How Family Offices Can Fight Climate Change

In Asia, there is an acute need for more transparency and disclosure on ESG to address climate risks, and family offices in the region can play a more active role

[Sponsored Article]

By Professor Entela BENZ-SALIASI,

Adjunct Associate Professor,

Department of Finance, HKUST Business School

By definition, ESG investing is works toward a sustainable business, a business that will last and thrive for more than one generation. The Asian economy is a family-based business that traditionally takes a long-term view which itself aligns well with the ESG principles. The drawback is that as these family-run businesses lack the investor pressure to disclose ESG related information, policies and strategies.

Climate risk is the biggest threat to family businesses

ESG accounts for hundreds of risk factors that are difficult to quantify, measure and control. Therefore, a proper ESG application needs a laser-like focus. In this midst of so many elements, there is one single risk factor that sits at the core of ESG, and that is climate change. This brings an enormous amount of associated environmental and social risks with it. Due to climate change, climate risk is set to be the most significant risk to businesses and society overall.

A fast-changing environment with the upcoming regulations, policy changes, technological shifts and drastic shifts in consumer behavior, is expected to put significant pressure on companies. So, companies worldwide are starting to realize that the business-as-usual scenario is no longer valid. Nonetheless, few company leaders seem to grasp the idea of climate risk, let alone internalize these risks and carry stress-test scenarios. The card of downplaying these risks as too uncertain or too distant in the future is no longer credible.

No longer business as usual for family-run businesses, especially in Asia

Relative to America and Europe, Asia has twice as high physical climate risk as Europe and 50% more than the US. Moreover, Asia is also set for fast urbanization and that mostly in coastal cities. Due to climate change and extreme weather, coastal cities are the most vulnerable to sea-level rise and coastal flooding. In Asia alone, about 180 million people living in cities such as Guangzhou, Mumbai, Kolkata, Shenzhen, Tianjin, Ho Chi Minh City, Jakarta, Chennai, Surat, Zhangjiang, Bangkok and Xiamen will be affected from flood related losses by 2050 #2. Consequently, the combination of high climate risk and high urbanization in coastal areas will lead to both environmental disasters, enormous economic losses while threatening millions of lives. To make it worse, Asia’s increasing need for energy and infrastructure, while transitioning from agriculture to industry-based economy, has exuberated the CO2 concentration and the water scarcity in the region.

Climate change is putting to test the “long-term views” of family businesses

We often say that family-run companies take a long-term view. The problem is that in the light of increasing climate risk and climate change, these long-range views have become very hard to visualize and predict.

The latest release from WMO in Dec 2019, predicts temperatures rising as much as 4-5 degrees Celsius. Now let’s compare that to 1.5 degrees Celsius mark, the ambition of the 2015 Paris Agreement. By 2019 we have already passed the 1 degree Celsius. The UN Climate Change Conference (COP25) saw governments failing to act despite the mass rallies which demanded concrete actions in curbing climate change. In fact, 2019 saw many one-in-100-year events happening on a weekly basis, including devastating hurricanes, spring bushfires, heatwaves and unusual cold spells. If one dares to visualize what the world will be like ten years from now, the future is bleak and getting bleaker.

In the past few years, the financial losses related to climate change and extreme weather reached anywhere between $200-300 billion per year. In Asia, less than 10% of weather losses are insured, and these losses are getting bigger, unpredictable and uninsurable. Because of climate change, climate risk is no longer a tail risk but a systematic risk.

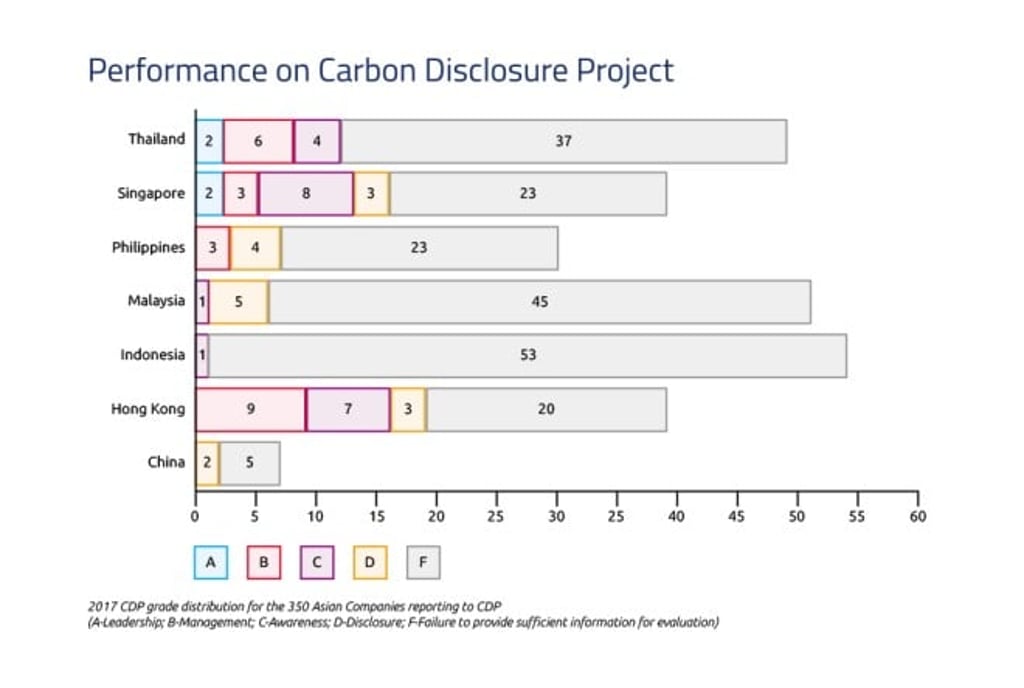

Where there is risk there are also opportunities, starting from mitigation and adaptation to new products and new markets. The bad news is that only a handful of companies in Asia disclose climate risk. Back in 2018, we analyzed a comprehensive and unique set of 350 Asian companies that reported to Carbon Disclosure Project (CDP) in 2017 #3. As expected among the 350 companies, 326 disclosed some information to get a CDP rating. However, 80% of them failed to provide sufficient information for evaluation, hence they received an F rating. Only Hong Kong, Thailand and Singapore have B-level Awareness (the 2nd highest), while none makes it to the A-Leadership position (the 1st -highest rank). Concerning country performance, Singapore ranks the best with only 66% of companies failing to disclose information for evaluation. Indonesia and Malaysia rank the lowest with almost 98% and 80% of companies respectively failing to pass the minimum stage F, which is a failure to disclose.

In today’s world, wealth means power. The rich have a moral obligation to do so even more than the poor who are currently struggling to survive in the face of climate change. So what can family offices, holding the economic and the political power, do? Here are some well-discussed but not yet adopted measures that family offices can effectively embrace.

First, there is evidence stating that the richest (1%) of the population emit 175 times more carbon than the poorest #4 (10% bottom). Family offices can take more active steps to reduce the carbon footprint generated from their businesses.

Second, family offices have political influence on governments and regulators to push for structural changes such as stricter policies on carbon pollution, water usage and heavier fines for water-polluting companies.

Third, family offices can exert direct pressure on companies to disclose climate risk assessments as well as policies and strategies to reach these goals. Similarly they can discuss these criteria with their client advisors in managing their wealth consciously and respectfully.

Fourth, family offices can actively divest from companies that refuse to take actions against climate risk and make these decisions public. Currently, there are 59,524 wealthy individual #5, 1101 organizations with a combined wealth of $8.8 trillion that has divested from companies with controversial activities.

Fifth, family offices can themselves fund, support with donations or simply invest in climate solutions. Many of these solutions are new, expensive to build and need patient capital in tackling climate-related problems.

Sixth, they can raise awareness and instill change in other family offices. Many family businesses do address these issues within their existing investment framework, but as the time is pressing, we need leaders and a more aggressive stance on it.

To conclude, climate risk is an existential threat to our society. Most importantly, given the economic footprint of family offices in the Asia region, it is their moral duty to use their political power and play a significantly active role in tackling climate change.

References:

- DWS Research Institute October 2019 “Why emerging markets are defined by ESG”

- Asian Development Bank (January 2017) A Region at risk: The human dimensions of climate change in Asia and the Pacific

- Chapter 2 on "Climate Disclosure and Climate Risk for Asian Companies" and chapter 9 on "Impact of Climate Risk Factors on Valuations of China A-Share Market", Book on “Sustainable Energy and Green Finance for a Low-carbon Economy”, Jingyan Fu and Artie W. Ng (Eds), Springer Nature Switzerland AG 2020

- Nature Climate Change | VOL 9 | FEBRUARY 2019 | 82–87 | www.nature.com/natureclimatechange

- https://www.divestinvest.org/