Hong Kong-based fund managers keen to tap Middle East investment opportunities need cultural insights into the region, panel says

- Domestic fund managers keen to tap opportunities in the Middle East markets need to understand and appreciate the local culture and religious traditions, a panel said

- Chinese and Hong Kong companies deriving revenues from Middle East and Asian countries can benefit from investment opportunities there, it said

Hong Kong’s strong capital markets are attractive for Middle Eastern companies seeking to raise funds, but investor education is required for a better understanding of the Gulf region’s cultural and religious traditions, according to a panel discussion held on Thursday.

At the same time, there are opportunities for Hong Kong and mainland Chinese companies that are already deriving revenues from Middle East and Asian countries, to invest in this region as they seek to diversify their economies, the panel said.

“For the domestic fund managers to get ready to tap the opportunities in the Middle East markets, they need to understand and appreciate the local culture and religion, which is very important as they are quite different from those in Hong Kong and China,” said Plato Yip, vice-chairman of Elion International Investment and a veteran private equity and green finance investor.

“The Middle East market is complicated,” Yip said. “Don’t expect things to happen as fast as they do in Hong Kong or China.”

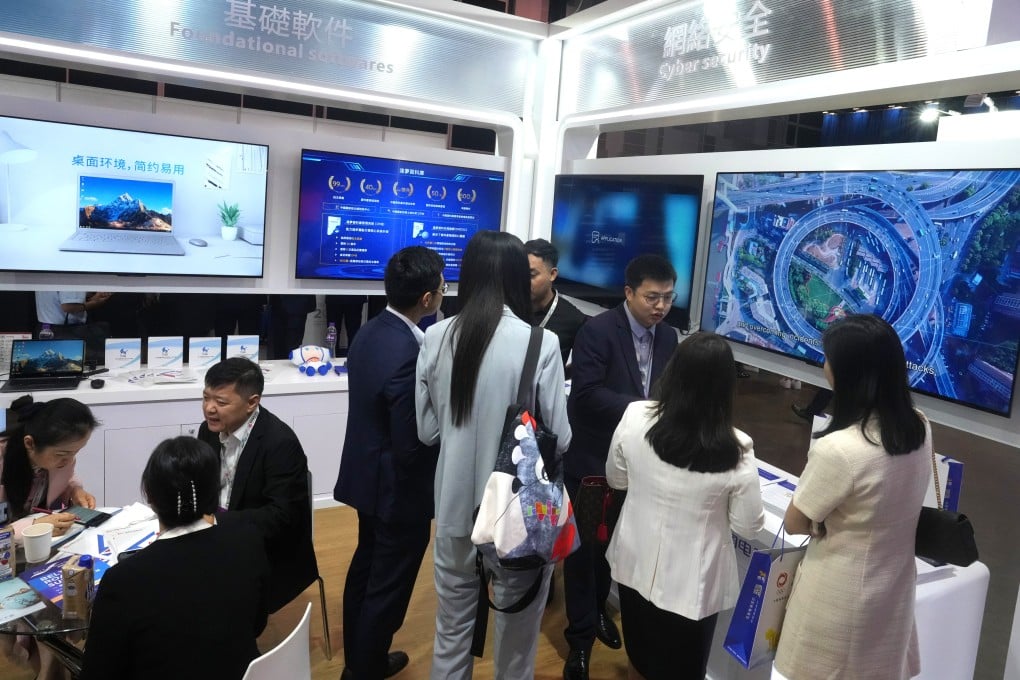

Yip was speaking at a panel discussion at the two-day Belt and Road Summit, which marked the 10th anniversary of the Belt and Road Initiative, Beijing’s plan to link dozens of economies in Asia, Europe and Africa around a China-centred trade network.