Advertisement

Advertisement

TOPIC

/ company

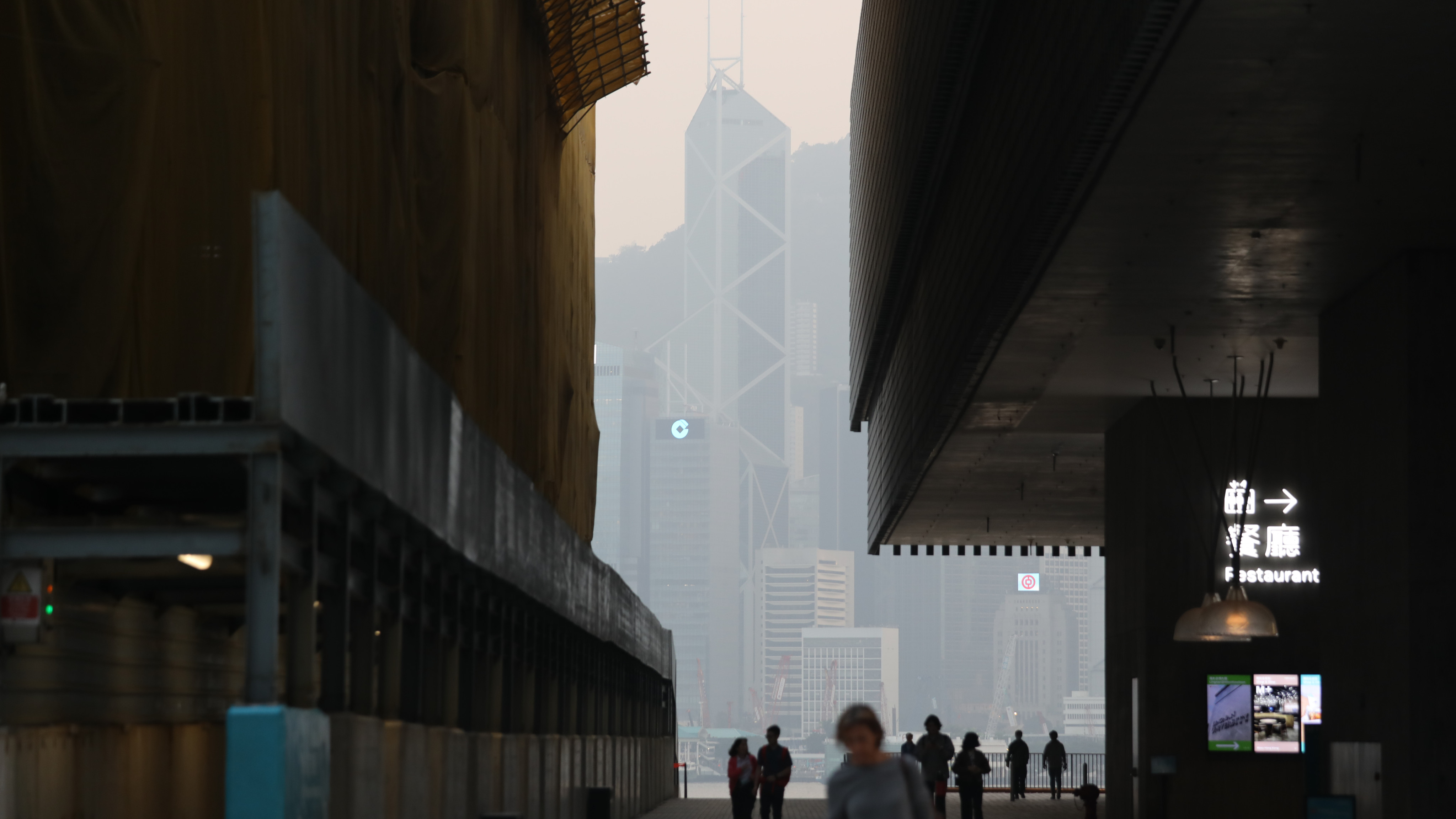

Bank of Communications

(交通银行)

Bank of Communications

交通银行

Established in 1908, Bank of Communications is one of the largest banks in the People’s Republic of China. It was listed in Hong Kong in 2005 and in Shanghai in 2007.

Chairman / President

Ren Deqi

CEO / Managing Director

Zhang Baojiang

CFO / Finance Director

Liu Jianjun

Industry

Financial services

Website

bankcomm.com

Headquarters address

Shanghai, People's Republic of China

Stock Code

SEHK: 3328

SEHK: 4605

SSE: 601328

SEHK: 4605

SSE: 601328

Year founded

1908

China’s banks to sell US$60 billion of loss-absorbing bonds to meet PBOC’s norms

ICBC and BOC line up issuance plans for 60 billion yuan worth of total loss-absorbing capacity (TLAC) bonds as Chinese G-SIBs (global systemically important banks) are expected to sell 440 billion yuan of these newly introduced bonds.

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement