6 ways cloud accounting can help to transform small businesses

- Digitalised systems help companies save time for important tasks such as planning, financial forecasting and delivering value-add to customers

- Technological advances include use of AI and machine learning to help automate backend tasks and bank reconciliation

[Sponsored Article]

Accounting is the backbone of all companies, both big and small. It allows the owners to keep track of their finances and business performance, and conduct analysis and financial forecasting to plan ahead.

In a small business, though, accounting can easily take a backseat in favour of seemingly more urgent tasks such as sales and product development. After all, it takes a lot of time and patience to carry out administrative tasks, such as recording expenses and preparing invoices.

A survey of 150 small to medium-sized enterprises (SMEs) in Singapore by Xero in 2017 found that small business owners spend an average of 15.5 hours a month manually importing and reconciling their bank statements. Of these, more than two-thirds cited manual bank statement reconciliation as a key challenge in managing their operations.

As a result, time-strapped business owners might be tempted to put off such tasks, or leave accountants to deal with months’ worth of records and information gaps.

Benefits of digitalised accounting system...

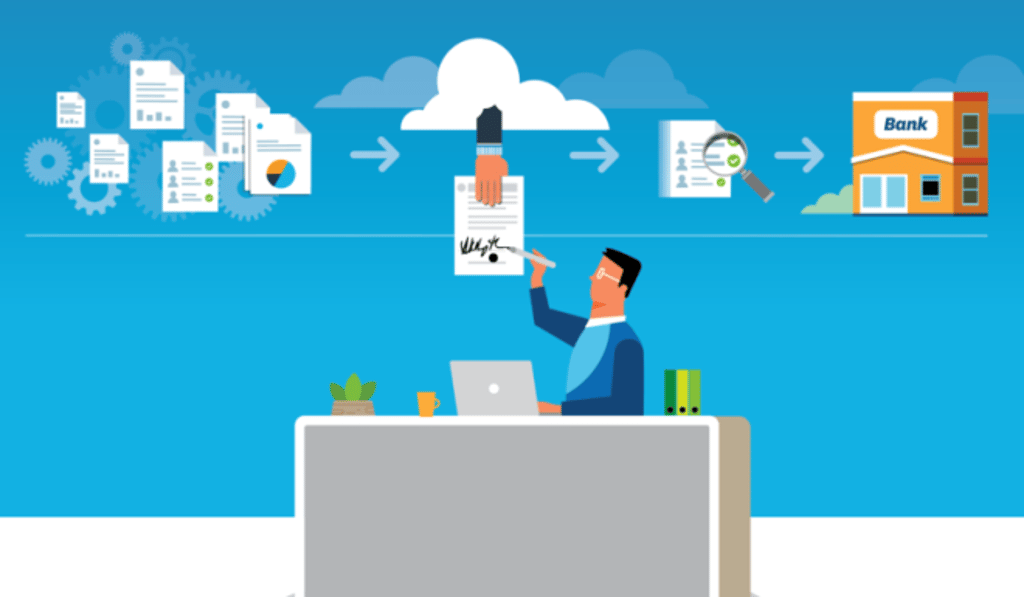

One way to relieve the accounting burden on small businesses is to digitise the entire process.

When businesses digitise the accounting process, they are able to streamline processes and increase visibility for greater rein over the business.

As a bonus, business owners will be able to get more out of their partnership with accountants, who can focus their efforts on strategic, analytical work, and less on mundane, administrative tasks.

1. Real-time visibility into accounts

With the ability to reflect updates in real time and being accessible on various devices, cloud accounting software gives businesses an updated overview of all their accounts.

Cloud-enabled application programming interfaces (APIs) that let different forms of software integrate with each other make it possible to get a view of your books, bank accounts, invoices and other financial data all in one platform. This allows you to make business decisions based on accurate, updated financial data.

2. Increased access to working capital

By digitising, small businesses are able to ensure the integrity and accuracy of their accounts, placing them in a better position to run the business efficiently and prove they are viable for a loan and secure the loan faster than traditional timelines.

These companies can enjoy a simple and easy application process that gives them access to capital faster by granting lenders (banks and alternative lenders) access to a real-time view of their finances within their cloud accounting platform, allowing them to access relevant financial information to make a faster credit decision.

3. Reduction in manual and routine work

With digitisation and automation, businesses can reduce time spent on things such as manual data entry, chasing late payments, reconciling accounts and preparing invoices.

Business owners can then dedicate the extra time and resources to activities that directly add value to the business, including building relationships with potential clients and planning for growth.

4. Shorter payments cycle

Research conducted by Xero on its small business users shows they are able to shorten the number of days in between invoicing and getting paid (2015-2017), from 42 days to 32 days in Hong Kong, and from 43 to 30 days in Singapore.

This can be partly attributed to the e-invoicing function within a cloud accounting platform, which allows businesses to create and issue invoices digitally and accept payments via various channels such as PayPal and Stripe.

By eliminating the manual tasks, delays and errors associated with manual data entry, processing and payment reminders and offering more ways for customers to pay, it can speed up the invoicing process and shorten the payments cycle.

5. Insights from data analytics

All this will help businesses to make data-driven decisions, identify potential markets, predict financial trends, and manage risks associated with compliance.

Analytics tools can also spot anomalies in data over time, thus helping business owners and their advisers to detect financial reporting mistakes, poor performance and fraud.

6. Enhanced data security

Software-as-a-service (SaaS) providers employ complex security controls to safeguard their clients’ data.

With financial data on the cloud, instead of in physical books or on USB drives, both of which can be easily tampered with, businesses can limit access to certain users. They can also track who accesses the data and when, enabling greater transparency within the organisation.

Technological advances

With the rapid pace of development, especially in the SaaS sector, accounting technology has improved over the years to provide users with a more efficient and seamless experience.

Integration of banking transactions

Governments are building APIs that allow bank accounts to be integrated with financial service platforms.

When integrated with payment providers, businesses will also be able to make or accept payments directly from or into their bank accounts, which can be easily managed on their cloud accounting platform in real time.

Complementary app ecosystem

With APIs, different apps can work seamlessly with a digital accounting software, allowing businesses and their advisers to view all of the business data on one platform.

E-invoicing and automatic reminders

The digitisation of accounting has enabled the automation of tasks such as preparing invoices and recording these as accounts payable. Today’s accounting systems can also provide automatic reminders on due payments and follow-ups. All these depend on the rules one sets for the system, which in turn will be based on internal accounting processes, controls and compliance procedures.

Machine learning and AI

With the help of AI and machine learning, many similar back-end administrative tasks can be automated to save businesses precious time. Right now, Xero has automated the coding of about 80 to 90 per cent of transactions that clients do on a daily basis – and this is only the beginning.

AI has eradicated the time spent on manual and administrative activities such as punching and coding transactions, allowing company owners to focus on running their businesses and advisers on providing strategic counsel to their clients,

In essence, every small business has a personal robot dedicated to learning how they do business and help them automate a large portion of their administrative, routine tasks.

Digitalisation can speed up growth

It’s normal for a business to feel anxious when taking the leap into digital, cloud-based systems.

Business owners may be concerned about migration challenges and data security. The good thing is cloud-based solutions tend to be flexible and highly scalable, allowing businesses to choose subscription packages based on the features they need and the number of users.

The immediate and long-term benefits that digitising the accounting process bring would allow small businesses to punch above their weight and compete on a level playing field against much larger players.

Businesses that embrace digitalisation now are therefore set, not only to survive, but to thrive in a competitive world.

Learn more on the Xero website