The nomination comes as economic issues – from tariffs to affordability – dominate the policy agenda ahead of the November midterm elections.

31 Jan 2026 - 6:29AM videocam

Trade envoy says Washington aims to steady ties after a bruising tariff year, even as disputes over minerals and AI chips persist.

11 Dec 2025 - 6:22AM videocam

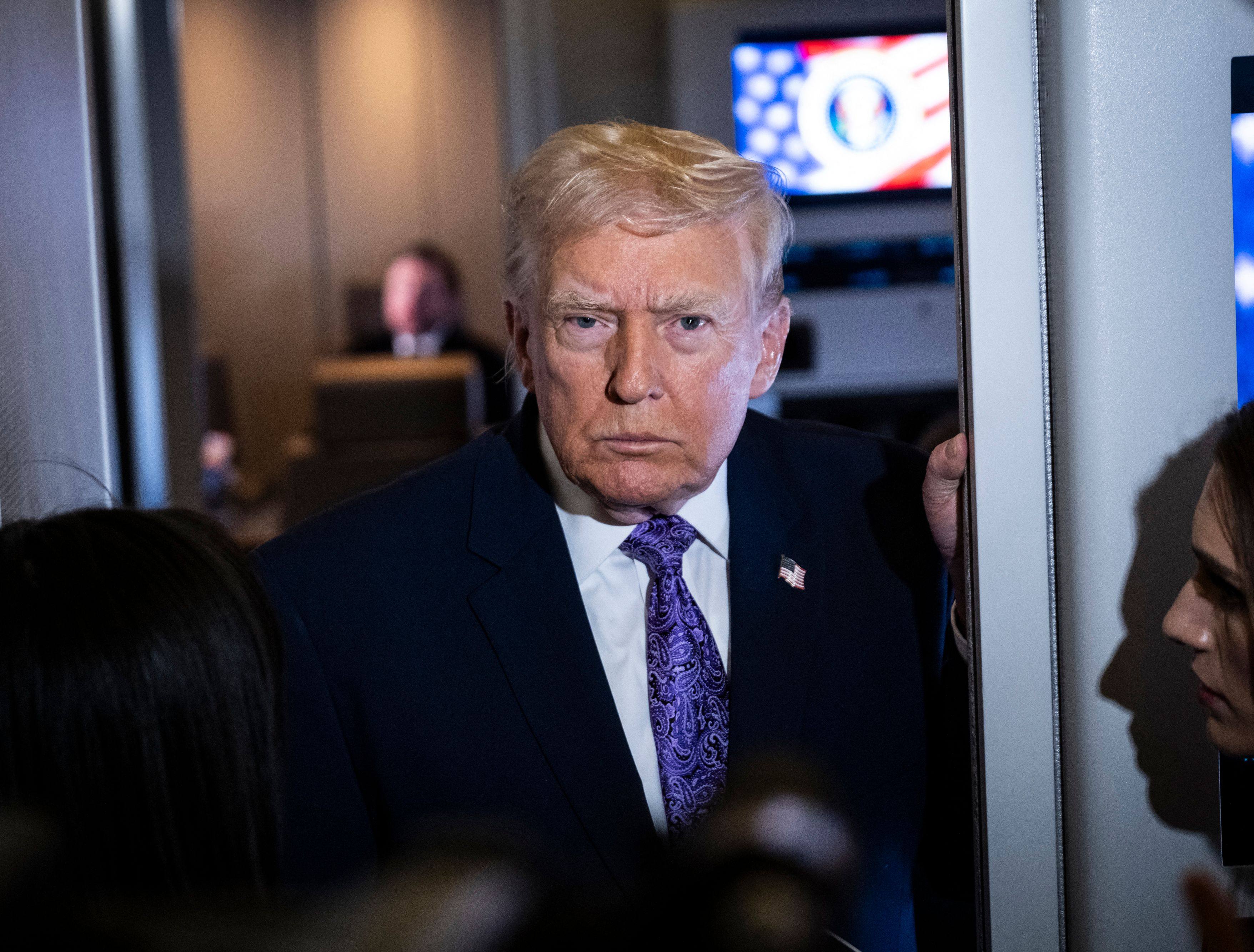

Move falls short of Trump’s demands as debate over Fed independence intensifies and markets brace for global spillover effects.

11 Dec 2025 - 4:34AM videocam

China Investment Corporation opened its third offshore office in London in December 2024, joining outposts in Hong Kong and New York.

Both sides agree to promote the development of bilateral trade ties to ‘expand the list for cooperation and shorten the list of problems’.

6 Dec 2025 - 6:05AM videocam

Isaacman says Washington must move quickly to stay ahead of Beijing amid intensifying rivalry in space exploration.

4 Dec 2025 - 6:43AM videocam

Ten months after it was proposed as a key tool to compete with China, there are still few clues about how it can be structured and managed.

3 Dec 2025 - 5:57AM videocam

Trump hails ‘extremely strong’ relationship with Beijing after call covering bilateral relations, Taiwan, Ukraine, fentanyl and agriculture.

25 Nov 2025 - 6:04PM videocam

The veteran China watcher talks Beijing’s need for financial reform and how US-China economic convergence could still be on the horizon.

24 Nov 2025 - 10:09AM videocam

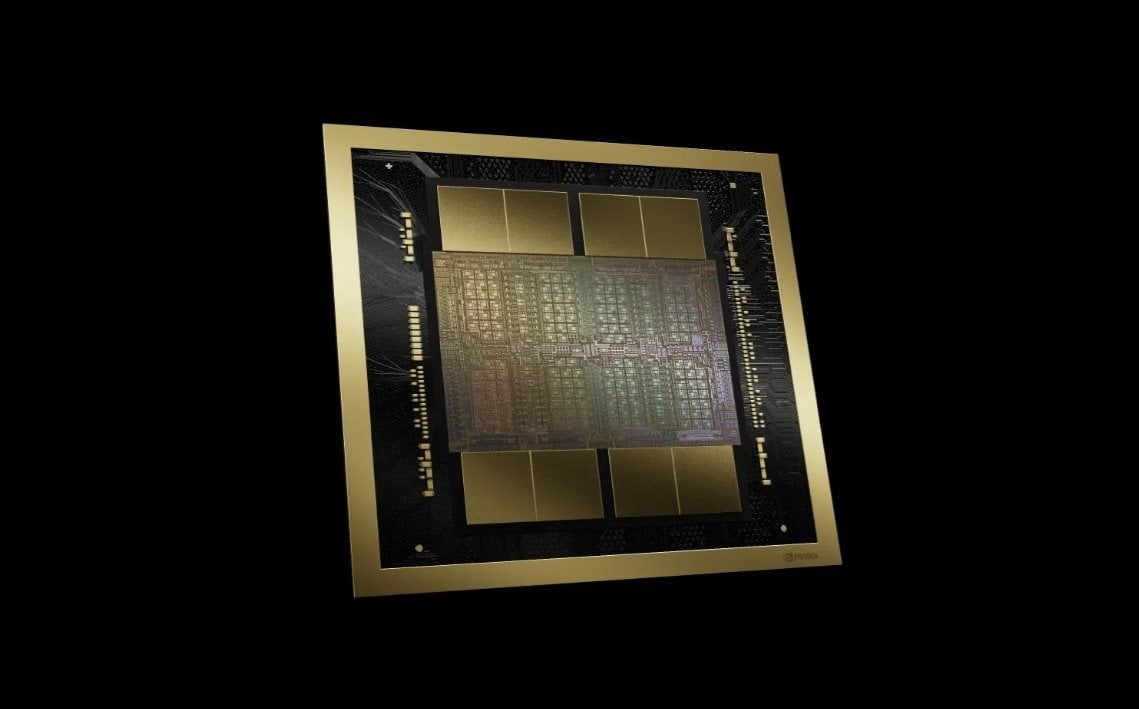

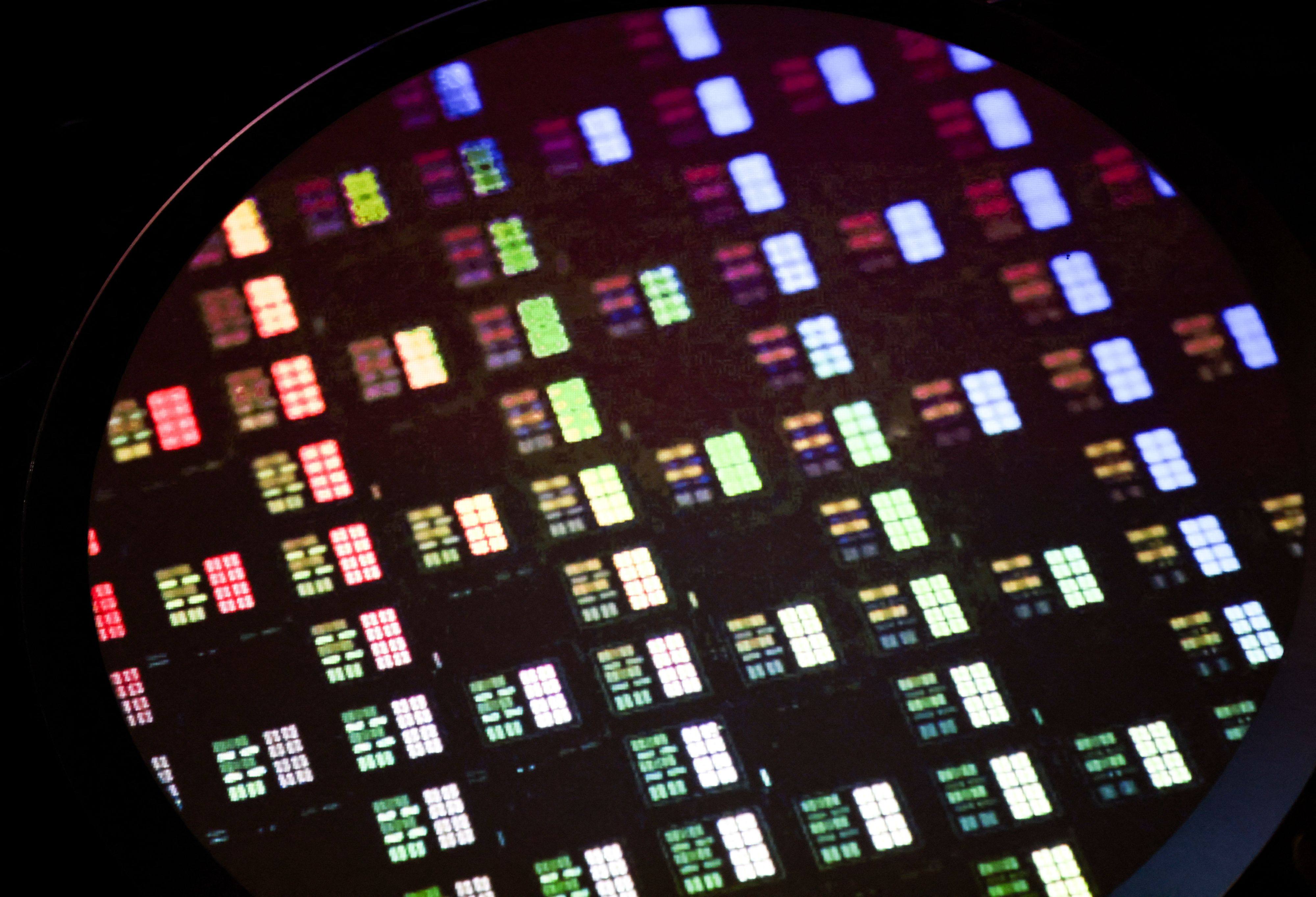

Lawmakers seek stronger BIS powers and more staff, saying Beijing could use one-year pause in export controls to advance domestic abilities.

21 Nov 2025 - 7:06AM videocam

Economist at US think tanks on bright prospects for China, the challenges it faces and why more market discipline is needed.

20 Nov 2025 - 1:15PM videocam

Congressional panel urges alternative technologies as Beijing’s pricing power and slow US production raise doubts about reducing dependence.

24 Nov 2025 - 10:31AM videocam

China Investment Corporation has reassigned three department heads and delayed its 2024 report amid US pressure on foreign inflows.

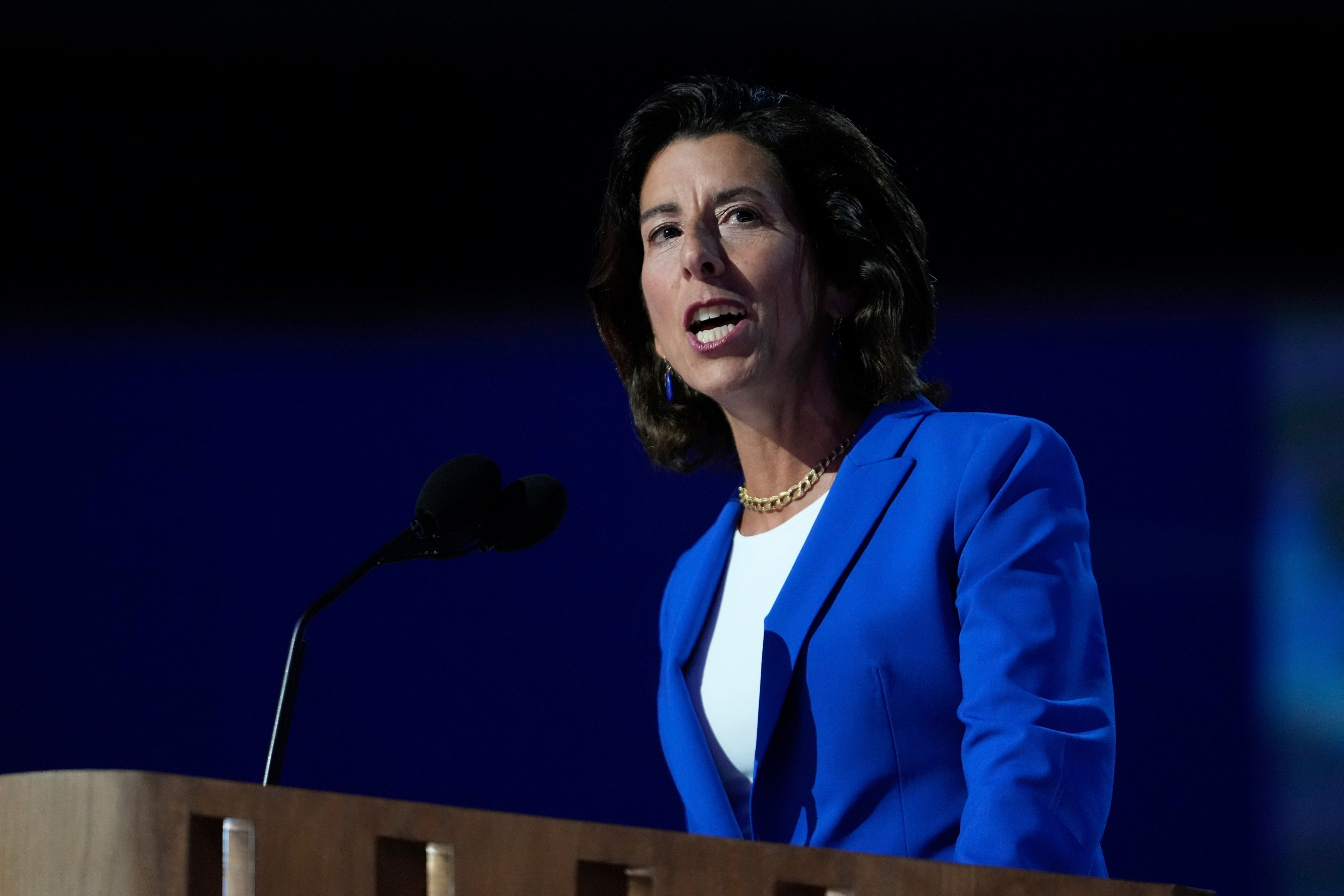

Gina Raimondo believes tougher export controls are vital for US national security and high-end chips should be kept out of Chinese hands.

14 Nov 2025 - 7:46AM videocam

Beijing to restrict 13 precursor exports as part of a Washington-backed effort to choke off the deadly opioid’s supply chain.

Fed Governor Lisa Cook warns lack of government data has challenged the US central bank’s ability to assess current economic climate.

5 Nov 2025 - 3:51AM videocam

Preparatory work is progressing well, the Post has learned from the Beijing-headquartered multilateral development bank.

Raja Krishnamoorthi urges Trump administration to deliver increased investment, strategy and leadership to combat China’s growing influence.

30 Oct 2025 - 5:57AM videocam

Experts urge long-term planning, government funding and consistency to close Beijing’s massive lead in the sector.

30 Oct 2025 - 2:54AM videocam

Move blocks Huawei, Hikvision devices and tightens rules on Chinese parts ahead of Trump-Xi summit this week.

29 Oct 2025 - 6:03AM videocam

China’s ambassador in Washington frames expected meeting as an opportunity for cooperation rather than confrontation.

With Beijing ascending, ex-commerce chief Gina Raimondo calls industrial policy ‘necessary’ where it’s a ‘true matter of national security’.

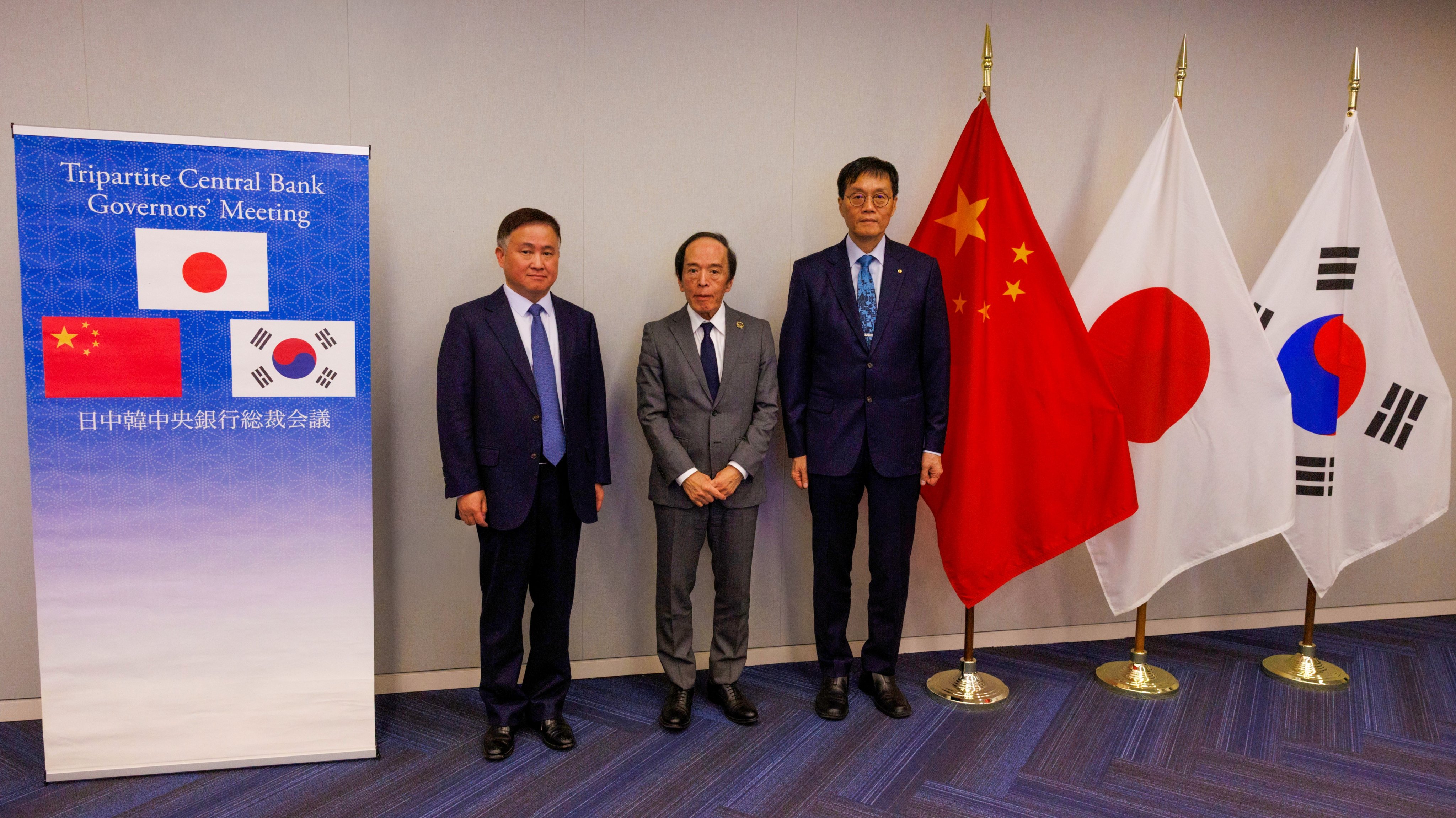

Beijing seeks to strengthen regional financial ties and boost yuan use as US trade pressures weigh on East Asian economies.

22 Oct 2025 - 10:37AM videocam

Panama is still open to being flexible and reaching an amicable agreement with CK Hutchison, owned by Hong Kong billionaire Li Ka-shing.

21 Oct 2025 - 6:49AM videocam

Finance chief Paul Chan concludes his first visit to Washington since 2019, as a new phase of the US-China trade war looms.

Treasury chief Scott Bessent urges Europe and Asia to ‘de-risk’ supply chains as tensions flare ahead of Apec summit.

16 Oct 2025 - 9:02AM videocam

Beijing also initiates anti-discrimination investigation over US handling of Chinese semiconductors, a day ahead of latest trade talks.

14 Sep 2025 - 12:24AM videocam

A few years ago, it beat extreme poverty – now, it’s a frontline province in Beijing’s economic shift.

The Beijing-based multilateral development bank’s satellite in Hong Kong will handle ‘operational investments’ with city institutions.

27 Jun 2025 - 11:16AM videocam

‘Milestone’ programme links mainland China’s Internet Banking Payment System with Hong Kong’s Faster Payment System, simplifying cross-border payments.