How Standard Chartered’s myWealth service helps Hong Kong’s DIY investors navigate market volatility

- Research shows many people overrate their own abilities and make poor long-term investments based on public forum tips rather than professional advice

- The bank’s new 24/7 offering uses advanced algorithms and data analytics to provide tailored buy-and-sell investment ideas so clients respond faster to market opportunities

[Sponsored article]

Most Hongkongers tend to rely on the do-it-yourself (DIY) approach when it comes to personal investing such as selecting stocks, bonds and other strategic advice about how to diversify a portfolio.

More than 50 per cent of the South China Morning Post online readers questioned in a survey say they tend to form their own impressions about how to structure their investments using information from public forums, such as market gurus’ tips, corporate disclosures and other news on business trends.

In contrast, the idea of seeking advice about portfolio management from an investment professional does not rank so highly, the poll of 1,888 people has found.

However, the DIY approach can often lead to misfortune, behavioural finance experts report. Academic research shows most activist investors – people who buy shares in a company to gain influence over its business decisions – end up making the wrong decisions when managing long-term investments, Professor Ling Cen, associate professor of finance at the Chinese University of Hong Kong, says.

This is the result of a combination of factors, including the tendency for investors to make decisions based on personal biases instead of factual assessments. For example, most shareholders tend to overrate their abilities to time the market and invest in tomorrow’s winning companies, Cen, an expert in behavioural finance, says.

Investors also tend to lose out because of what people are taught in the classroom about how financial markets work, he says. In reality, financial markets are far from being logical and efficient – with prices reflecting the information possessed by the market and remaining in a state of balance – as the neoclassical finance theory proposes.

“Behavioural finance is saying that no, the [market efficiency theory] is not true,” Cen says. “So the key point is to bring the investor psychology into our kind of explanation of the financial markets.”

So how can shareholders harness these behavioural finance insights to help guide their investment management decisions during the current period of high volatility affecting the global investment environment in the post-Covid-19 world?

A better approach may be to default to strategies involving structured diversification and periodic rebalancing. “In such a difficult market, it may be wiser to admit you’re ignorant – you can never beat the market because you don’t have the time to go through each industry thoroughly and complete knowledge about everything,” Cen says. “It’s not a bad attitude: this way, you’re fully diversified and not vulnerable to idiosyncratic risk.”

Alson Ho, managing director and head of wealth management at Standard Chartered Bank in Hong Kong, agrees that in times of pressure it is crucial to have a balanced portfolio with assets that do not all move in the same direction.

“It is important to spread the investment across various asset classes and look for asset classes that are locally or negatively correlated with each other in your portfolio,” he says. “This helps investors to have better staying power.”

Typically, balanced portfolios include both equities and government and corporate bonds, although foreign currencies and alternative assets, along with geographic diversification, should be considered.

“I think a balanced portfolio usually considers risk and return, with respect to individuals, their risk appetite, unique financial needs and their personal circumstances, within the context of the investment backdrop,” Ho says.

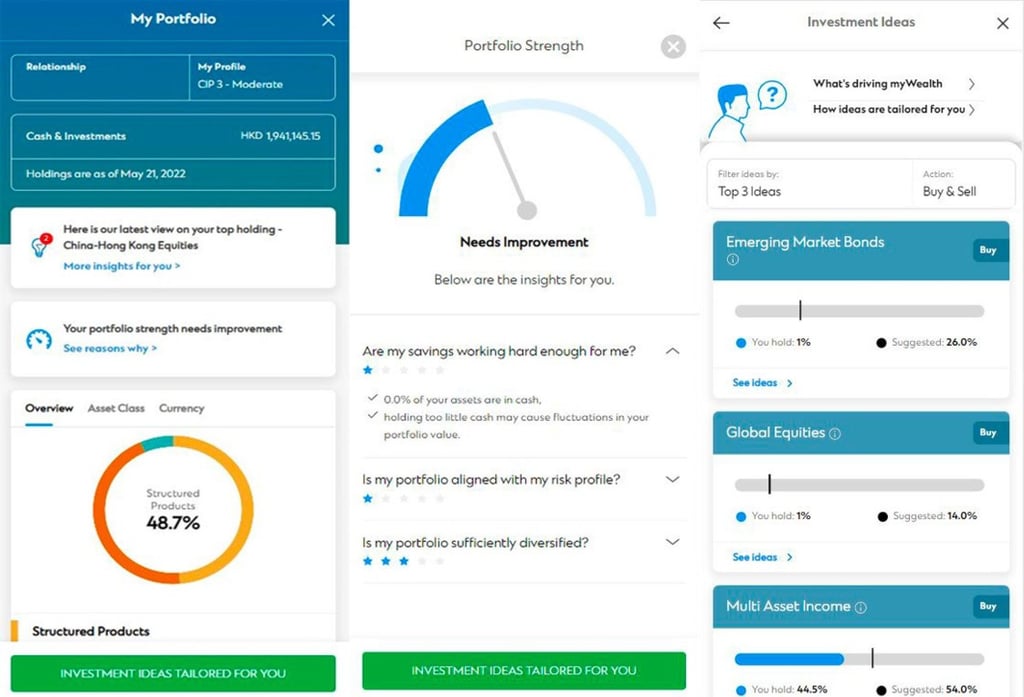

Standard Chartered’s myWealth service is a digital solution within the bank’s mobile app designed to help clients build balanced portfolios with geographic diversity tailored to their individual needs.

“The myWealth service offers clients the ability to assess their portfolio, in terms of their product types, asset classes and currencies, right at their fingertips,” he says. “Clients can actually review the overall health of the portfolio through the portfolio strength score anytime in any way, depending on their needs.”

Taking a detached approach to periodically review assets can be hard, but historically it has been proved to work. As a general rule, investors should revisit their portfolio to make sure it is aligned with their investment objectives and risk tolerance on a quarterly basis.

Ho says trading too often can lead to undesirable outcomes. Shareholders should stay invested and not shift to excessively defensive cash positions as asset classes undergo big swings in prices, he says.

One benefit of Standard Chartered’s service is that investors can easily access it whenever the time for the review arises. Ho says his own busy schedule often means he has time to look at his own personal investments only late in the evenings.

“It is a 24/7 service, which helps clients respond faster to market opportunities by providing tailored buy-and-sell investment ideas,” he says. “Clients can keep up with the changing market conditions, and even execute the fund trades, in a seamless journey within their mobile interface.”

The myWealth service combines advanced algorithms and data analytics while leveraging the bank’s investment research expertise. It compares a client’s current asset allocation against the bank’s model portfolio with respect to parameters such as risk profile and the latest house views. The service will identify investment gaps and also suggest options.

“If the client’s portfolio is overweight in one asset class, myWealth will provide a sell idea for that asset class and vice versa with notification prompts to the customers,” Ho says.

The service also provides a shortlist of trades to resolve the imbalance drawn from a list of Fund Select funds shortlisted from the hundreds of funds available.

One advantage of the service is that it removes biases in fund selection while still providing investors with alternatives, Ho says. “We have a dedicated team of fund experts to conduct independent analysis and shortlist quality funds every month, based on the quantitative and qualitative factors,” he says.

Clients will also have the option to use the myWealth service DIY style, or in combination with a real-world relationship manager, who can meet them face-to-face or digitally.

“Standard Chartered is committed to providing an omnichannel – online and offline – wealth management experience for our clients through all channels, including face-to-face, digital, or even relationship manager and a digital hybrid model,” Ho says.

Behavioural finance experts believe services such as myWealth could be valuable in helping guide activist investors during the current period of market volatility thanks to its ability to screen out subjective decision-making.

Cen believes the service can help investors avoid biases while also empowering clients “to make informed investment decisions and manage risk in a highly convenient and efficient fashion against increased volatility in the global markets”. Shareholders pursuing sustainable investment strategies could find that using the service involves far less gut instinct, but yields longer-term wealth benefits.