City’s new retirement mastery index reveals productive generation’s competency and control over retirement savings

How prepared are you for your eventual retirement years? You may think you are well prepared. But how well organised is your retirement strategy, compared to others?

[Sponsored Article]

Now you can find out, thanks to Sun Life Hong Kong—a long serving insurer in Hong Kong with life, health and pension solutions. Last month, Sun Life Hong Kong commissioned a dedicated survey, which randomly chose 1,000 respondents, aged 30-45.

The survey considered Hong Kong people’s performance in three key areas, or pillars. Namely: Intelligence, which assesses the individuals’ own personal knowledge about retirement planning and retirement savings; Momentum, meanwhile, looks at the actual activities taken to plan and save for retirement; and finally, Positive Experiences represent an individual’s personal experiences during the time that they worked to achieve their retirement savings goals.

The feedback was meticulously extrapolated and calibrated and the final overall score of the inaugural Sun Life Retirement Mastery Index (Index) was found to be 56.3. Various degrees of “performance deficit” are registered for the three key areas of Intelligence, Momentum, and Positive Experiences. These performance deficits measure the gaps between perceived importance assigned by an individual and the real performance he or she puts out.

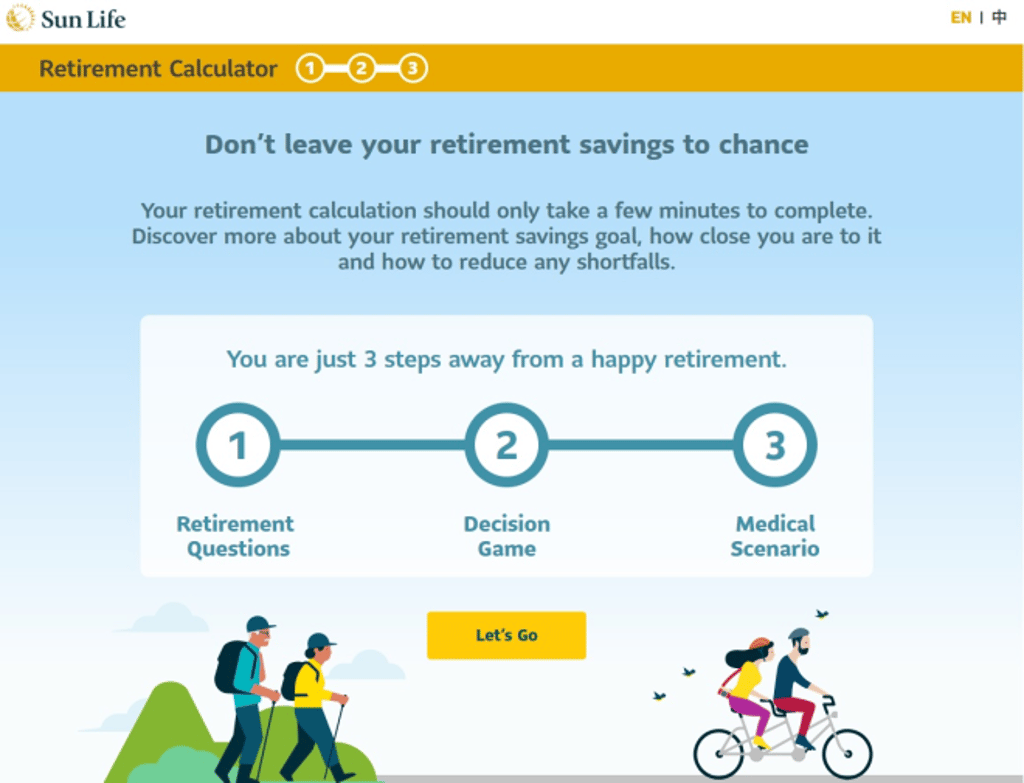

So what do the scores mean and why has Sun Life Hong Kong launched this Index now, considering that the awards-winning company already provides its clients and the community at large a range of tools and calculators to gauge their financial health? With the company’s retirement savings calculator being popular.

The Index, as it turns out, offers people working towards their financial retirement goals a respite from just being concerned about the amount of money they have saved and the saving gap.

“Instead, the index allows Hongkongers a chance to constantly review the degree of control and their competency they have over their own retirement journey,” explains Haymans Fung, Chief Marketing and Digital Officer of Sun Life Hong Kong. “The journey from retirement savings planning to execution, and how pre-retirees can make the best of the journey by identifying the key movements, enhancing the positive experiences.”

If divided into singles and coupled, the scores were 52.4 and 58.6, respectively. The 6.2-point difference suggests that, perhaps unsurprisingly to many, singles are less proficient at retirement planning than married people.

The survey also found that one out of five respondents trusted themselves more than professional financial planners. Sun Life Hong Kong, however, encourages people to seek the services of professional financial planners—even if only to have their savings records placed in proper order.

On a separate and encouraging note, Hongkongers are found to think and act more positively about their retirement plans. For example, despite these challenging times of the pandemic, almost half of the surveyed people (48%) said they have worked rather hard in the planning for their retirement savings; this compared to one-third (33%) who did so just one year ago.

But people have not only become extra responsible for planning. More people (55%) have now seriously started systematically saving for retirement; this compared to just 36 per cent a year before. The two tax deductible voluntary contributions launched in 2019—Tax Deductible Voluntary Contributions and Qualifying Deferred Annuity Policies—proved popular among respondents, with nearly six out of ten (58%) of the surveyed individuals already using or considering using the products.

Another of the survey’s interesting findings is the level of attractiveness of the Greater Bay Area (outside Hong Kong) as a potential destination for a long term or even permanent home for retired life. Nearly half (46%) of the respondents entertained the thought of relocating, or staying temporarily, in the Greater Bay Area (outside Hong Kong).

Will the Greater Bay Area become more appealing in the years ahead for people to spend their golden years? 51% of respondents believe that new initiatives and developments in healthcare will increase their interest in moving to the Greater Bay Area post retirement.

Sun Life Retirement Mastery Index provides intriguing reading into how well prepared Hong Kong people are for their eventual retirement. And this revealing Index comes at a fitting time. Because Hong Kong— like much of the rest of the world, is still gripped by the pandemic, one of the greatest health and economic challenges of our lifetimes. The Index could not arrive at a more crucial time to help Hong Kong’s hard-working people become better informed on how to safeguard their retirement years—no matter what our future may hold.

All information contained in this article shall only be used as general reference for sharing purposes. The statistical data of this article is obtained from a survey conducted by a survey agent commissioned by Sun Life Hong Kong. All information contained in this article is not intended to provide any forms of guarantee, and does not constitute a solicitation of an offer or offer, and shall not be regarded as the basis for any contract, to sell or to purchase any insurance products. The view contained in this article may be changed at any time without prior notice. Information is provided base on sources believed to be reliable, Sun Life Hong Kong Limited (Incorporated in Bermuda with limited liability), its associated companies and their directors and employees (collectively “Sun Life Hong Kong”) gives no express or implied warranty, guarantee or represent its accuracy, effectiveness, completeness of the same. Sun Life Hong Kong accepts no liability whatsoever for any loss or damage arising from use of any information or opinion herein. This article is owned by Sun Life Hong Kong. Modification or change is not allowed without the Sun Life Hong Kong’s prior consent. This article is intended to be distributed in Hong Kong only and shall not be construed as an offer to sell or a solicitation to buy or provision of any products of Sun Life Hong Kong outside Hong Kong.