Bank’s independent shareholders, getting 85.75 per cent of the votes.

Zhipu AI, Iluvatar CoreX and Edge Medical raised US$1.2 billion in their share offerings.

The Alibaba-backed firm is set to price its 25.4 million shares at HK$165 each, the top end of its marketed range, sources say.

While digital money experiments promise greater efficiency, they also risk deeper fragmentation and regulatory pitfalls, experts warn.

Dubai’s dim sum bond momentum points to investor confidence in China and diversification from the US dollar, says regulator.

Shares leap 82 per cent in debut after retail investors’ demand exceeds supply by 2,347 times.

Deal value is expected to rise, with strategic transactions and overseas ambitions driving momentum.

Debutants raise total of US$899 million as exchange wraps up one of the most active months for IPOs since 2021.

JD.com, CNBM, carmakers and hundreds of other Chinese companies use the hub to reach consumers across Asia, Africa and Europe.