Opinion | How the US can actually benefit from China’s ‘overcapacity’

China doesn’t have a problem with ‘overcapacity’; rather, the United States lacks an economic strategy that can generate abundance

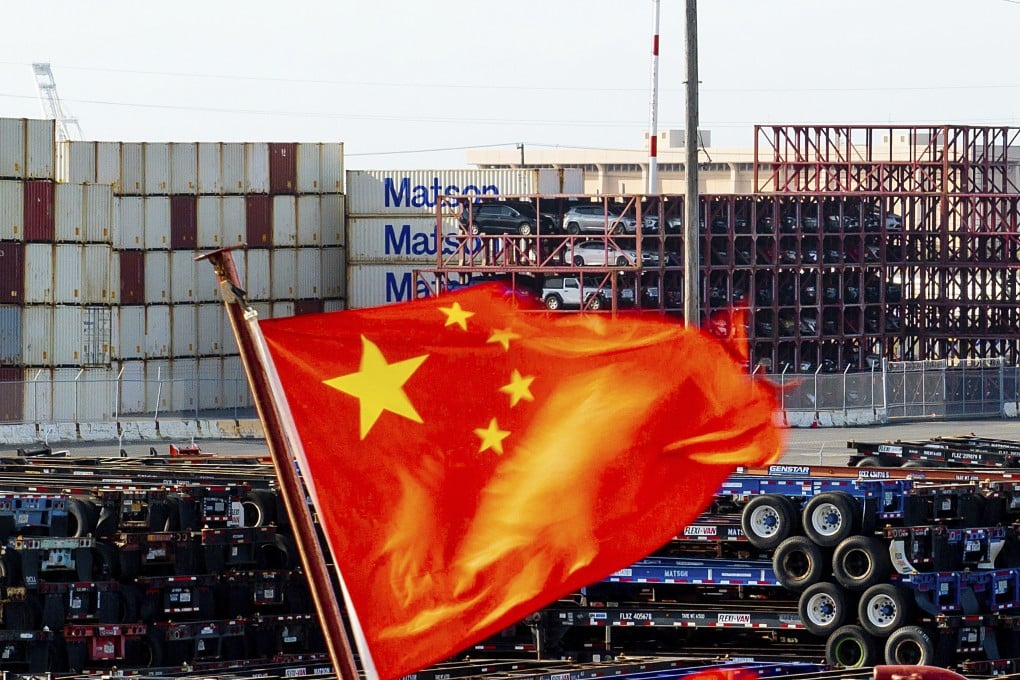

Western media and policymakers enjoy wagging their fingers at China’s industrial “overcapacity”, which in reality is simply the ability to produce solar panels, batteries, electric vehicles, steel and other goods more cheaply and efficiently than others can.

The standard narrative is that China is building a Potemkin economy of ghost cities, churning out goods no one ordered and hoping that foreign consumers will absorb the surplus. In the West, it’s usually a story of waste, predatory dumping and inevitable collapse. We decry deflation in China but lament inflation in the United States. If you take our economists at their word, it’s bad when prices go up and bad when prices go down.

This exposes an ideological collision between the American and Chinese economic systems; China believes that growth should manifest as the deflation of essential physical goods; the US believes it should result in the inflation of asset prices. The US and China are using two different measuring sticks. They don’t only disagree on how to grow; they disagree on what growth is.

In the US, civilisational health is measured by the inflation of asset prices: the S&P 500, housing markets and venture multiples. We celebrate record equity indices and rising home prices even when they outpace wages, because asset inflation is the supposed primary framework for prosperity.