As Hong Kong’s currency peg marks 40th birthday with little fuss, some traders dither over its future

- Hong Kong has ‘no intention, no interest, no plans to change the linked exchange rate system’, said the de facto central bank

- The biggest hurdle that stands in the way of the Hong Kong dollar’s peg to the yuan is the non-convertibility of the renminbi

Hong Kong’s currency is marking the anniversary of its peg to the US dollar this week with little fuss. Swinging between a loss of 0.01 per cent and a gain of 0.05 per cent on its 40th birthday, the peg underpins a stable exchange rate that has shielded the local economy from shocks and numerous attempts by traders to break it.

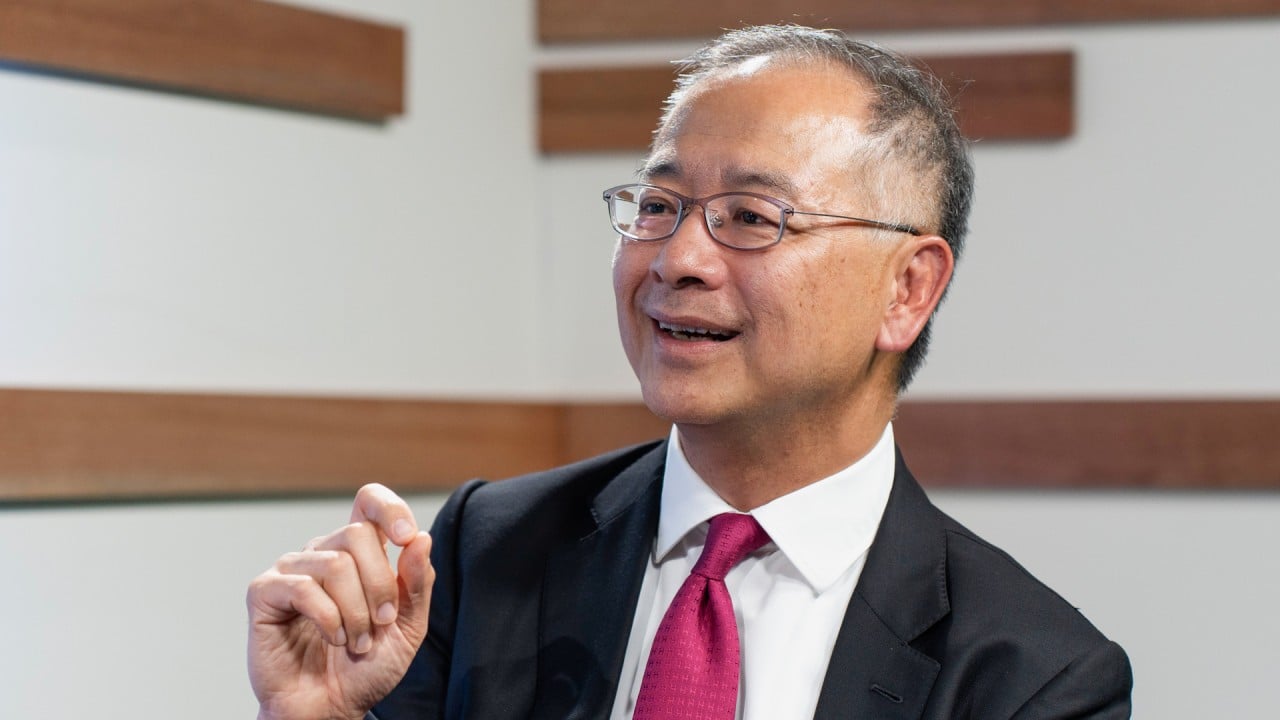

It is a system the city’s de facto central bank is determined to keep. “We have no intention, no interest, no plans to change the linked exchange rate system,” the Hong Kong Monetary Authority’s chief executive Eddie Yue Wai-man said in an interview with the South China Morning Post. “It has proven its worth as the pillar of stability for Hong Kong. There is no reason why we should change a system that has been operating well.”

Hong Kong, as a small and open economy with a lot of international trade and financial activities, will need a stable exchange rate to provide confidence to both companies and investors to invest in Hong Kong, Yue said.

“For any monetary system, that is the trade-off,” Yue said. “If we want our interest rate policy back, then you forgo exchange rate stability.”