Advertisement

The View | How Southeast Asia’s property sector is insulated from Trump’s tariff war

The region epitomises a vital source of resilience in Asian real estate: the strong role of domestic and regional demand

Reading Time:4 minutes

Why you can trust SCMP

0

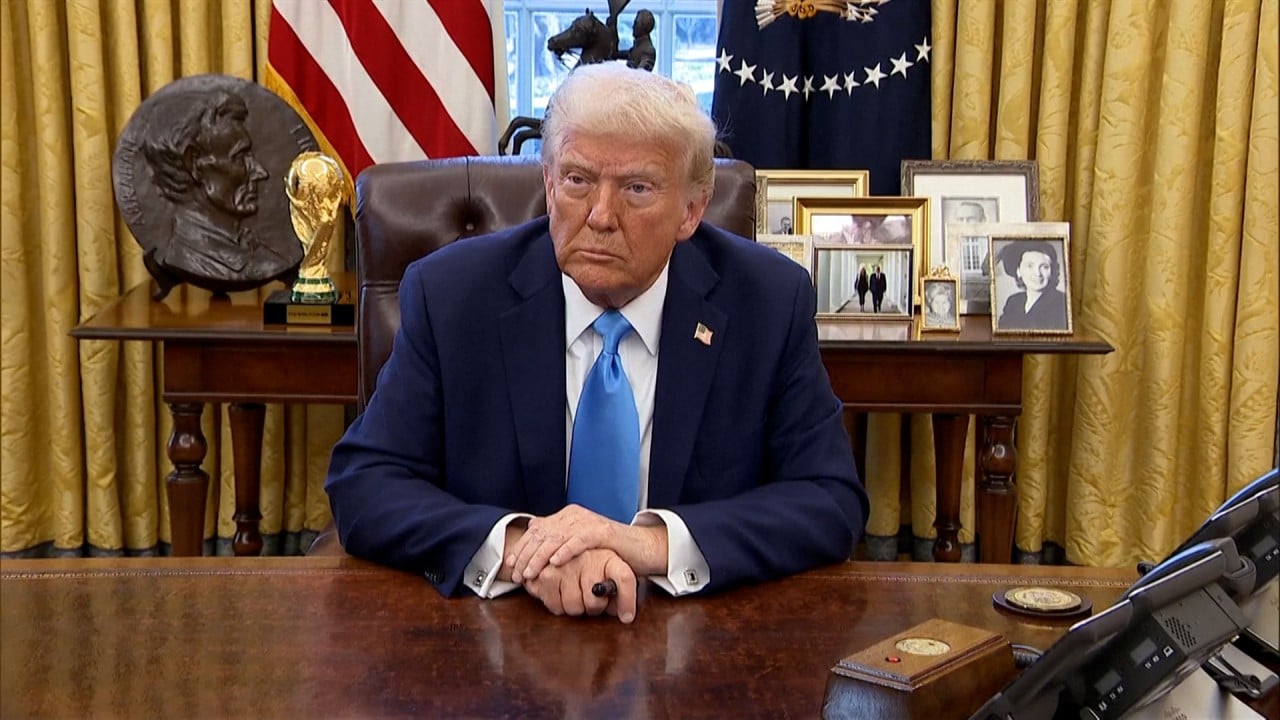

The onslaught of protectionism has begun. Three weeks after the start of US President Donald Trump’s second term, it is clear that his administration’s trade aggression will prove far more damaging than many Wall Street analysts predicted.

While the imposition of tariffs of 25 per cent on most goods from Canada and Mexico was delayed by a month, an additional 10 per cent levy on Chinese imports was maintained, sparking retaliation from Beijing. On February 9, Trump said he would impose 25 per cent tariffs on all steel and aluminium imports, intensifying his trade offensive.

Two conclusions can be drawn. The first is that Trump’s willingness to eviscerate the North American free-trade agreement he himself negotiated with his country’s two largest trading partners will generate uncertainty for businesses and erode trust in the United States as a reliable partner. The second, which was obvious before Trump returned to the White House, is that Asia is the most vulnerable region to higher tariffs.

Not only are seven of the 10 economies with the largest trade surpluses with the US in Asia, exports have become a more important driver of growth in parts of the region since the eruption of the Covid-19 pandemic. Excluding China and India, exports account for 58 per cent of economic output, up from 52 per cent in 2019, according to JPMorgan data.

The dependence on foreign trade is strongest in Southeast Asia. Trade volumes accounted for 89 per cent of the region’s gross domestic product between 2013 and 2023, compared with 34 per cent in China, 30 per cent in India and 17 per cent in the US, according to a report in August 2024 by Bain & Company, DBS and the Angsana Council.

During the 2018-19 trade war, Southeast Asia was largely a beneficiary of fraying ties between the US and China as big multinational companies adopted “China plus one” strategies to diversify and divert their supply chains. This time, US tariffs are more punitive and wide-ranging, putting the diversification of supply chains – in particular the increase in the value added by China to Southeast Asia’s exports to the US – under sharper scrutiny.

Advertisement