Advertisement

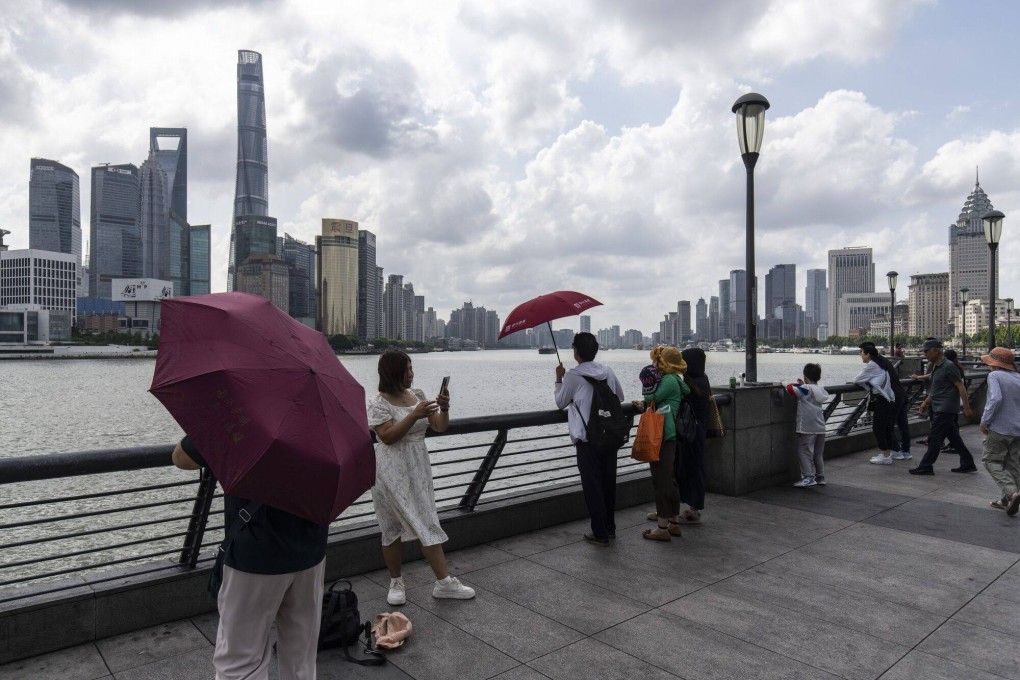

Opinion | China’s economic strategy is change by a thousand adjustments

Beijing has shown its commitment over the years to constant adaptation and structural reform that sets the stage for balanced growth

Reading Time:3 minutes

Why you can trust SCMP

In the wake of China’s exit from its zero-Covid strategy, the government has recognised the need to address the economic risks arising not only from supply shocks but from weakening aggregate demand. Doing so will require a shift in macroeconomic policy, which previously focused on the supply side.

At the same time, after examining the financial risk and environmental costs of the real estate sector, Chinese leaders have doubled down on their commitment to achieving the long-term goal of structural transformation. As a result, policymakers are seeking to increase the flow of resources to more productive sectors such as emerging technologies.

To be sure, the government has implemented a set of policies to boost domestic demand. But the package is more muted than the aggressive stimulus of 2009, reflecting the dilemma facing Chinese policymakers: how to encourage household and business spending without further inflating the real estate bubble?

Advertisement

The Chinese government would obviously not allow turmoil in the real estate market to morph into a systemic crisis, and would instead introduce increasing support measures to help stabilise it. More importantly, though, the sector’s downturn serves as a reminder that China must urgently establish a long-term mechanism to ensure a more robust housing market.

This is likely to prompt China to accelerate the transformation of the real estate market to adapt to the new stage of growth that the economy is entering.

Advertisement

Looking back over the past decade, the Chinese economy has already undergone considerable structural change as part of official efforts to shift towards higher-quality growth. Apart from the damage brought about by the pandemic, much of the economic landscape has fundamentally changed. Sectors and individuals who had grown accustomed to stability and easy profits are increasingly finding themselves in a less certain and more unfamiliar environment.

Advertisement

Select Voice

Choose your listening speed

Get through articles 2x faster

1.25x

250 WPM

Slow

Average

Fast

1.25x