Advertisement

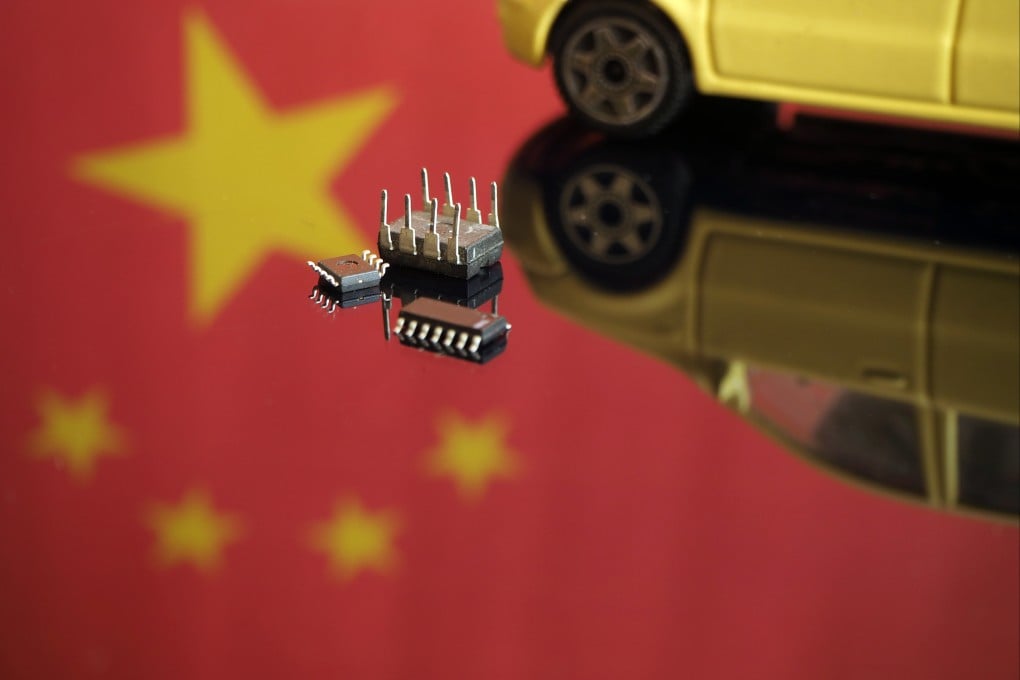

Chinese auto chip designer Black Sesame to raise up to US$143 million in Hong Kong IPO

- Black Sesame’s listing initiative in Hong Kong would follow the successful IPO in June of Tencent-backed QuantumPharm

Reading Time:2 minutes

Why you can trust SCMP

0

Wency Chenin Shanghai

Black Sesame International Holding, a Chinese system-on-a-chip (SoC) designer focused on autonomous-driving systems, aims to raise more than US$140 million from its initial public offering (IPO) in Hong Kong under the city’s relaxed listing rules for hi-tech firms.

Based in Wuhan, capital of central Hubei province, Black Sesame plans to float 37 million shares at a price range of between HK$28 and HK$30.3 per share, according to its latest filing with the Hong Kong stock exchange. The company’s listing could raise HK$1.12 billion (US$143 million) at the top of that price range.

The firm’s IPO falls under Chapter 18C of the city’s listing rules that took effect on March 31 last year. This enables companies with at least HK$10 billion in valuation to sell shares in Hong Kong even if they have yet to earn a single dollar in sales. For companies with at least HK$250 million in sales in the financial year before their IPO, the minimum valuation was slashed to HK$6 billion from HK$8 billion.

Black Sesame’s prospectus showed that its 2023 revenue reached 312.4 million yuan (US$43 million), nearly double that of 2022. Its losses, however, widened to 4.86 billion yuan from the previous year.

Black Sesame’s IPO initiative shows that Hong Kong’s listing reform for specialist technology firms via Chapter 18C is paying off in terms of attracting more hi-tech investments in the city. In November 2023, the firm said it plans to establish a research and development centre in the Hong Kong Science Park. In 2023, Black Sesame said it was working with Baidu on its intelligent car systems.

Advertisement