Five key real estate priorities for Asia Pacific companies, and what this means for the post-pandemic office of the future

By Luke Moffat, Regional Managing Director and Head of Advisory & Transaction Services, Asia Pacific at CBRE, and Ada Choi, Head of Occupier Research & Data Intelligence and Management, Asia Pacific at CBRE

[Sponsored Article]

As more Asia Pacific markets change their policies to live with Covid-19, companies too are adapting their real estate strategies to prepare for a new way of working in the post-pandemic era.

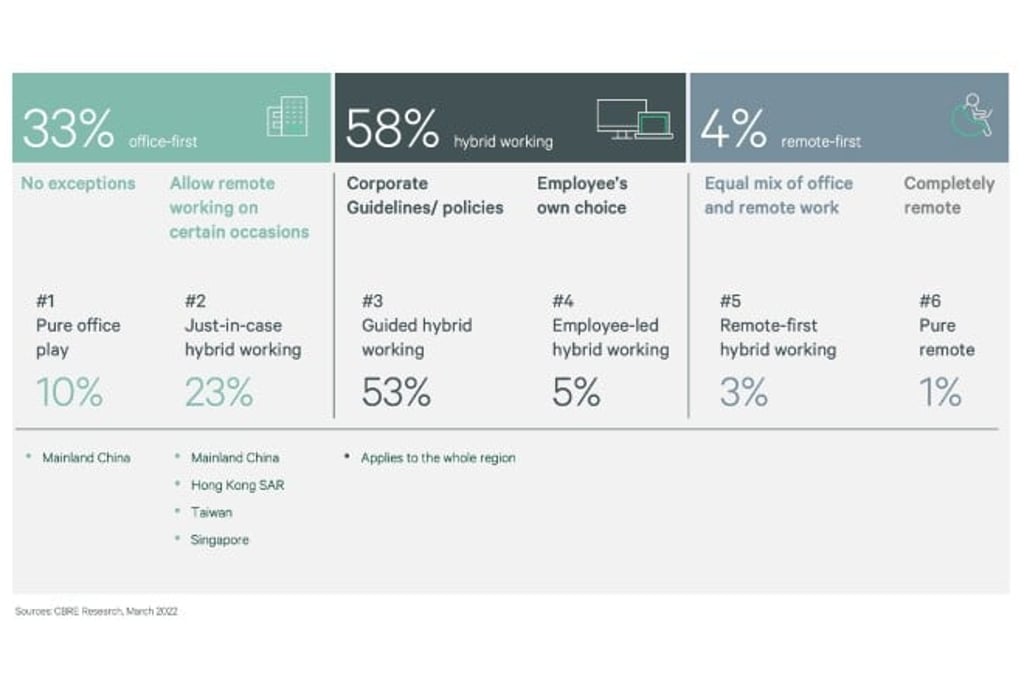

1) Adopting Flexible Working as the New Normal

Companies are displaying a clear shift towards embracing real estate strategies that recognise that Covid-19 is here to stay, with the most significant policies being the adoption of flexible work and new workplace policies to facilitate this change.

The most prevalent flexible working model in Asia Pacific is ‘guided hybrid working’, defined as a mix of office-based and remote-based work, and governed by a clear set of corporate guidelines and policies. In Asia, many companies are also seeking to adopt ‘Just-in-case hybrid working’, which involves an office-first model but allows employees to work remotely if needed, rather than a regular split between home and office.

Enhancing workplace strategies and policies to create the ideal post-pandemic office is a key area of focus. In order to achieve this, companies need to prioritise:

- Improving Workplace Flexibility: The survey reveals a sharp drop in fixed seating arrangements in favour of flexible seating and activity-based working. Prior to the pandemic, 58% of firms had fixed seating compared to just 28% of companies that still retain it.

- Balancing “Me” and “We” Space: With the adoption of hybrid working allowing more focused work to be performed remotely, the office will increasingly become a location for discussion and collaboration.

- Utilising Technology: Technology will be critical in supporting the adoption of hybrid working models and helping occupiers create smarter workplaces. About 60% of companies intend to increase their investment in technology in order to achieve these goals, with enhanced video conferencing facilities the most popular measure.

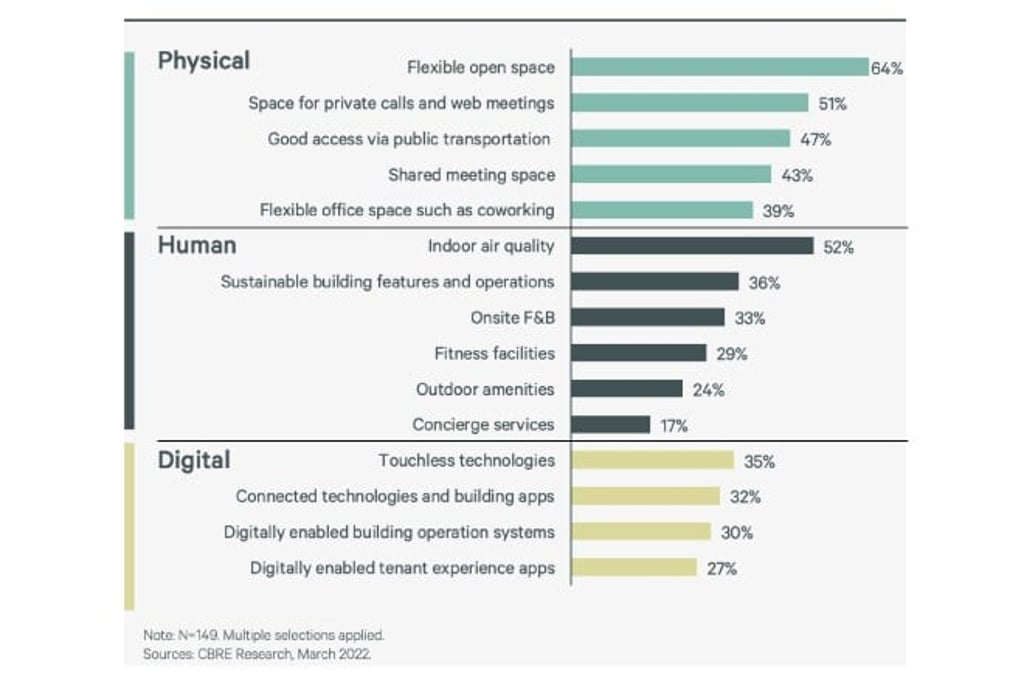

- Selecting Futureproof Buildings: The adoption of hybrid working will require cutting-edge physical, human and digital amenities, with flexible open spaces, good indoor air quality and touchless technology among the features that companies most want to incorporate in their buildings.

Most sought-after building attributes

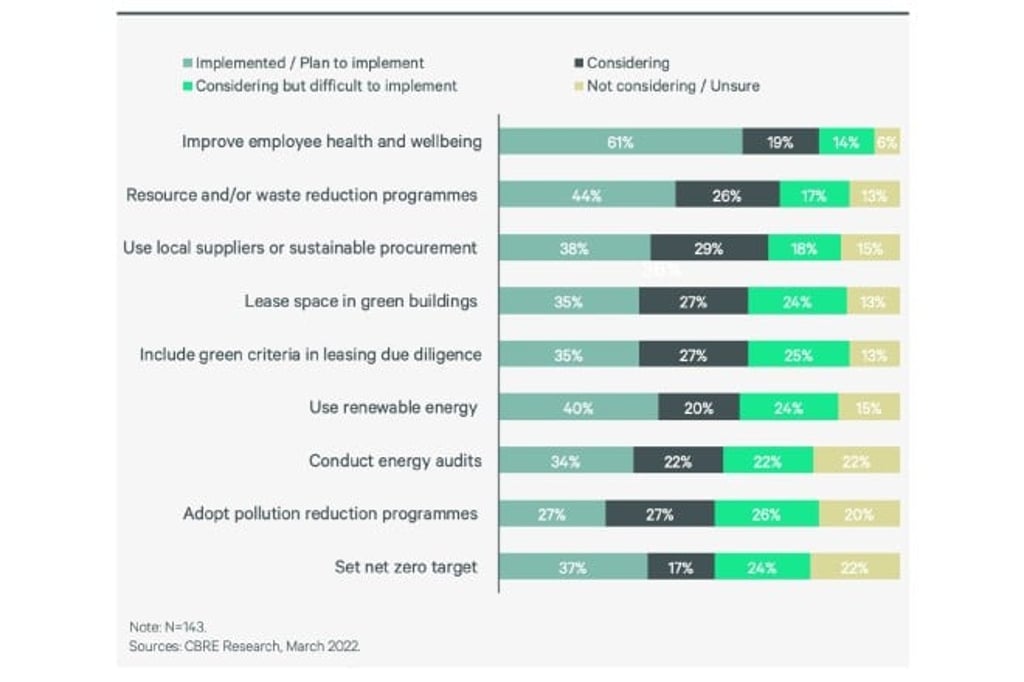

3) Augmenting Office Wellness and Sustainability

Strengthening workplace health and wellness is another key priority. Measures to improve employee health and wellbeing have already been implemented by 61% of respondents, with a large number also focusing on resource and waste reduction.

While initiatives related to green buildings, green leases and the use of renewable energy remain popular, many respondents have found it difficult to adopt such measures.

Companies’ wellness and sustainability priorities

4) Facilitating a Return to the Office

Companies in Asia Pacific are finding it less challenging to bring staff back to the office, with over 50% already seeing employees return as of Q1 2022.

North Asia is leading this trend, although some cities – notably Shanghai – saw the introduction of stricter measures following an increase in Covid-19 infections. Respondents expect office attendance in Singapore, India and Australia to pick up gradually throughout the second quarter of 2022.

New Zealand and Hong Kong SAR anticipate an organic return to the office, with the latter already registering an increase in office attendance following the relaxation of pandemic-related restrictions in early May. “Besides cultural factors and shorter lockdowns, smaller home sizes and extensive mass transit systems in many Asia Pacific markets such as Hong Kong have helped support the return to the office,” says Tom Gaffney, Regional Managing Director, Hong Kong, at CBRE.

But for multinational companies that are still exploring the right globally-aligned guidelines and policies around flexible working, bringing people back to the office is still an area of concern. “Clear messaging and guidance from leadership will be key to facilitating a smooth return to the office and to creating a culture of transparency where information related to office attendance, infections among employees and cleaning schedules are clearly communicated,” says Gaffney.

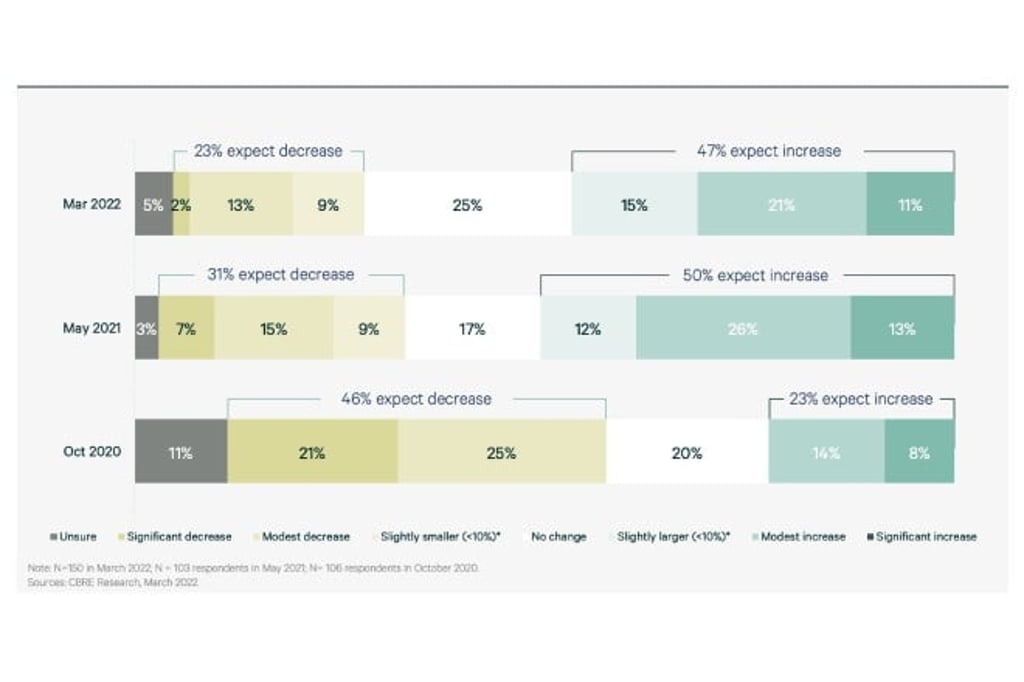

5) Pursuing Long-Term Portfolio Expansion

The overriding preference for office-based working in Asia Pacific signals healthy long-term prospects for office demand, with nearly half of the respondents intending to increase their real estate portfolios over the next three years, while 59% of multinationals plan to expand this year, up from 33% in 2021.

There is no ‘one size fits all’ strategy for companies; measures can differ across geographies, industries, and even individual departments in the same company. In our view, the companies that can create a tailored and comprehensive approach to effectively address the five aforementioned key real estate priorities and create the ideal post-pandemic office will be best positioned for long-term success.