[Sponsored Article]

There is no doubt that the last two years of a pandemic have been challenging for businesses around the world. For small and medium enterprises especially, currency market volatility has meant that profit protection and cost management have taken center stage as businesses find ways to move forward.

With the rise in digital technology and a move to selling online, E-commerce has boomed. For sellers however, it’s not always an easy process. Businesses that frequently transact across borders are at risk of supply chain disruptions and are vulnerable to the exchange rate fluctuations that come with overseas transactions.

In fact, according to Cissy Hon, Head of Sales & Partnerships of OFX, Hong Kong, sending or receiving money overseas for many of these businesses means exposure to FX risk, which could be the difference between profit and loss.

“FX risks are caused by exchange rate fluctuations, and those can have a huge impact on your costs and profits,” Hon said. “The pandemic has caused great disruption to logistics which has led to prolonged shipment times, meaning longer lead times between placing orders and receiving settlement, and this means higher exposure to currency fluctuations.”

Research conducted in 2020 by market research firm East & Partners shows that businesses have suffered currency losses as high as US$71,400 because of foreign exchange (FX) volatility. The study further revealed that within a 6- month period, 64% of Asian small and medium enterprises (SMEs) have suffered an average loss of US$11,500 per transaction.

For this reason, OFX has been filling a gap in the market by offering not just global money transfer services, but also strategies and practical FX solutions such as hedging to help businesses, especially SMEs, to weather the pandemic storm.

“This is an opportunity for SMEs to take control by actively engaging with FX risk management knowledge and products,” Hon said.

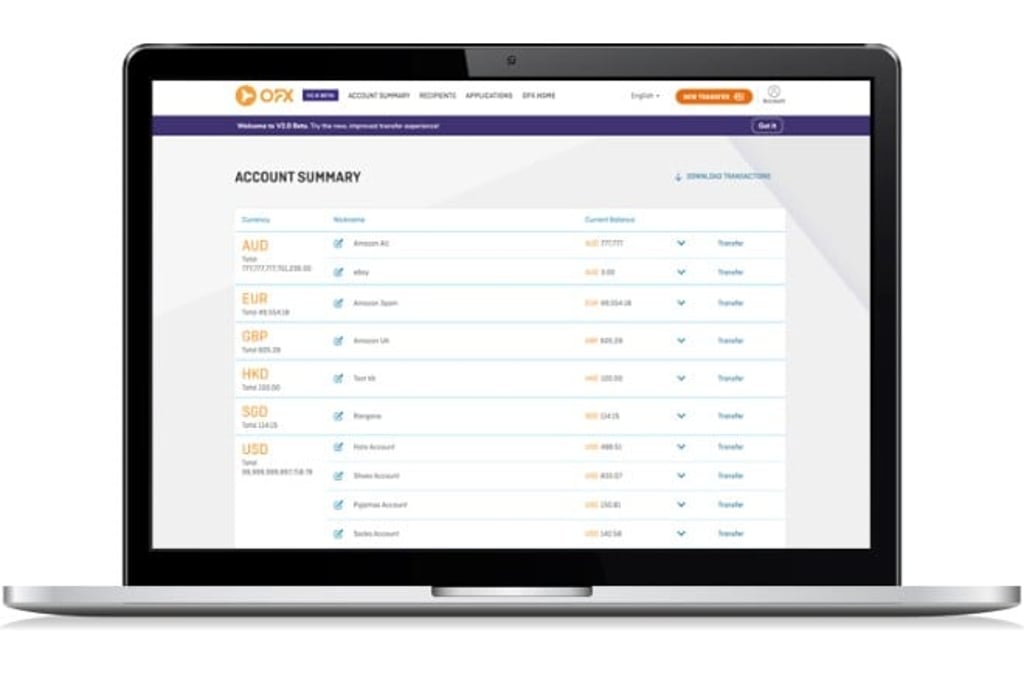

And there are many advantages to this. Firstly, Hon said that by having an OFX Global Currency Account, companies can pay and get paid like a local even when they are selling overseas. They can receive money and collect and hold funds from international marketplaces such as Amazon and eBay, or even payment gateways such as Paypal.

Another advantage is that businesses can send money using the funds in their Global Currency Accounts to pay international suppliers, fees and taxes using the local currency. This also reduces any unnecessary conversion fees and costs.

Last, but not least, businesses can lock in a rate for up to 12 months through the company’s hedging products and protect itself against any market movements.

Indeed, OFX offers a range of products that helps companies to mitigate their exposure to currency risk. These include:

- Forward Contracts, which allows customers to lock into a favourable exchange rate for up to 12 months, very much like a fixed mortgage rate;

- Target Rate Transfers, which allows customers to set a target rate that works for them. OFX will trigger the customer’s deal once the target rate is reached;

- Market updates, which allow customers to receive the latest information on the FX market and to make more informed decisions; and,

- the Currency Outlook, which is a monthly wrap-up and forecast of the Hong Kong dollar and other major currencies, which is ideal for budgeting and reporting.

Hon says that getting specialist help on FX risk management not only allows businesses to focus on their growth plan, but also to regain control of an unpredictable and rather volatile market.

“The fact of the matter is that data points show businesses turning to cost certainty and predictability over pure cost savings, as more businesses are also turning to E-commerce over bricks and mortar,” she said.

And indeed, there seems to be a growing trend for SMEs to utilise such services.

“We’ve seen a rise in E-commerce adoption from around the world, almost at the speed of 10 years of adoption compressed into three months, so naturally our OFX Global Currency Account is highly sought after by online sellers,” Hon said.

Stanley Lee, Founder and Director of IDS (HK) has been trading in E-commerce for over 10 years and found that being an international seller meant frequently receiving money in multiple currencies. Handling remittances soon became a real hassle.

“To international corporations, the remittance charges may not be a significant cost but for those SMEs with E-commerce businesses, handling multi-currency transactions may be very difficult,” he said.

“If you’re proactive in understanding what FX risks your business is exposed to, and actively seek help from FX specialists like OFX, you can then develop a FX risk management strategy that suits your business,” Hon said.

For more information on how to better manage your FX risks, you can check out here.