Exclusive | Shui On to sell assets to pare debt, explore new revenue sources

Shui On aims to build as many as 10 of its knowledge and innovation community projects in China over a decade

Shui On Land, the pioneer developer of China’s heritage landmarks, said it will continue to sell commercial assets and explore new revenue sources like its property management service to pay down debt.

The developer of the Shanghai Xintiandi, which is already replicating the heritage enclaves in Wuhan and Chongqing, has also begun to focus on its start-up ecosystem concept called the knowledge and innovation community. It aims to build as many as 10 such communities in China over a decade.

“It’s exactly what the Chinese government wants to promote throughout China,” Shui On’s chairman Vincent Lo Hong-sui said in an interview with The Peak magazine, published by the South China Morning Post. “We might be able to secure a couple of jobs in the near future. The next step for the Chinese economy must be in that direction.”

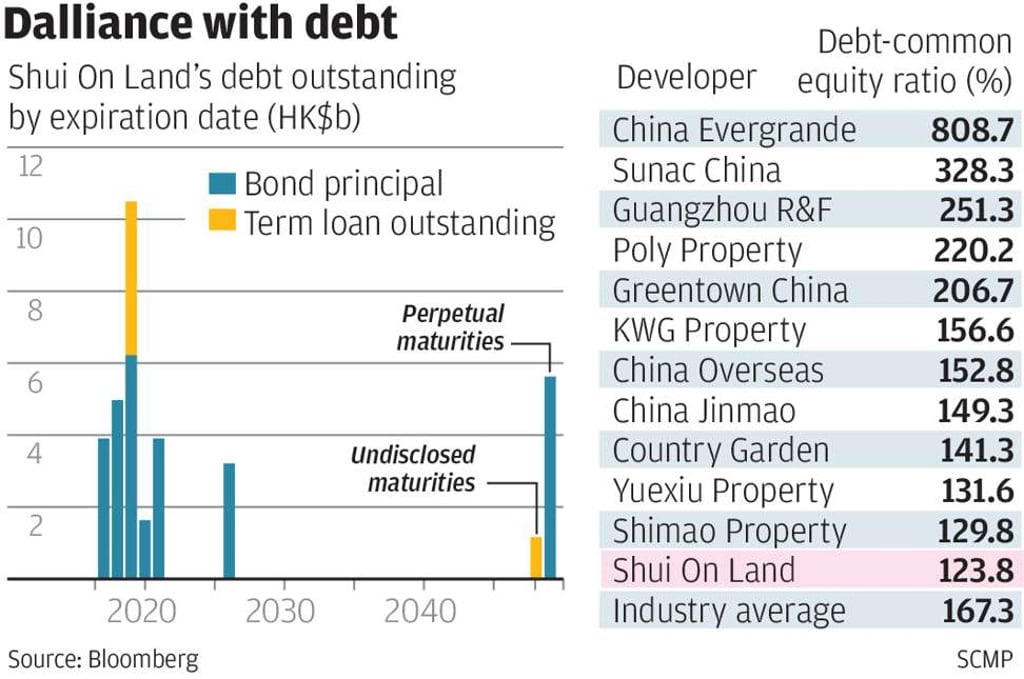

Shui On had been selling off commercial assets to bring down its debt, in one case to Lo’s brother Lo Ka-shui, after the company shifted direction in 2015 to what Vincent Lo called an “asset-light” strategy.

In its 2016 interim report, Shui On reported that its gearing ratio had dropped 12 percentage points to 75 per cent from the previous year.

Its asset turnover rate, a measure of the company’s efficiency in deploying its assets, exceeded 20 per cent in 2016, compared with 18 per cent in 2015 and 9 per cent in 2014, Lo said.