Heads Up CIOs: What Lies Behind the 2024 Gartner Magic Quadrant Report for Primary Storage

[The content of this article has been produced by our advertising partner.]

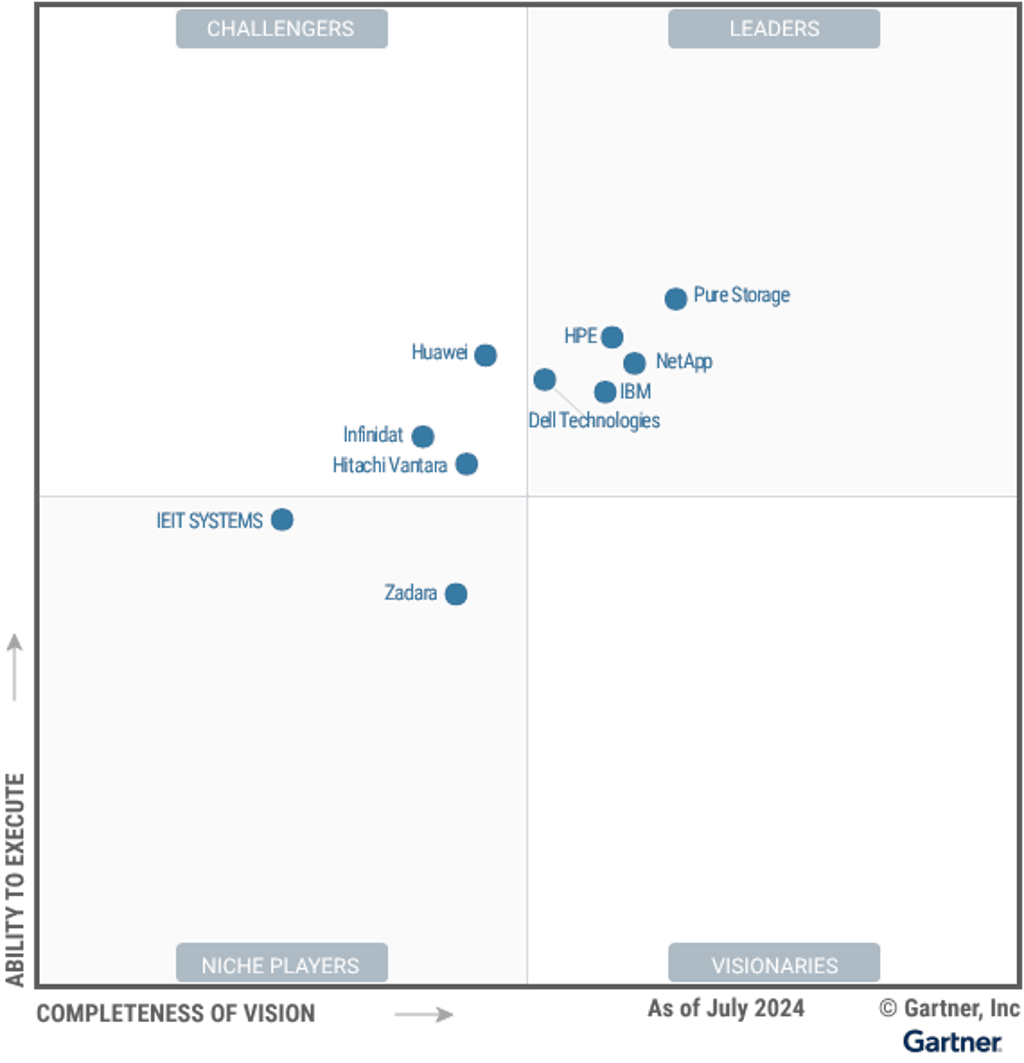

As the data storage industry evolves, Gartner’s changes to the 2024 Magic Quadrant for Primary Storage Platforms (PSP) are causing concern among vendors and customers. The reorientation toward hyperscaler integration and geopolitical raises critical questions about competition, innovation, and customer choice.

Inclusion and Evaluation Criteria Revisions Favour Hyperscalers

The revisions by Gartner heavily emphasise platform-native services, storage-as-a-service, and hybrid cloud architectures, where hyperscalers excel. A similar story unfolds with a focus on software-defined storage. Moreover, Gartner’s revised criteria demand a global presence across major geographies, further cementing the advantage for hyperscalers.

While many traditional vendors maintain strong customer bases in specific regions, they often lack the extensive global infrastructure of hyperscalers, which operate on a global scale by design. This challenges vendors outside the United States, where the hyperscalers dominate. Traditional vendors offering high-quality solutions with a strong vision for the future will be disadvantaged due to their limited global reach, an issue sometimes driven by geopolitical constraints rather than a lack of capability. For example, regional players in Europe and Asia-Pacific could be excluded from the Leaders quadrant by not having a substantial presence in North America. This is particularly contentious as Gartner arguably presents a less comprehensive view of the Primary Storage Market.

Revisions Limits Choice and Innovation

The criteria shift to favour a hyperscaler-dominant model could have far-reaching implications, fundamentally reshaping the competitive landscape of the primary storage market. One of the most concerning outcomes could be an erosion of competition and stifling of innovation. Traditional vendors, who have pioneered breakthroughs in areas like flash storage, data deduplication, and enterprise-grade data management, could be sidelined, resulting in a loss of innovation.

Without competition, hyperscalers will be less incentivised to innovate, leading to a homogenised market where new and disruptive technologies struggle to emerge. Equally, if the Leaders quadrant only includes US-based vendors, it weakens enterprise IT's diversity, richness, and innovation, potentially negatively impacting its long-term prosperity and competitiveness.

Another significant risk is the increasing likelihood of vendor lock-in. As hyperscalers consolidate their power, businesses may increasingly rely on these cloud providers. Switching providers or integrating with alternative solutions could become costly or operationally complex, limiting customer flexibility and cost predictability. Over time, businesses may face fewer choices, higher long-term costs, and reduced negotiating power, leaving them vulnerable to market dominance by a few large players.

The Future of Primary Storage Requires Balance

The proposed changes to Gartner’s Magic Quadrant for Primary Storage will undoubtedly reshape the competitive landscape. While hyperscalers, almost by default, are positioned to thrive under the new criteria, traditional vendors will respond to the challenge. Critically, the future of the primary storage market depends on maintaining a balanced ecosystem. Gartner’s evaluation criteria must continue to reflect the diverse needs of the storage ecosystem, including recognising the scale and reach of hyperscalers while also valuing the specialised expertise and customer-driven focus of traditional vendors. Yet, its revisions seem at odds with this.

This isn’t just a concern for storage vendors but also enterprise customers. Industry stakeholders, including vendors, customers, and policymakers, must advocate for a market that promotes open standards, fair competition, and customer choice. Only by maintaining a diverse market can we ensure that innovation continues to thrive and businesses retain access to the tailored solutions they need to succeed in an increasingly digital and interconnected world.