Taking a multi-pillar approach on Asia’s pension reforms

[Sponsored Article]

As life expectancy continues to increase, with people born in developed countries since 1997 now having a 50-50 chance of living beyond 100 years,1 pension systems are faced with handling retirements that could last in excess of 40 years.

Meanwhile, cost of living in Asia continues to rise, evidence has suggested a notable shortfall for people to sustain their post-retirement lifestyle. Pension design in the future is likely to shift from asset accumulation to providing lifetime income in the form of decumulation solutions.2

A multi-pillar prescription for Asia

Given the diversity of challenges in the region, a system that includes a combination of solutions from a multi-pillar framework seems to be a good way to address the need for change. The World Bank has outlined a five-pillar pension framework, and proposed useful criteria to evaluate the performance of pension systems on the basis of five key outcomes: efficiency, sustainability, coverage, adequacy and security.3

Chart 1: The World Bank’s five-pillar pension framework

Considering the unique situation facing every market in Asia, each requires a tailor-made approach. A multi-channel, multi-format strategy and a blend of human and digital interaction form a good starting point for the pension system design.

Looking at Hong Kong, the government plans to roll out the centralised “eMPF” platform from 2022, allowing scheme members to use a single login to access and manage all their MPF (Mandatory Provident Fund) accounts. The platform should provide a better user experience and greater scheme administration efficiency, paving the way for further fee reductions. 4

The core focus of pension design in future will likely shift to providing lifetime income, otherwise known as decumulation, in order to ensure adequacy and manage longevity risk. This will be crucial in serving the segment of Hong Kong retirees who find themselves asset rich but income poor. Select industry pioneers are working to develop compelling solutions that meets the complex and specific needs of current and future retirees.

Boosting adequacy also requires financial education and consumer engagement. The industry should lend support to the government’s efforts in further enhancing public awareness, through a combination of human and digital channels to help users assess their retirement expenses and savings based on their current financial situation.

A reform towards growing the third pillar

While there is no single solution to serve Asia’s pension markets, the five-pillar pension approach of the World Bank provides a useful framework to think about where reform is needed.

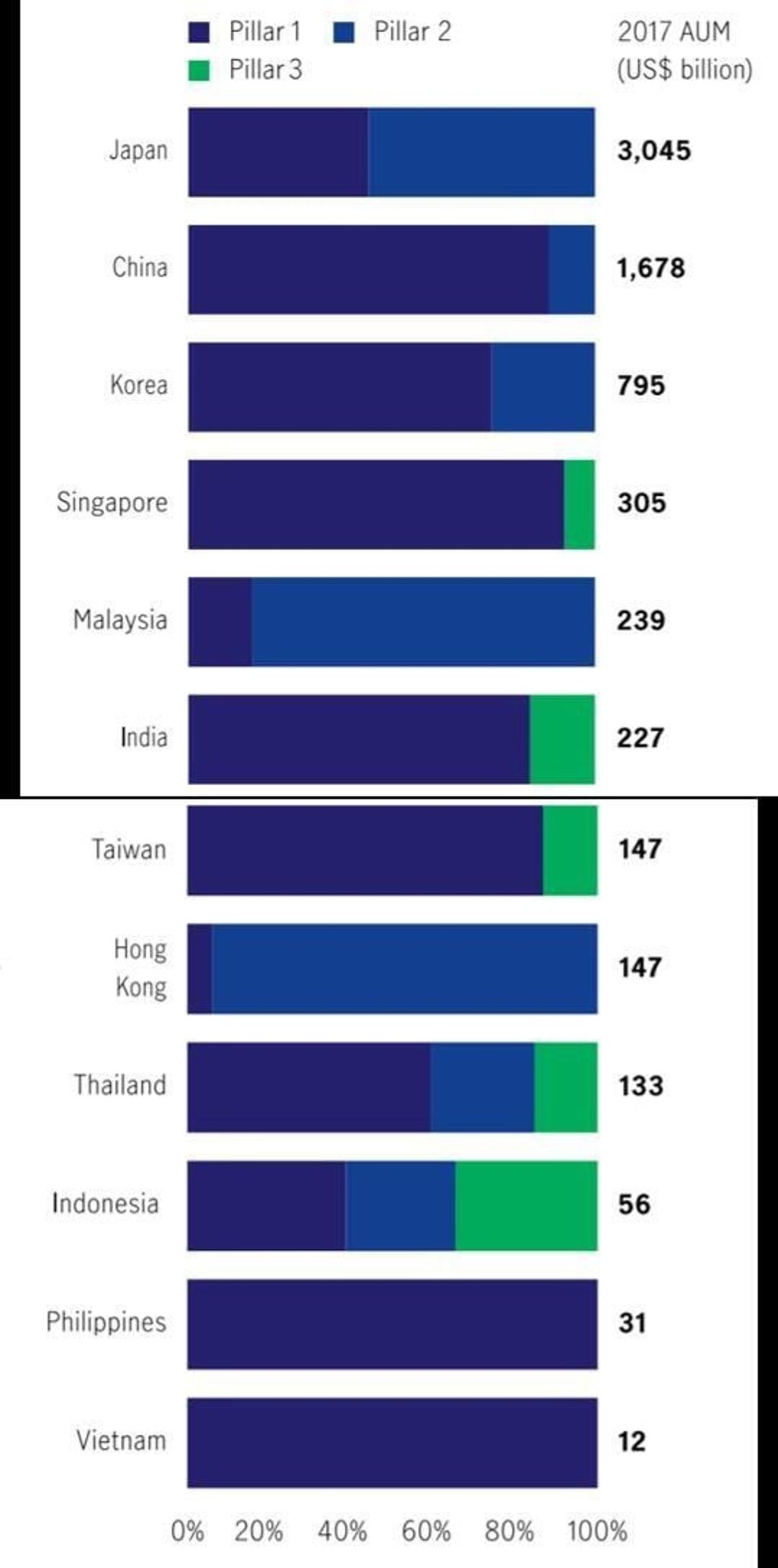

The third pillar will play an increasingly important role across the region. It is by far the least developed of the three pillars across Asia, and is expected to see significant growth in the coming years.

Indeed, as many governments in Asia are at different phases of the pension reform process, they can devise specific policies for their unique demographic and fiscal situations. Once implemented, they can continually review their progress and make further improvements along the way.

Chart 2: Asia’s third pension pillar remains largely undeveloped

Outlook: Consumer engagement/education and innovation will drive future progress

While structural pension reforms coupled with strategic tax incentives are critical for future success, markets in Asia must also focus on consumer engagement and education efforts. These are best pursued through a multi-channel, multi-format strategy that blends human and digital interaction. For instance, Hong Kong and Malaysia have already taken steps to boost their digital presence to make it easier for individuals to access pension-related information (i.e. PRS Online platform in Malaysia and the eMPF platform in Hong Kong).

For consumer education, both the private sector and the government have important roles to play, and would do well to coordinate their efforts.

Overall, Asia can expect to see strong growth in the third pillar retirement system. The crucial next step is to further garner everyone’s support through effective education and engagement. After all, cultivating awareness is the first step to promoting any change, with which Asian markets will be capable of forging their own sustainable path to pension reform.

The article is contributed by Manulife Investment Management