Advertisement

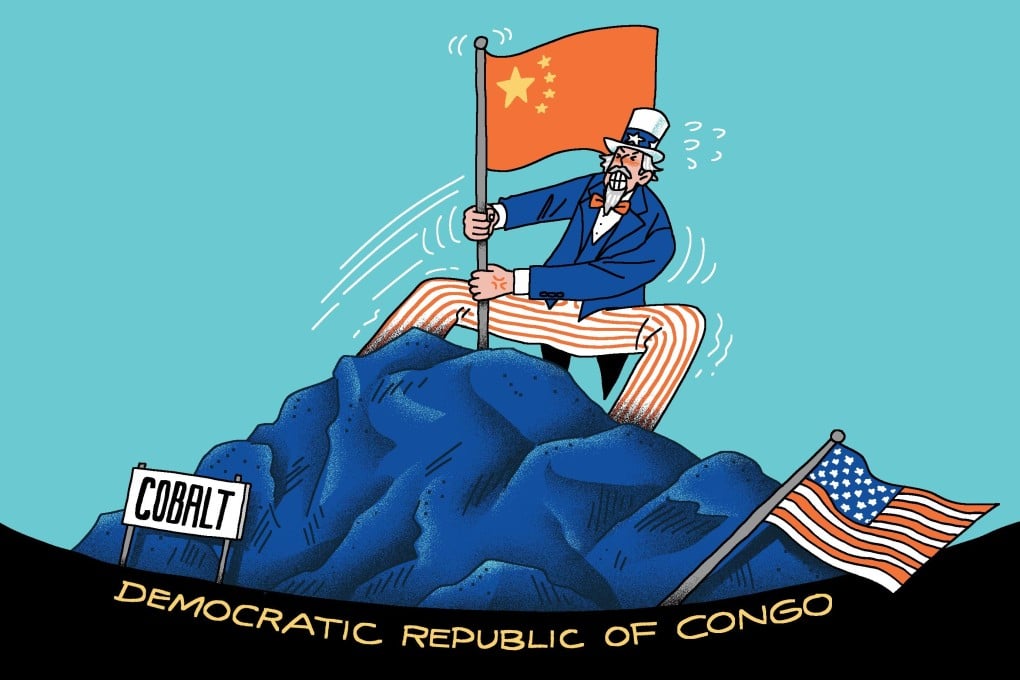

A battle is playing out over Congolese cobalt. China is well ahead

Rivalry for critical minerals is intensifying, but observer says US ‘doesn’t offer viable alternative’ to Chinese investments in DR Congo

Reading Time:6 minutes

Why you can trust SCMP

9

Donald Trump has been upending the world order since his return to the White House in January. In this three-part series, we look at the implications of Trump’s foreign policy – starting with the competition between the US and China for critical minerals in the Democratic Republic of Congo.

The tussle playing out between Beijing and Washington over the sourcing and processing of critical minerals might not have been so intense had the United States not sold two of the world’s biggest cobalt mines to China.

Both cobalt-copper mines are located in the Democratic Republic of Congo.

Advertisement

American mining giant Freeport-McMoRan sold its stake in the Tenke Fungurume Mine to CMOC Group – then known as China Molybdenum – for US$2.65 billion in 2016. Four years later, it also offloaded its share of the Kisanfu mine to the Chinese miner for US$550 million.

The two acquisitions more than doubled CMOC’s cobalt supply and it became the world’s largest producer of the mineral in terms of output in 2023.

Advertisement

DR Congo, or the DRC, is by far the world’s biggest source of cobalt – a mineral needed for making the batteries used in phones and electric vehicles – accounting for about 70 per cent of global production. It is also a key source of copper and a dozen other critical metals and rare earth minerals.

Advertisement

Select Voice

Select Speed

1.00x