Bitcoin hits US$116,000 as options traders eye US$120,000 amid Trump’s bullish messages

Bitcoin’s breakout is fuelled in part by institutional demand and bullish comments made by Trump on social media

As bitcoin breached US$116,000 for the first time, the open interest, or the number of outstanding contracts on the Deribit exchange, has become concentrated around bitcoin call options with US$115,000 and US$120,000 strike prices.

Longer-term options expiring in late September and December have seen elevated open interest at US$140,000 and US$150,000.

Liquidations in short positions accelerated after bitcoin topped US$116,000, with US$543 million over the last hour and US$762 million over the 12-hour period, according to data compiled by Coinglass.

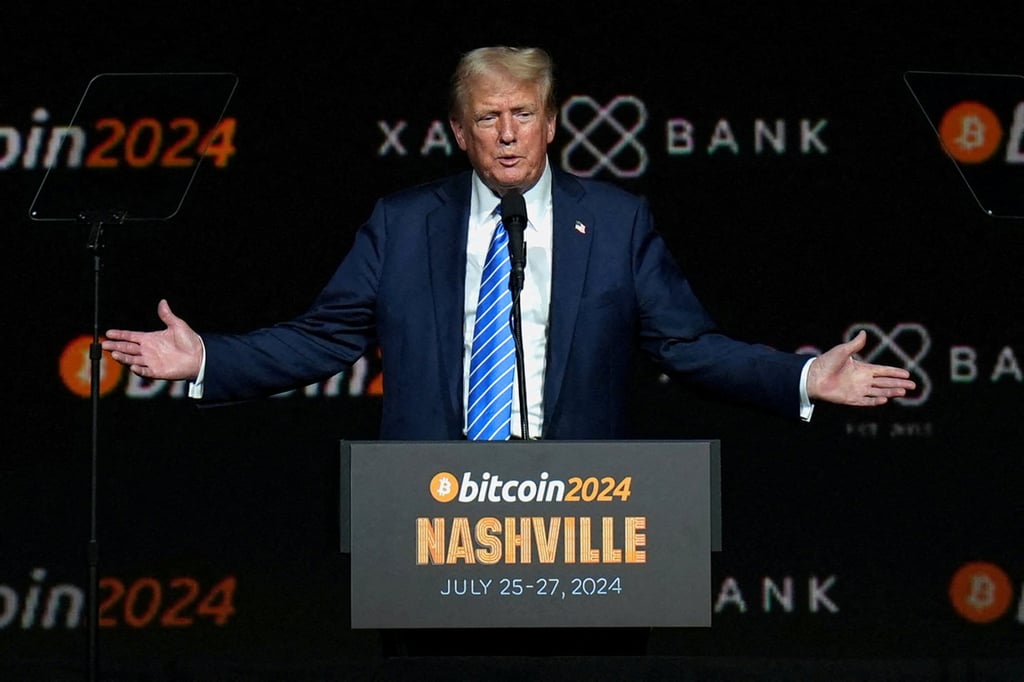

Bitcoin’s breakout, fuelled in part by institutional demand, is the latest validation for crypto bulls, who pounced after the November election on bets that the second US presidency of Donald Trump will usher in a new era of permissive regulation.

A US Congressional committee declared the week of July 14 as “Crypto Week”. The biggest digital asset by market value is up around 25 per cent this year amid the broader rally in risk assets that has also sent stocks to all-time highs.