Taxes Hurt Innovation: Study

[Sponsored Article]

MUKHERJEE, Abhiroop | SINGH, Manpreet | ZALDOKAS , Alminas

Journal of Financial Economics 124 (2017)

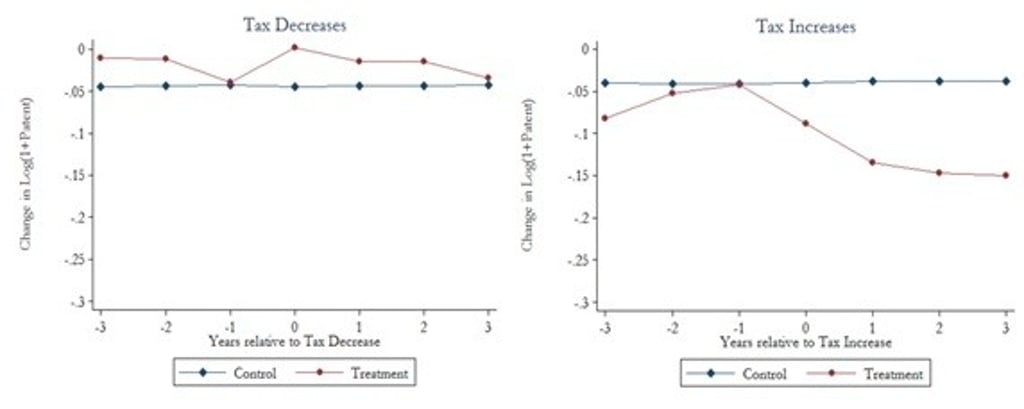

An increase in corporate taxes leads to drops in patents, research and development (R&D) expenditure and new product introductions, but a decrease in taxes does not appear to boost such innovation-linked activity, according to a study that looked at corporate income tax changes across American states from 1990-2006.

Researchers Abhiroop Mukherjee, Manpreet Singh and Alminas Žaldokas were able to rule out other causes to explain the decreased innovation activity, including local economic conditions. They showed that within two years of a tax increase, 67 per cent of firms affected filed about one fewer patent compared to a firm in a neighbouring state exposed to the same economic conditions but not affected by a tax change. This added up to an overall five per cent drop in patenting activities.

Similarly, R&D expenditure declined by 4.3 per cent and new product introductions by 5.1 per cent.

“These findings taken together imply the effect of corporate taxes pervades all stages of innovation. To the extent that innovation is regarded as a key determinant of economic growth, we believe these results are not only academically interesting, but also timely and policy-relevant,” the authors said.

Apart from ruling out local economic conditions as the cause a drop in innovation, they also took account of such factors as whether firms came from politically-different states, whether the effects were driven by changes in big innovation states (California and Massachusetts), and whether the tax increase was predictable. The findings still held.

The authors also looked at factors that may be driving the decrease in innovation, and found tax increases led to a significant number of inventors leaving their employers and a systematic decline in the riskiness of innovation projects. They also noted that changes to firm financing in response to tax changes might partially explain the drop in innovation.

Tax cuts did not appear to redress the balance, even though these were more frequent. During the study period, there were 51 instances of tax cuts in 24 states, against 32 instances of tax increases in 20 states. Such an asymmetry in tax effects could stem from the following fact. If research funding is cut, existing projects have to stop; but if research budgets suddenly go up that doesn’t mean that researchers will find great new innovative ideas immediately. So the effect of tax cuts might take longer to show up, making them hard to detect in the data given that many other things can change over the longer run.

The authors said their findings were particularly important because there has been little research on the effects of corporate taxes on investments in or output of the innovation process, in particular patents and new products.

“Compared with physical capital investment, innovation involves higher risks of failure, little chance of re-deployability of assets invested in if projects fail, and is much more human-capital investment,” they said.

The focus of the study is pertinent today because many governments face a sharp trade-off between austerity and future growth. This debate has centred on two key arguments: do tax increases risk harming innovation, as some have argued in regards to the Greek austerity deal, or can innovation still thrive alongside high taxes, as is the case of Sweden?

“Our evidence supports the first view,” the authors said. “Firms respond to tax increases by filing a lower number of patents, investing less in R&D, and bringing fewer new products into the market which, taken together, suggests higher corporate taxes indeed reduce innovator incentives and discourage risk-taking. We find weaker results on increasing innovation in response to tax cuts.”