Standard Chartered: Technology-enabled wealth advisory is the future

[The content of this article has been produced by our advertising partner.]

Artificial intelligence (AI) is probably one of the most said words in the past year, with the world amazed by the launch of Open AI’s ChatGPT in late 2022 which perfectly showcases how powerful the technology can be. In fact, generative AI is just the tip of the iceberg and the wider AI applications are far beyond that.

There is no doubt that AI will profoundly change the way we live and disrupt almost every industry. Banking services are of no exception. There are many already-known benefits that AI can bring to the industry, such as enabling more personalised services, enhancing efficiency and productivity, and thus improving overall customer experience and satisfaction.

In particular, AI is considered a future tool to help drive smarter investment decisions. It is not an extravagant claim by banks or technology companies only. Investors also believe that AI can help them in wealth management, according to Standard Chartered’s survey conducted in recent months. The study polled 508 respondents, each of whom held a minimum of HKD 1 million in net investible assets.

Upward trajectory of technology-enabled wealth advisory adoption

As reflected in the Bank’s survey titled “Managing Wealth Using the Latest Technology”, about 80% of affluent investors – who have an average of nearly HKD 4.56 million in investible assets – believe that AI will become important in helping them achieve their financial goals over the next three years. Older millennials (aged 35 to 42) are the most confident about AI, among whom 35% believe it is “very important”, compared to 26% of younger millennials (aged 27 to 34).

Alson Ho, Head of Wealth Management at Standard Chartered Hong Kong, said, "Technology-enabled wealth advisory services will be a major trend in the future. Overall, digital technology is making Hong Kong affluent investors more confident in their investments and more flexible about using AI and expert analysis."

The increased understanding of technology-enabled wealth advisory explains its high level of adoption (68%) among Hong Kong affluent investors. 40% of respondents claim that they access these services through their relationship manager (RM) or wealth specialist, and 28% say they are already using these tools self-directedly.

Not surprisingly, the majority (77%) of affluent investors respond that they would adopt technology-enabled wealth advisory in future. 93% of affluent investors believe innovations in technology and digital platforms will transform how wealth advisory is delivered in the next five years and expect to use such services more going forward.

Better investment returns and services anticipated

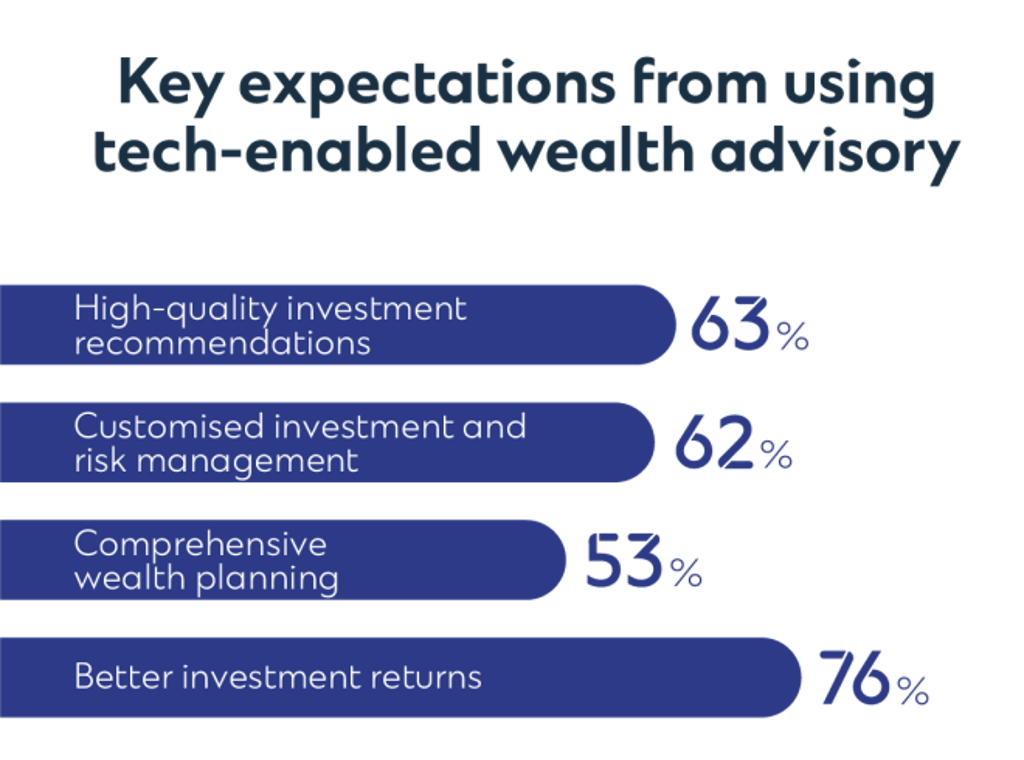

Hong Kong affluent investors are showing a high confidence level in using new tech tools in the wealth advisory process, with 86% indicating high or moderate confidence. Over three-quarters of respondents anticipate better investment returns brought by technology and digital tools, followed by high-quality investment recommendations, customised investment and risk management, and comprehensive wealth planning.

Yet, despite the fact that the use of digital channels has been gaining popularity, the human touch in financial advisory services cannot be replaced. The survey shows an overwhelming need for continued assistance from RMs alongside the use of new technology, with 84% of respondents stating their preference for continued in-person interaction with their RM or wealth specialist.

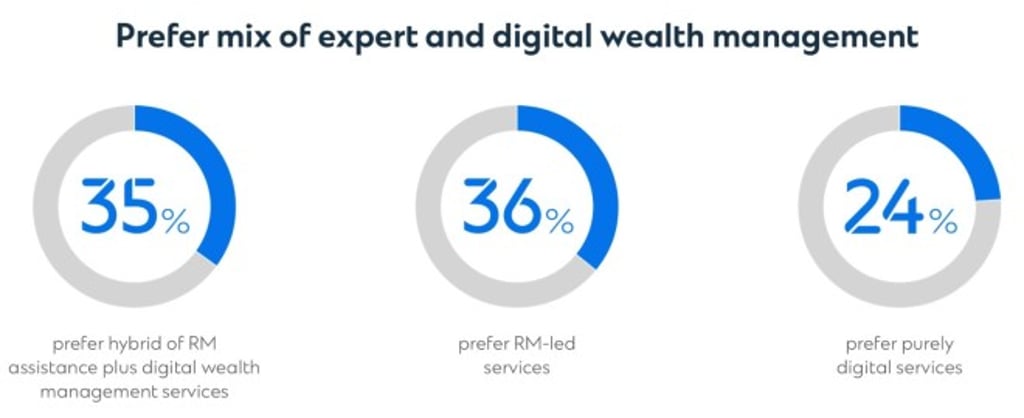

Respondents of the survey exhibit a clear preference for hybrid (35%) or RM-led (36%) services over purely digital (24%) wealth management services. This trend was largely consistent across age groups.

Respondents cite access to exclusive services and investment opportunities (60%), trust-based and personal relationships (58%), and personalised services and tailored advice (43%) as key reasons for preferring RMs over digital tools.

Affluent investors are increasingly accepting technology-enabled wealth advisory services, meaning a combination of expert views and digital analysis which well complement each other, to strive for the best possible investment outcomes.

For instance, Ho points out, “Nearly 40% of the survey respondents want to receive house view investment advice to support their wealth management needs. Standard Chartered’s Wealth Management Chief Investment Office (CIO) is designed to meet this need – our Signature CIO Funds, based on views of the Group’s CIO, are constructed to offer sustainable risk-adjusted returns, capitalising on near-term market or economic conditions, which will be reviewed and rebalanced regularly.”

With Standard Chartered’s myWealth service, accessible via SC Mobile or through RMs, investors can view personalised investment ideas with analysis backed by the Bank’s CIO house views, based on their current portfolio holdings, risk profile and personal wealth goals, to make well-informed investment decisions and diversify their investments by cross-referencing various model portfolios that match their investment target. They can also access portfolio and performance data, as well as perform analytics-driven health check anytime, enabling them to take necessary actions in a timely manner, keeping their portfolios on track all the time.

As AI technology advances, it has become more accessible, convenient and practicable for use in different areas of finance. Today we are seeing only a glimpse of what the technology could eventually do to significantly improve banking and wealth advisory services.