Home-buying sentiment remains upbeat across Asia Pacific

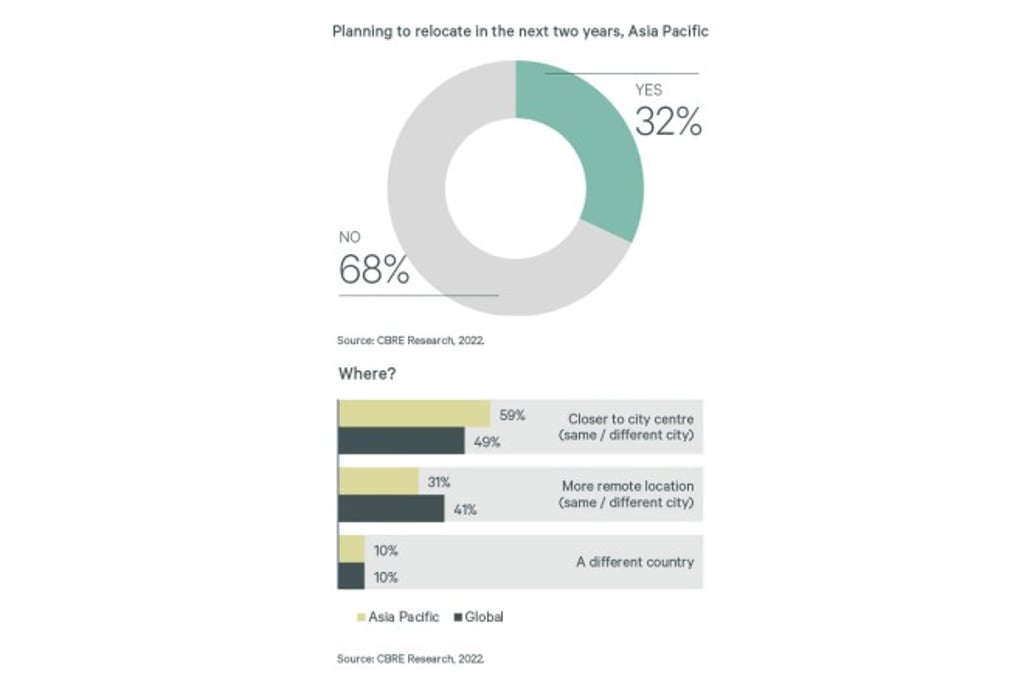

A new Global Live-Work-Shop Survey conducted by CBRE finds that nearly one-third of respondents want to move, and there is a stronger preference to live closer to city centres, with most of them preferring buying to renting

[The content of this article has been produced by our advertising partner.]

Not only has Covid reshaped the way we work and shop, but it has also prompted more people to think about moving house, preferably by buying a new home in a city centre location where they can enjoy a better quality of life and less time commuting.

This observation is based on a new CBRE survey of more than 20,000 people worldwide – from Gen Z to Baby Boomers – that aimed to understand how they will live, work and shop in the future. Included in the survey were 9,000 respondents from across Asia Pacific.

Asian households are generally less indebted and have stronger financial standing than their Western counterparts. They generally perceive real estate to be a long-term investment, says Henry Chin, Global Head of Investor Thought Leadership & Head of Research for Asia Pacific at CBRE.

“While real estate markets in some Asian markets are now enduring a correction in response to recent rate hikes, buyers are opting to wait it out and take advantage of buying opportunities when they emerge.”

Another interesting observation is that the Gen-Z generation, or those currently in their 20s, in some cities, for instance Singapore and Hong Kong, have shown a greater willingness for co-living.

One of the reasons for this could be that it is more affordable and more environmentally conscious than living separately. “As co-living becomes increasingly popular, developers and investors will realise that there are opportunities to develop products with this need in mind,” says Chin.

As well as a strong buying sentiment, the pandemic has also prompted a shift in home selection criteria. The study found that 66% of people now consider health and safety more important than the price when selecting a new home.

“This growing preference is especially obvious among mainland Chinese homebuyers,” says Ada Choi, Head of Occupier Research & Head of Data Intelligence and Management for Asia Pacific at CBRE.

With several Chinese cities having gone through periods of lockdown, mainland Chinese homebuyers have realised how important the living environment and safety is to their overall well-being.

“It’s not just about the living space itself, but it’s also about property management, security, facilities, access to amenities, and more,” Choi explains.

From China to Singapore and South Korea, more respondents consider public transportation to be more important than car-parking space, while in the US it is the other way around. For Asian buy-to-let investors and owner-occupiers, ‘location, location, location' remains as true as ever.

Strong demand for enhanced workplace flexibility and quality

Living in a pleasant environment and spending a minimum amount of time commuting to work are integral to achieving work-life balance. As evident in the findings, ease of access to work has a strong positive correlation with an employee’s happiness – 75% of workers are satisfied with their offices in city centres, while only 55% of those working in suburbs are satisfied.

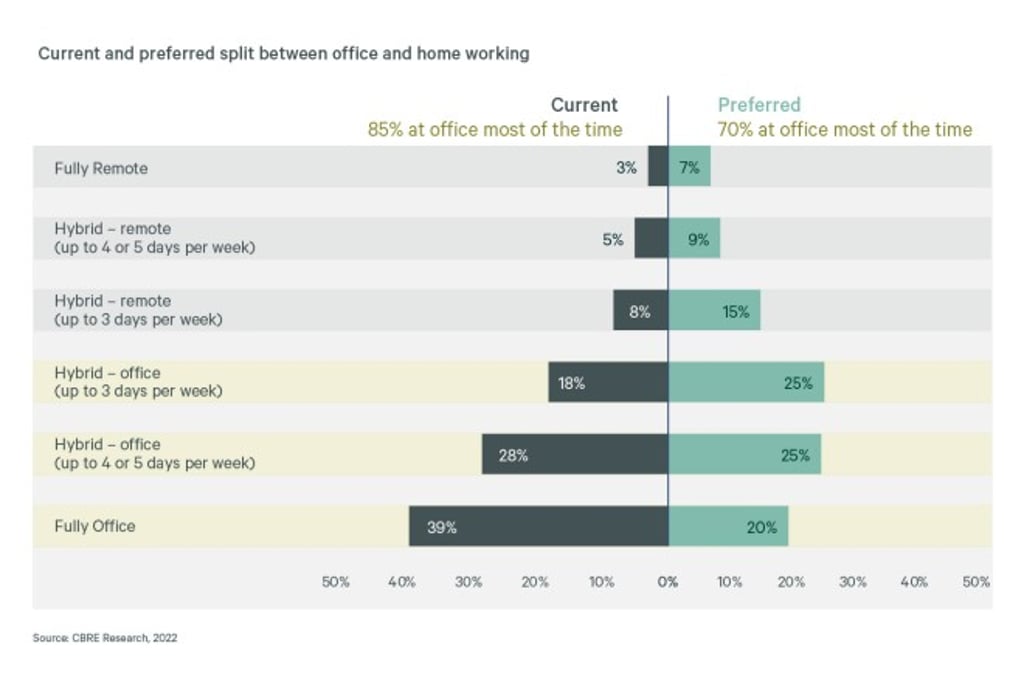

Unsurprisingly, most workers want a better work-life balance, but to put it in perspective, workers want more flexibility in the ways that they switch between work and home. Many employers now provide a ‘hybrid work’ option as a fringe benefit.

In the survey, about 85% of Asia Pacific respondents said they spend at least three days a week in office, but also have the option of working from home for a day or two.

When they are back to office, the quality of a workplace -- valued by 69% of surveyed office workers – is important to productivity and creativity.

A few years back, workspaces started to become less closed off. Open spaces, co-working spaces and flexible seating have taken the place of cubicles, making office workers more visible to one another, and increasing collaboration and communication.

Collaboration and teamwork are important, and so open spaces will remain as an integral part of office configuration. But there will also be more creative spaces, like cafes and booths, to promote ideation, brainstorming and socialisation to keep office workers creative, engaged and motivated, says Chin.

“On the other end of the spectrum, cubicles and fully enclosed pods where workers can concentrate and focus will also be indispensable office design elements.”

Over the past three years, Hong Kong has faced unprecedented challenges. This has led to record highs of Grade A office vacancy and rents falling by nearly 30% since mid-2019, according to CBRE research.

“I think Hong Kong is now recovering from a sustained difficult period. Since the office market has shifted in favour of the occupiers, it’s time for businesses to re-establish themselves and take advantage of more office space availability and affordable rents,” Chin notes.

Omnichannel strategy is key to cater to shifting shopping preferences in Asia Pacific

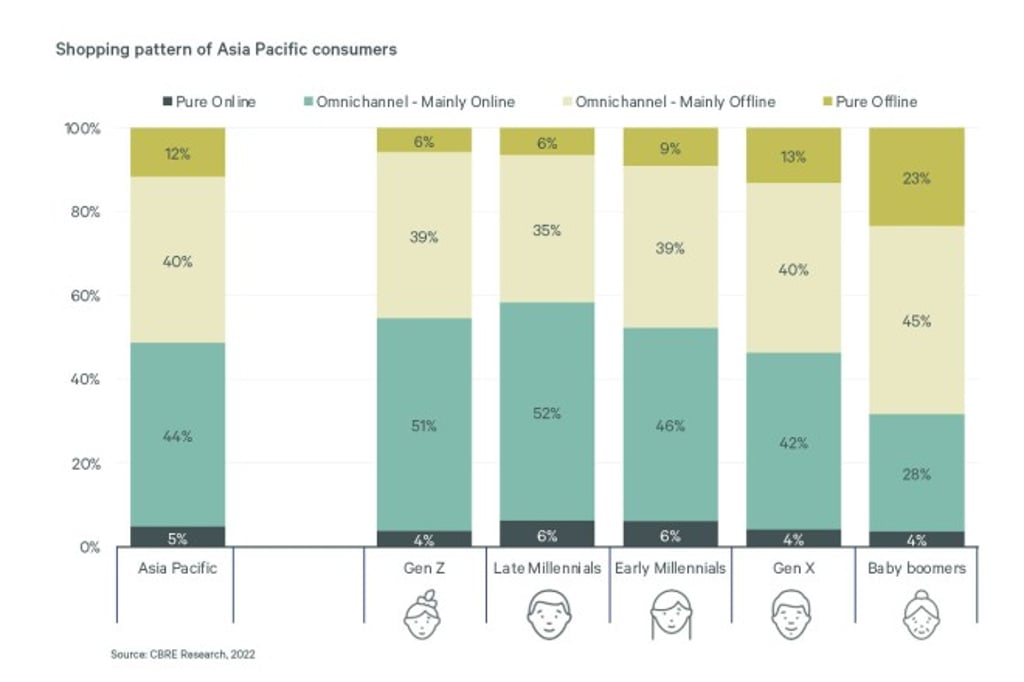

The retail landscape has also been structurally reshaped by the pandemic. More than 60% of Asia Pacific respondents have made omnichannel features combining buying online, in-store pick-up and in-store shopping part of their regular shopping routine.

But compared to the global average, Asian consumers prefer shopping in-store especially when it comes to shopping for luxury items.

It is likely that this shopping habit will continue post-Covid. Retailers and brands must rethink their omnichannel strategies and how to implement them, from store logistics to infrastructure, says Chin.

The survey findings further show that people in Asia generally want to live where they can easily commute to work, near public transport links and have access to the benefits of living in a city. This is where transit-oriented development (TOD) comes into play.

“Hong Kong, for example, is a compact city. Yet, we have many large-scale mixed-use developments concentrated around MTR stations, so residents and workers can live, shop and work in close proximity to one another,” says Choi.

“The urban planning approach used in Hong Kong that focuses on TOD could be a good example for other Asian cities as well.”

Read the full Asia Pacific Live-Work-Shop report to delver deeper into the findings.

CBRE’s Interactive Data Dashboard allows you to explore the data behind the survey and compare global results against those of your own geographic region, market and age group.