Council Tax changes in UK may hit Hong Kong property owners

Extension of local property taxes to ease homes shortage is likely to hit Hong Kong investors

Hong Kong owners of British property may find their costs rising following changes to local government charges which came into force last week.

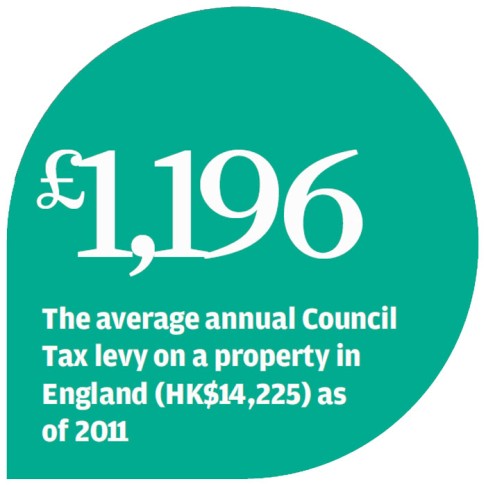

Residents pay Council Tax to cover the cost of services such as refuse collection and street cleaning. The amount of tax varies from one local authority to another and according to the value of the property, but ranges from hundreds of pounds to several thousands of pounds each year.

When rental homes are occupied, the tax is paid by tenants; when empty, the landlord pays.

Previously, empty properties, including those being refurbished or left vacant between lettings were exempt from Council Tax, and it was levied at a discounted rate on holiday homes.

But, from this month, all homes can be taxed at the full rate. In addition, councils can add a 50 per cent premium to the tax on homes left vacant for two years or more.