An Emerging Crisis

The COVID-19 pandemic is having a powerful effect on emerging markets.

[Sponsored Article]

By Professor Albert PARK,

Head and Chair Professor, Department of Economics,

HKUST Business School

Professor Alicia GARCIA-HERRERO,

Adjunct Professor, Department of Economics,

HKUST Business School

The center of the COVID-19 pandemic has shifted to the emerging markets. As of August 5, the countries with the most cases of COVID-19 after the US were Brazil, India, Russia, and South Africa, which along with China, where the pandemic started, form the BRICS, an acronym coined in the early 2000s to signify the world’s leading emerging markets. These countries have made important contributions to global growth, especially China. Their struggles with COVID-19 therefore threaten to undermine the global economic recovery. It is not just the BRICS. Highly populous countries with more than 100,000 COVID-19 cases now include Indonesia, Pakistan, Bangladesh, Mexico, Iran, and Egypt. Every country in the world continues to battle the virus and guard against new outbreaks.

A unique feature of the pandemic’s massive economic cost, in comparison to other global crises, is that it has created large shocks to demand and supply at the same time. Demand shocks are both external, as other countries hit by the pandemic reduce their demand for exports and reduce travel to and investment in other countries, and domestic, as people in the country reduce spending due to greater unemployment and fear of leaving their homes.

Supply shocks refer to the disruption to work caused by stay-at-home orders, shuttering of businesses, and mobility controls, which wreak havoc on supply chains. This double whammy of demand and supply shocks is especially devastating for emerging markets and developing countries whose economies rely on exports (especially commodities) and tourism. Less developed countries are often less equipped to deal with the pandemic due to weaker institutional capacity and a limited ability to mobilize fiscal and financial resources.

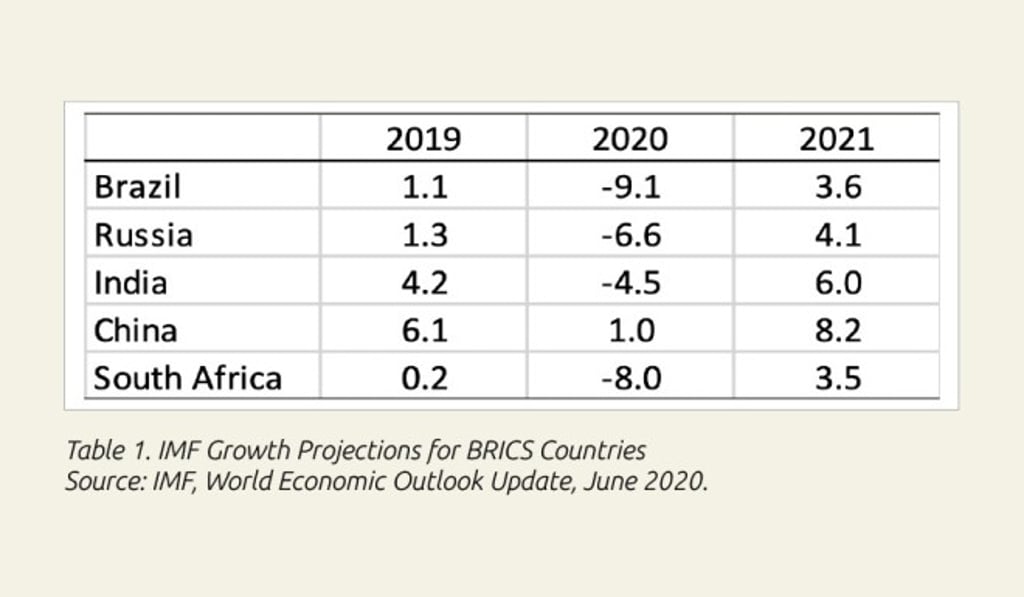

According to the International Monetary Fund’s (IMF) June Economic Outlook projections, global growth is expected to be -4.9% in 2020 compared to 2.9% in 2019. Growth in emerging markets and developing countries is expected to be -3.0% in 2020 compared to 3.7% in 2019, which is less of a decline than in advanced countries, which are expected to decline by -8.0% in 2020 compared to 1.7% in 2019. The larger impact on rich countries likely reflects the fact that they were hit harder by the pandemic in the first half of 2020, and their economies rely more on services, which are more adversely affected by social distancing requirements.

However, these projections may already be out of date given the recent surge in cases in BRICS and other developing countries. They also obscure the diverse impact of COVID-19 across countries, and overlook the heightened vulnerability of some emerging markets and developing countries to dependence on external financing. The stakes are particularly high in less developed countries, given their large vulnerable populations at risk of falling into poverty.

Like many countries, China saw a steep reduction in consumption when the country was in lockdown, followed by a quick recovery after it reopened. But the economy did not fully return to pre-crisis levels due to persistent cautious behavior, and negative external demand shocks that persisted after lockdowns ended. Many countries are also discovering that recovery will be more gradual than originally predicted, for the same reasons.

Among the BRICS, Brazil is projected to be most negatively affected, with GDP in 2020 estimated to decline by 9.1%. As in the US, despite its strong healthcare system, Brazil’s president played down the dangers of the virus and failed to implement a national strategy to combat COVID-19, leading to more than 2.75 million COVID-19 cases by early August, which resulted in large domestic demand and supply shocks. Brazil is also an oil exporter, and was therefore hurt by the collapse in oil prices, which reduced from more than US$60/barrel at the beginning of 2020 to less than US$20/barrel in April (recovering since then to just over US$40/barrel in early August).

Russia is the world’s second largest oil exporter after Saudi Arabia and its leading exporter of natural gas, so suffered greatly from reduced global energy demand caused by the pandemic, reducing projected growth to -6.6% in 2020. By contrast, China, India, and South Africa are oil importers, and so benefited from lower oil prices, although demand for oil also fell in nearly every country. South Africa, however, is an exporter of many minerals, and saw external demand fall (except for gold). The country’s weak economic position before the crisis (anemic growth, high indebtedness, huge social disparities) limited its ability to respond effectively to the crisis.

India has faced challenges due to its limited health infrastructure, its crowded urban slums which make social distancing difficult, and its huge number of informal workers, who account for 90% of the labor force, and are highly vulnerable to losing jobs when the economy declines.

A new debt crisis?

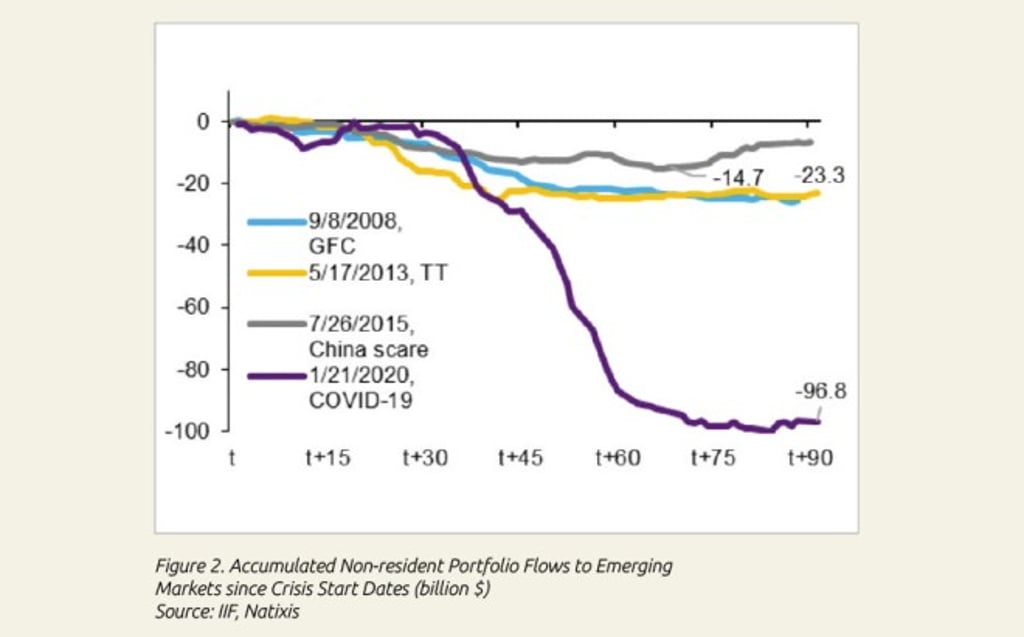

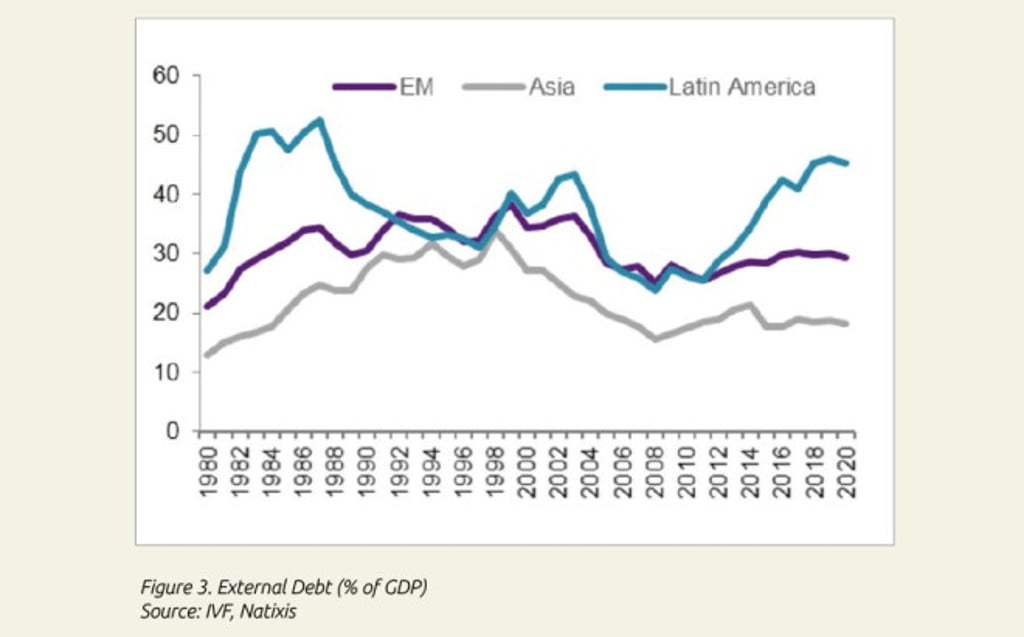

The spread of COVID-19 to emerging economies has also revealed a vulnerability not fully appreciated before the pandemic hit, namely the excessive dependence of many emerging market countries on external financing. Such dependence historically has left countries vulnerable to financial crises when international capital decides to leave suddenly (e.g., the Latin American debt crisis of the 1980s, the Asian financial crisis in 1997-1998, and the Great Financial Crisis of 2007-2008).

The COVID-19 pandemic saw foreign investors exit emerging markets at the fastest speed ever, in search of safer dollar assets. In a co-authored study, Alicia Garcia-Herrero and Elina Ribakova (2020) analyze the factors that made emerging economies vulnerable to a sudden reduction in dollar liquidity due to the pandemic, and assess the potential of different tools available to address the problem, including the role of the IMF.

Emerging markets are highly reliant on dollar liquidity through both capital and income channels. The capital channel refers to net borrowing in the form of capital inflows. The more that emerging markets rely on short-term portfolio inflows, or ‘hot money’, the more they are potentially exposed to global dollar liquidity shortages. The income channel refers to USD income generation mostly via net exports of goods (including commodities) and services (notably tourism), or payments for the cross-border use of a country’s endowments such as remittances, both of which were adversely affected by the pandemic. Thus, the COVID-19 shock sharply reduced emerging markets’ access to dollars through both channels.

Many central banks in emerging markets have used monetary policy to stimulate their economies in response to economic downturns. However, lowering interest rates or printing more money leads to currency depreciation which increases the burden of dollar-denominated debt, and the benefits from increased exports are limited due to plummeting external demand. The fear of continued depreciation also can accelerate capital outflows. Thus, monetary policy cannot solve the external financing problem.

An obvious shortcut to avoid raising interest rates to stem capital outflows is to impose capital controls. However, for countries that have liberalized their capital accounts, this is a drastic response that can shut off immediate market financing options and lose the trust of investors who may never return once the crisis has passed. Nonetheless, as for previous financial crises, external debt problems may lead countries to take a more positive view toward restrictions on capital movement, a stance which may eventually be reflected in the IMF’s integrated policy framework. China has never liberalized its capital account partly to reduce vulnerability to sudden capital outflows.

Of course, large foreign reserves can be a first line of defense in addressing challenges posed by dollar flight and repayment of dollar-denominated debt. Unfortunately, many countries lack significant reserves, and the countries with such reserves are concentrated in Asia and the Middle East. The economic impacts of the pandemic are reducing available reserves because Middle East oil producers are cutting back production in response to the low oil price, and trade surpluses of Asian economies are falling with the sharp decline in external demand.

The IMF is obviously the most appropriate institution to deal with the liquidity problems that emerging countries are encountering due to the pandemic, since helping countries deal with such crises is a core mission of the institution. However, the IMF’s available resources are currently estimated at just under US$800 billion, far less than the more than US$2 trillion demanded. An overall quota increase for the IMF is therefore greatly needed, but this is unlikely to be agreed upon quickly by IMF members. It will also be important to fast-track disbursements and provide loans with less conditionality.

More generally, given the global scope of the pandemic, international cooperation and coordination to help countries in greatest need, not just with debt problems but also in curtailing the spread of the virus and providing treatments and vaccines, is desperately needed. But this is a challenge to achieve given geopolitical tensions between the US, Europe, and China and the preoccupation of many leaders in dealing with the pandemic in their own countries. With millions of poor left vulnerable by the pandemic, the stakes couldn’t be higher.

Reference

Garcia-Herrero, Alicia, and Elina Ribakova. COVID-19’s Reality Shock for External-funding Dependent Emerging Economies, Bruegel Policy Contribution Issue No. 10, May 2020.