Samsung’s chip profit soars after AI fuels demand for memory

South Korea’s largest company has been trying to recover from a series of missteps that allowed SK Hynix to seize the lead in memory

Samsung Electronics’ semiconductor arm reported a bigger-than-expected 80 per cent surge in profit, suggesting global AI demand is helping drive a recovery at the Korean company’s most important business.

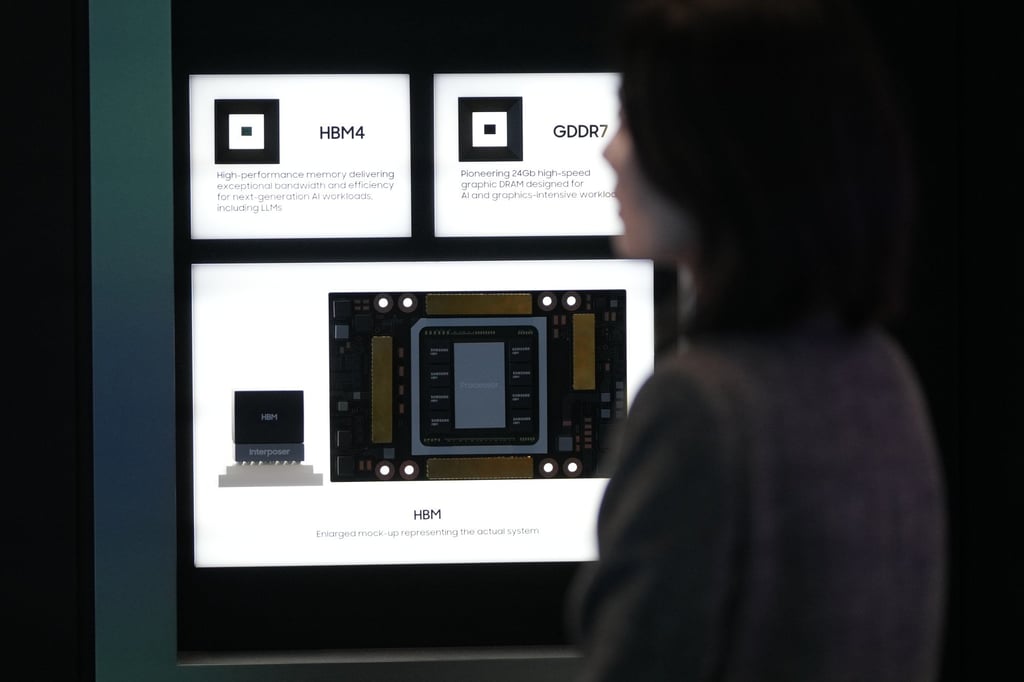

The unit, which competes with SK Hynix and US-based Micron Technology, said it will focus next year on mass production of the next generation of high-bandwidth memory or HBM4 – designed to work in tandem with AI accelerators from Nvidia. The company echoed SK Hynix’s prediction that a spending spree in artificial intelligence will persist this quarter and into next year.

South Korea’s largest company has been trying to recover from a series of missteps that allowed SK Hynix to seize the lead in memory that boosts artificial intelligence capabilities.

It’s now trying to get back into that fierce contest, in which big spenders from OpenAI to Meta Platforms are amassing computing power for AI services. Samsung has earmarked 47.4 trillion won (US$33 billion) of capital spending for 2025, to expand and upgrade capacity.

Samsung’s chip division posted an operating profit of 7 trillion won for the September quarter, compared with analysts’ average projection for 4.7 trillion won. The memory chip business – a key pillar of Samsung’s empire, which spans smartphones and home appliances – hit record-high quarterly revenue on HBM3E sales, it said.