Editorial | HKMA right to warn against market speculation over stablecoins

With its coming licensing regime, Hong Kong must ensure its first-mover advantage in developing virtual-asset trading reinforces its position as a financial hub

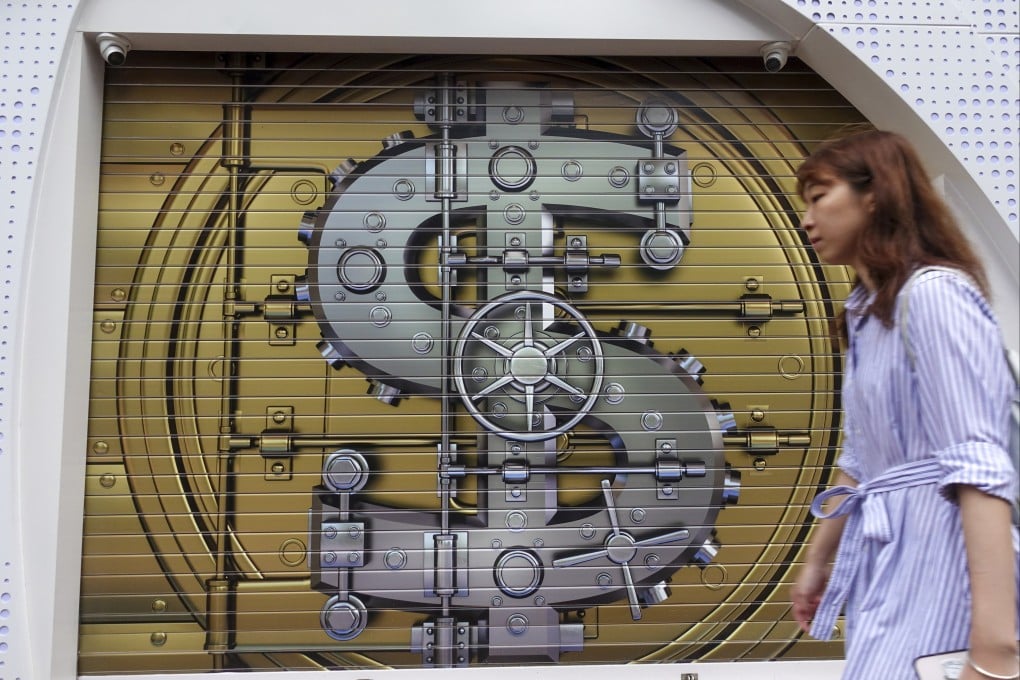

By being highly regulated, it is closer to central bank digital currencies and tokenised deposits by commercial banks, rather than cryptocurrencies such as bitcoin, whose value is determined by market forces. Recently, however, some local listed companies which have only proposed vague ideas about cross-border payment, Web 3.0 development or foreign-exchange trading have seen their share prices surge.

Yue said only a few issuers would be approved at the initial stage. Since any cybercoins issued must be fully backed by reserve assets, issuers will have to show adequate financial resources. The HKMA’s caution is warranted as the city is moving fast to develop virtual-asset trading while many foreign jurisdictions are still at the review stage.

The Bank for International Settlements has envisioned a future worldwide blockchain infrastructure to harmonise money and assets. Stablecoins’ global trading volume reached US$27.6 trillion last year, according to a report by cryptocurrency exchange operator CEX.io, surpassing the combined volume of Visa and Mastercard transactions during the same period. That is clearly the future of money. Hong Kong is ahead of the game and is reinforcing its position as an international financial hub.