Advertisement

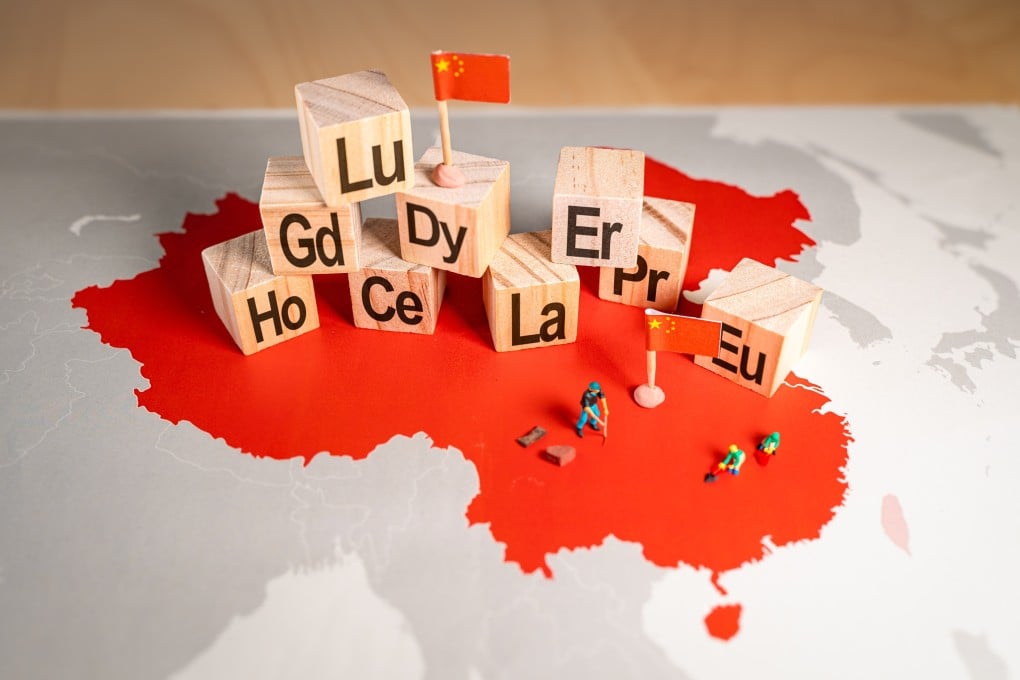

China’s new rare earth export controls will impact global chip supply chain, analysts say

The latest rules require ‘case-by-case approval’ on exports of rare earths for the design and production of advanced semiconductors

Reading Time:2 minutes

Why you can trust SCMP

1

Ann Caoin Shanghai

China’s latest export controls on rare earths are expected to have a direct impact on the global semiconductor supply chain, complicating the production of AI and memory chips from major US and South Korean suppliers, according to analysts.

On Thursday, China’s Ministry of Commerce imposed a raft of new export controls on rare earth materials critical for the chip manufacturing process. It imposed restrictions on the export of technologies related to rare earth production, such as mining, smelting and separation, magnetic material manufacturing, as well as the use and recycling of rare earth secondary resources.

The latest rules require “case-by-case approval” on exports of rare earths for the design and production of advanced semiconductors, including logic chips with process nodes of 14 nanometre or below and memory chips with 256 layers or more, as well as related equipment and materials for these semiconductors.

Advertisement

The latest measures, regarded by analysts as a “major upgrade” of Beijing’s rare earth export control regime, were seen as a move to strengthen China’s leverage ahead of crucial negotiations with the US.

In April, Beijing placed export controls on seven critical minerals. Subsequently, Chinese exports of rare earth magnets slowed as tensions rose over the following months, sparking alarm among Western manufacturers.

“It is the first time for [rare earth] export control policies to mention semiconductors,” China Merchants Securities, a state-backed brokerage firm, wrote in a research note on Friday, adding that Beijing’s latest action represented “a new level of regulatory intensity”.

Advertisement

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x