Trusted advice for Hong Kong manufacturers keen to explore overseas investment and partnership options

- The Hong Kong Trade Development Council (HKTDC) analyses the Southeast Asian markets that offer lucrative incentives to lure city’s manufacturing firms

[Sponsored article]

To cut costs and diversify their operations geographically, Hong Kong-based manufacturers are looking further and further afield for cheap and business-friendly economies in which to invest.

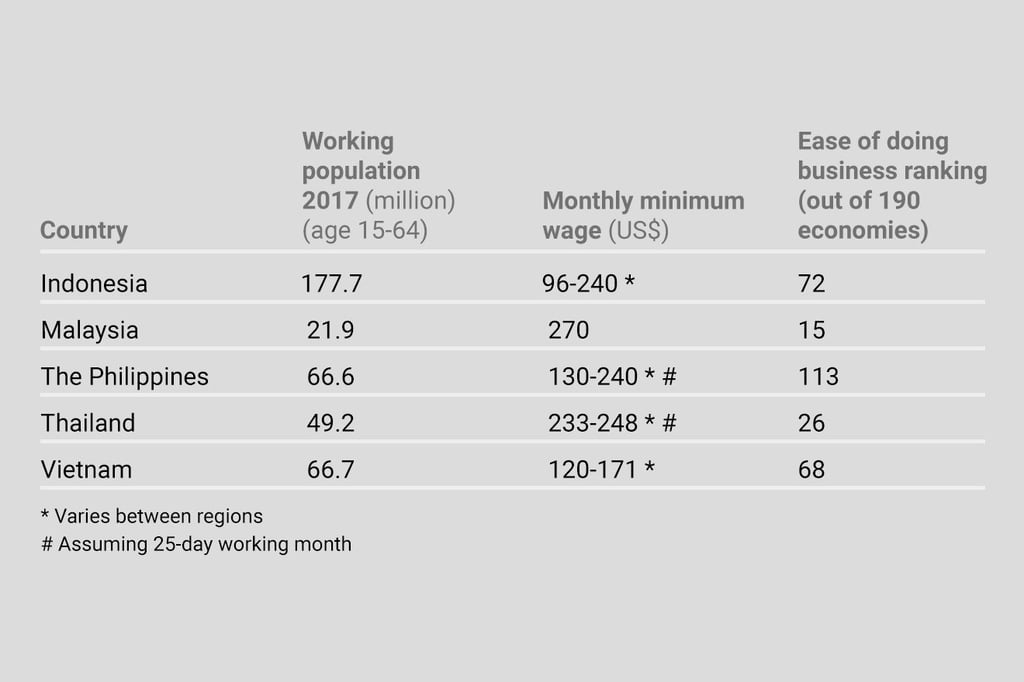

Emerging markets present a variety of pros and cons that manufacturers need to weigh up before making their move. In the first of a three-part series, the Hong Kong Trade Development Council (HKTDC) summarises prospects in the Southeast Asian nations of Indonesia, Malaysia, the Philippines, Thailand and Vietnam.

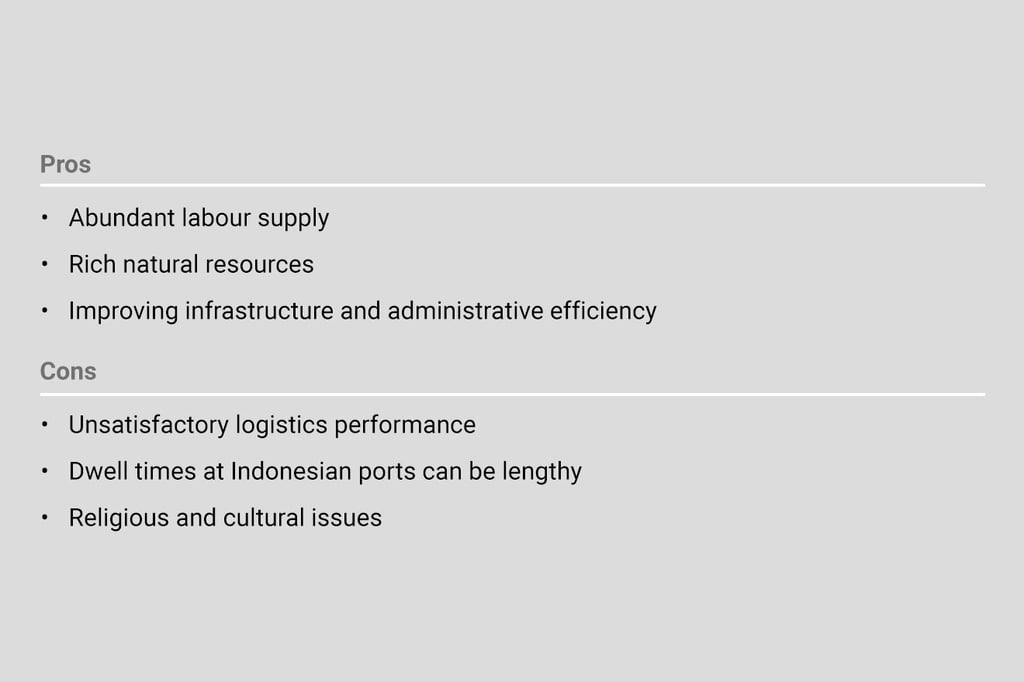

Indonesia: Abundant labour and natural resources

The most suitable industries for the largest member of the Association of Southeast Asian Nations (Asean) are garments, footwear and toys. The Indonesian government has assigned 10 Special Economic Zones specialising in industries ranging from palm/rubber processing and automotive to fisheries, logistics and tourism. These zones offer preferential tax and customs arrangements.

The largest is the Batam Island Free Trade Zone (FTZ). Investors are not required to apply for additional implementation licences (location, construction and nuisance act permits, and land title). There are also import duty, VAT and sales tax exemptions on imported capital goods.

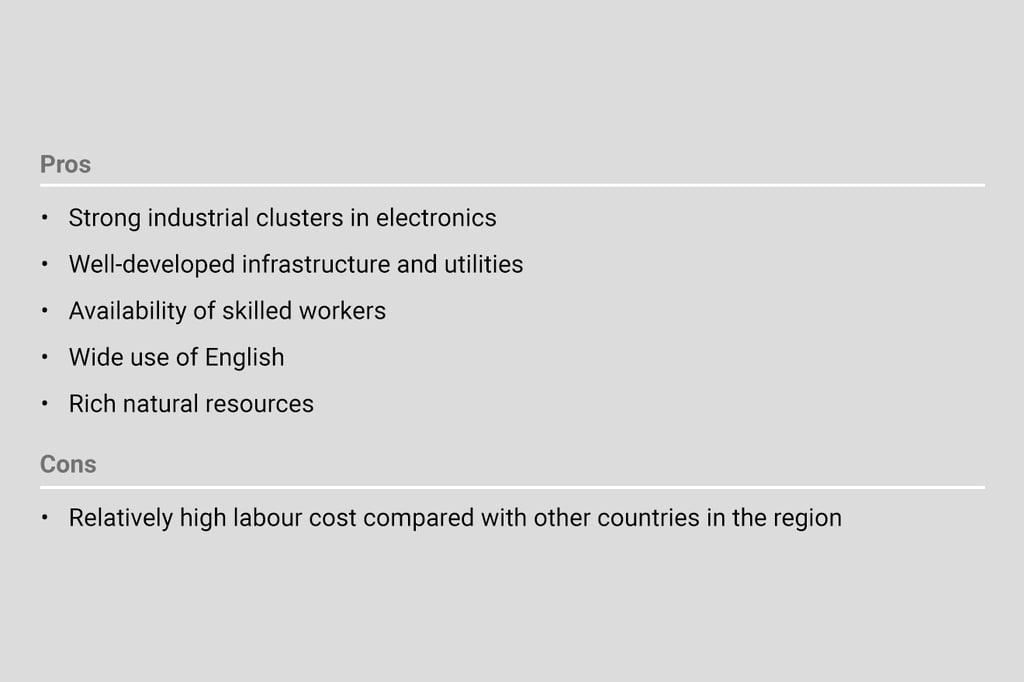

Malaysia: Tech-focused economy

This tech-focused Asean economy’s industries include electronics, as well as rubber and plastic products, and food processing (especially halal food). Malaysia has more than 500 industrial estates or parks and 18 Free Industrial Zones (FIZs), including specialised parks such as Kulim Hi-Tech Industrial Park catering to technology-related manufacturing and R&D activities.

The electronic industry clusters are mainly in Penang, Klang Valley and Johor.

Malaysia is one of the major natural rubber producers, with well-developed downstream industries including latex products and general rubber goods.

Malaysia’s halal certification system is well recognised by Muslims around the world and there are 14 halal parks, where manufacturers are eligible for halal industry tax incentives, including a 10-year income tax exemption.

In FIZs or export-processing zones, companies enjoy duty-free imports of raw materials, machinery, parts and components for export-oriented manufacturing. Firms with pioneer status are offered a five-year partial exemption of income tax; or investment tax allowance of 60 per cent of capital expenditure incurred within five years, which can be used to offset against 70 per cent of statutory income for each year of assessment.

A reinvestment allowance (RA) of 60 per cent on the qualifying capital expenditure incurred can be offset against 70 per cent of its statutory income for the year of assessment for 15 consecutive years beginning from the first reinvestment year.

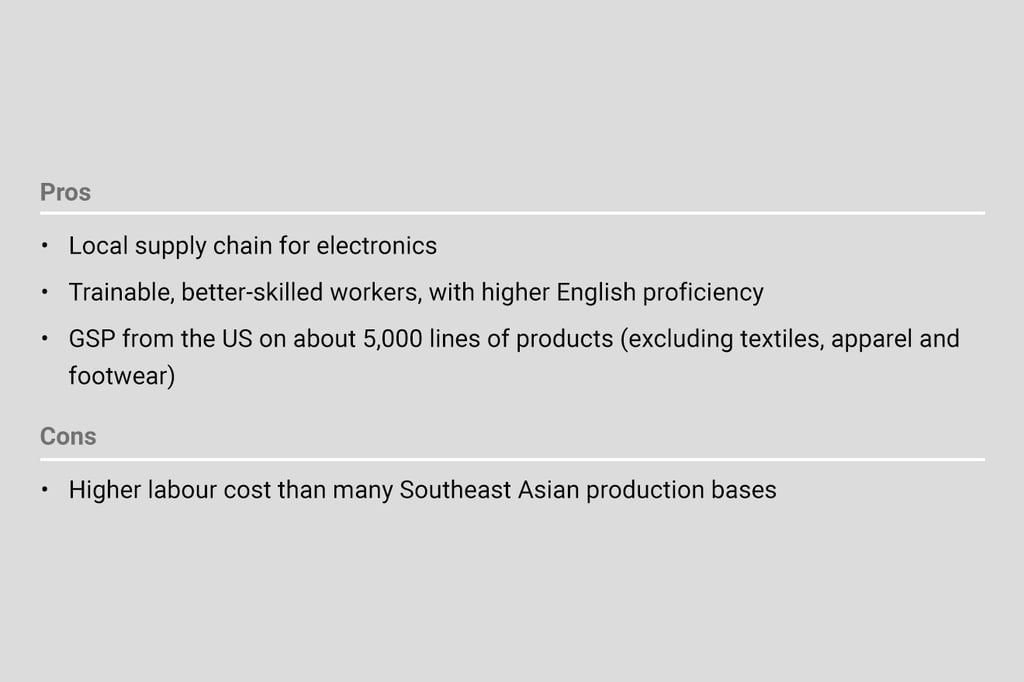

The Philippines: A foreign direct-investment magnet

Suitable industries for this neighbour of Hong Kong include electronics (semiconductors, computers, electronic components, peripheral equipment and accessories) and processed food. Manufacturing is a foreign direct-investment magnet in the Philippines and priority is given to export manufacturing and low-pollution light industries that can generate local employment, such as semiconductors and consumer electronics.

Freeport zones converted from former military bases such as Clark and Subic possess comprehensive infrastructure for manufacturing.

Examples of incentives offered by the Philippines Board of Investment include: income tax holidays of four to six years, customs duty exemption on capital goods, raw materials and intermediate inputs, and simplified customs procedures.

The Philippines Economic Zones Authority (PEZA) manages the economic zones and companies established under PEZA receive the above incentives, as well as a 5 per cent tax rate on gross income following the expiration of the income-tax holiday.

Thailand: 13 prioritised business sectors

Suitable industries in the kingdom include food and agribusiness, electronics and electrical appliances, automotive and auto parts, rubber and plastics. Abundant natural resources mean 80 per cent of the ingredients used in the food industry are sourced locally.

Special economic zones (SEZs) provide incentives to businesses investing in 13 prioritised business sectors – agriculture and fisheries; ceramics; garments, textiles and leather; furnishings/furniture; gems/jewellery; medical equipment; automobiles and parts; electrical appliances and electronics; plastics; pharmaceuticals; logistics; industrial estates; and tourism.

These incentives include corporate tax reductions, zero import duty for machinery and raw materials, and land occupation rights.

There are 12 Special Free Zones for manufacturing for exports located in Chonburi, Lamphun, Phichit, Songkhla, Samut Prakan, Bangkok (at Lad Kragbang), Ayutthaya, and Chachoengsao. Businesses may import raw materials and export finished products free of duty (including value-added tax).

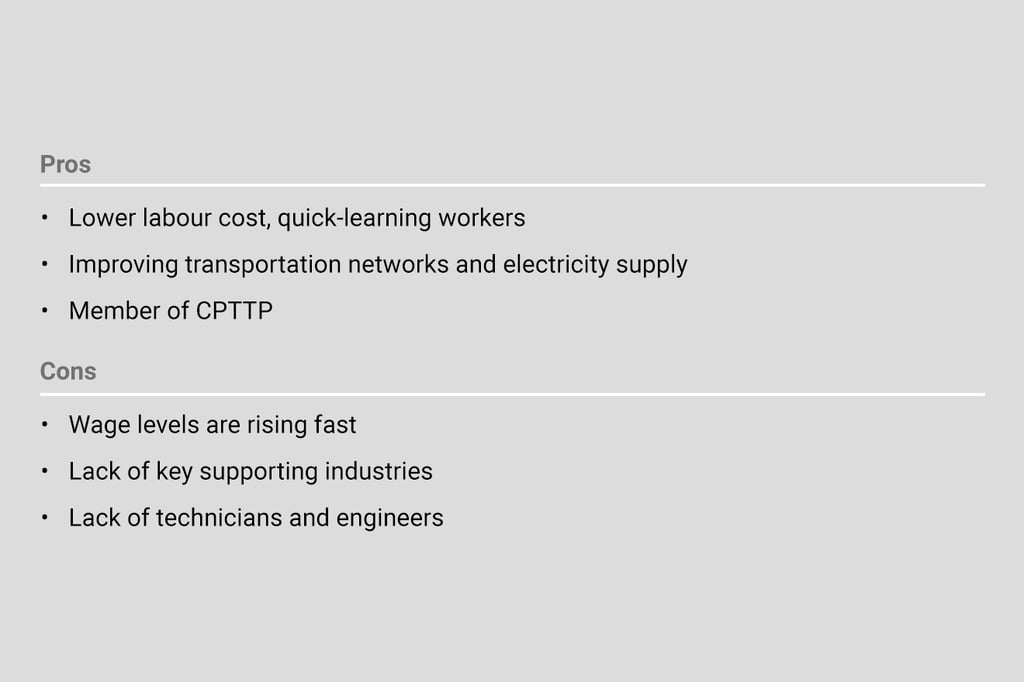

Vietnam: 270 industrial and export processing zones

This seaboard nation’s industries include garments, footwear and electronics. Authorities are seeking to attract investment from higher value-added industries such as precision engineering, pharmaceuticals and healthcare, and building materials.

Northern Vietnam is home to more capital-intensive manufacturing activities – automobile, electronics and office equipment. In the zones facilitating industrial investment, enterprises can enjoy tax incentives and exemptions on import tariffs or land rental.

There are 270 industrial and export processing zones in Vietnam. Foreign investors are exempt from import duties on goods for their own use that cannot be procured locally – including machinery, vehicles, components and spare parts for machinery and equipment, raw materials and inputs for manufacturing.