Review Your Medical Coverage Regularly and Get Insured with the Voluntary Health Insurance Scheme Certified Plans Early

[The content of this article has been produced by our advertising partner.]

Does your medical coverage remain sufficient as time goes by? It is essential to regularly review your medical plans. If you find out that your current medical coverage is insufficient for your future needs, it is crucial to consider enhancing your medical protection! Start early and purchase Voluntary Health Insurance Scheme (VHIS) Certified Plans for yourself and your family to secure protection for rainy days.

Is the renewal of your current medical plan guaranteed?

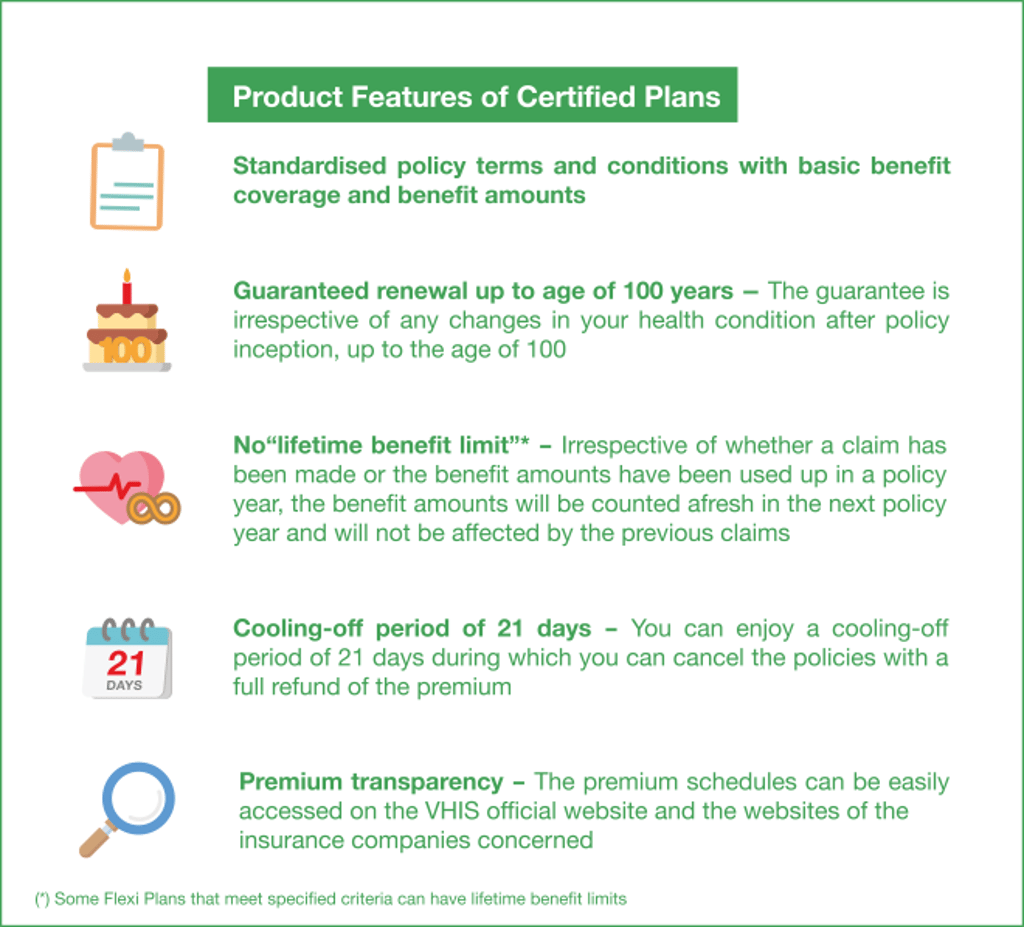

Some hospital insurances in the market have age limits on policy renewals, meaning that the insurance policy will cease when the insured person reaches a specific age. However, the VHIS offers guaranteed renewal up to the age of 100 years; the guarantee is irrespective of any changes in health conditions of the insured person after policy inception, up to the age of 100, providing long-term and comprehensive protection.

Does previous claims affect the benefit amounts?

Some medical plans count benefit amounts per disability. When the accumulated claims for a specific disability reach the benefit amount limit, the protection for that disability will cease. However, the benefit amounts of the VHIS Certified Plans are counted on policy year basis, without a “lifetime benefit limit”* in general. This means that irrespective of whether a claim has been made or the benefit amounts have been used up in a policy year, the benefit amounts will be counted afresh in the next policy year and will not be affected by the previous claims.

*Some Flexi Plans that meet specified criteria can have “lifetime benefit limits”.

How attractive is the VHIS?

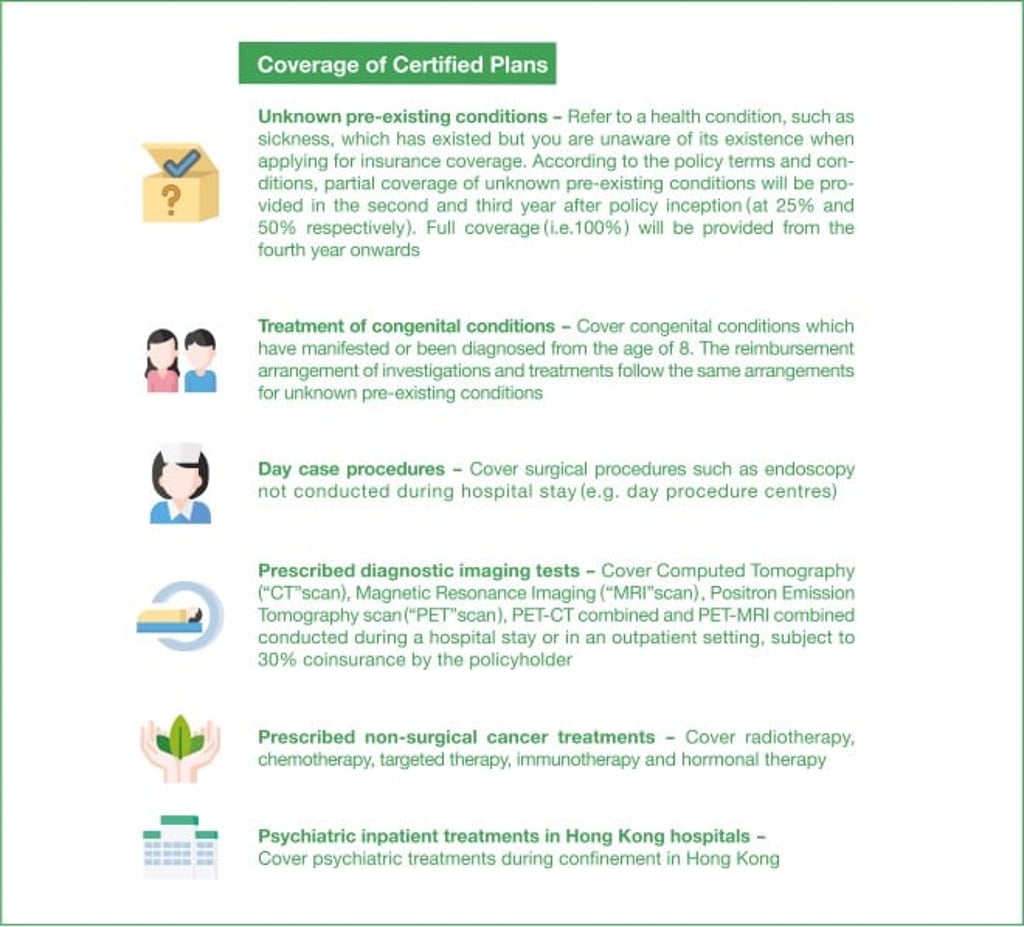

Certified Plans under VHIS are officially certified by the Health Bureau. To enhance consumer protection, all Certified Plans must comply with the minimum requirements of providing the following key product features –

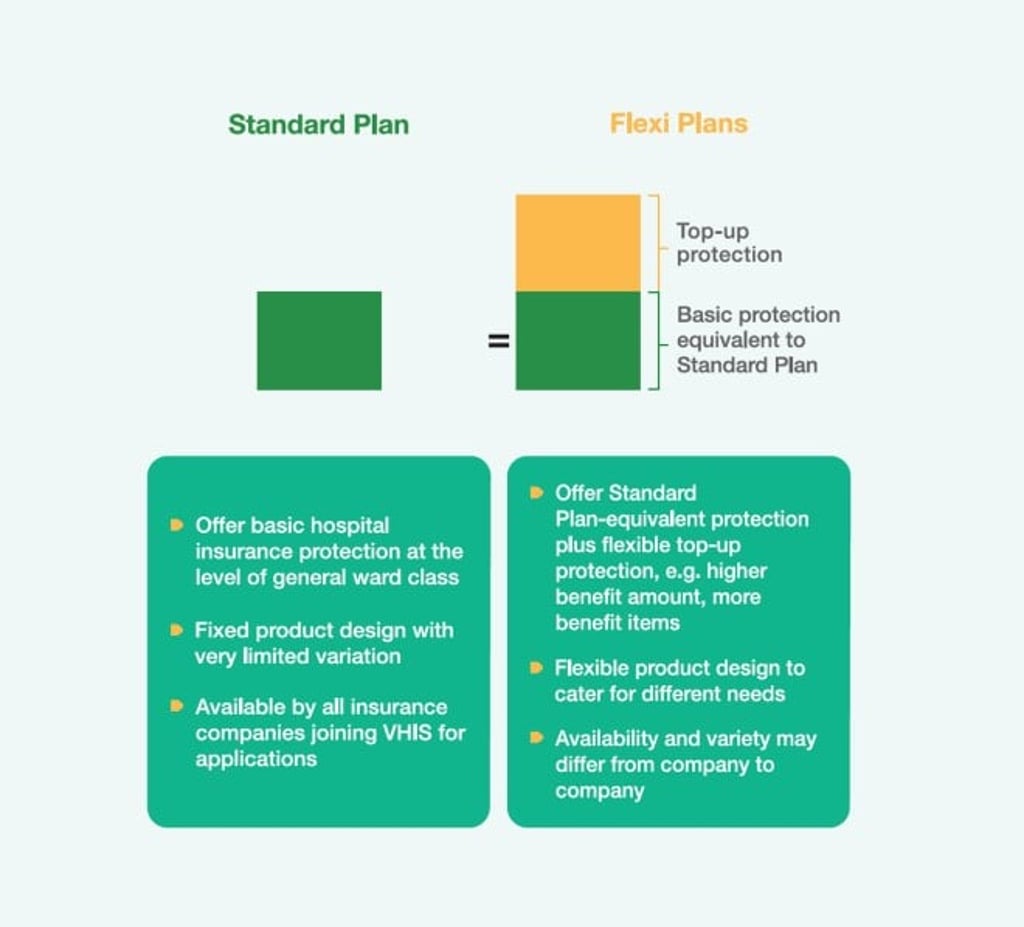

Diversity of VHIS Certified Plans

There are two types of Certified Plans, namely Standard Plan and Flexi Plans. A Standard Plan offers basic hospital insurance protection. Flexi Plans offer Standard Plan-equivalent protection plus flexible top-up protection such as higher benefit amounts, wider benefit coverage and supplementary major medical, etc.

What do I need to know before buying the VHIS Certified Plans?

- Before making any decision, compare the features and coverage of different Certified Plans by using the “Plan Search” function on the VHIS official website

- Have a clear idea about the benefit coverage of the product and read the policy terms and conditions carefully

- Choose a Certified Plan that best suits your needs and budget

- As the Standardised Underwriting Questionnaire has been applied to VHIS Certified Plans, you are advised to disclose the required information accurately

- Review your policy(ies) regularly to ensure that the benefit coverage and benefit amount suit your needs

- Contact your insurance companies or agent/broker to learn more about VHIS

Understand the “medically necessary” and “reasonable and customary” clause

Before making claims, you should check whether the medical service concerned is “medically necessary”. Medical insurance policies include a “medically necessary” clause, insured persons should check whether the hospitalisation treatments, operations or other medical services they are planning to proceed are considered as being “medically necessary”.

“Reasonable and customary” clause is one of the principles the insurance companies follow when handling claims. If insured persons’ medical expenses exceed the “reasonable and customary” level, they will have to pay the excess amount themselves. Claim procedures and guidelines of different insurance companies may vary, and the individual policy terms and conditions apply. Consult your insurance company or agent/broker for more information.

(Sponsored by: Voluntary Health Insurance Scheme Office)