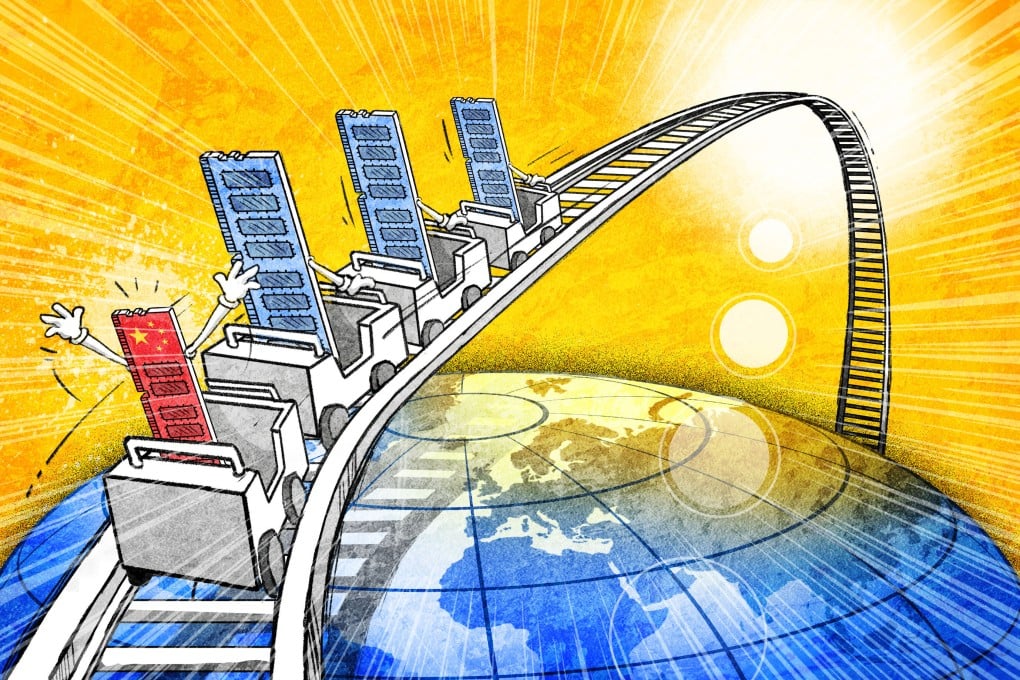

How hair-raising prices for memory chips could take China’s top makers to new heights

Eye-watering DRAM prices are bad news for consumers and smartphone brands, but present an opportunity for Chinese firms led by CXMT and YMTC

In the world’s biggest wholesale electronics marketplace in the bustling Huaqiangbei district of the southern Chinese metropolis of Shenzhen, memory is the new gold.

On a Tuesday in January, a merchant surnamed Ye held up a list of prices that looked more appropriate for luxury goods than humble computer parts. A pair of 32-gigabyte, 6000-megahertz Double Data Rate 5 (DDR5) memory sticks was priced at 6,878 yuan (US$990) – having shot up nearly fivefold since September.

“In my over 10 years in this industry, this is the single most aggressive price surge I have ever seen,” said Ye, who builds computers for individuals and enterprises.

As painful as the skyrocketing prices are for Ye’s customers and many others, the chaos also presents a high-stakes opportunity for China’s domestic memory makers – led by ChangXin Memory Technologies (CXMT) and Yangtze Memory Technologies Corp (YMTC) – to claim a larger slice of the global market.

Memory prices have been so volatile that in Huaqiangbei, price quotes now carry expiration dates measured in hours. An engineer surnamed Li, working at a store near Ye’s, said he had simply given up on drafting written quotes for clients, as prices change two or three times a day.