Nairobi tollway an example of China’s new belt and road financing approach in Africa

- The expressway opening in Kenya’s capital is part of a shift by China’s Belt and Road Initiative away from debt financing towards public-private partnerships

- Chinese lenders have become more cautious in financing infrastructure projects on the continent, concerned about borrowers’ ability to repay loans

A CRBC subsidiary, Moja Expressway, will operate the road for 27 years to recoup the investment through toll fees.

In all, the road marks a gradual shift in the belt and road strategy, from public debt finance to a new method of funding for infrastructure like roads and power plants in Africa: public-private partnerships (PPP).

Under the PPP model, Chinese private companies can lower the risks to repayment and help African governments reduce their loans and budget deficits, observers say.

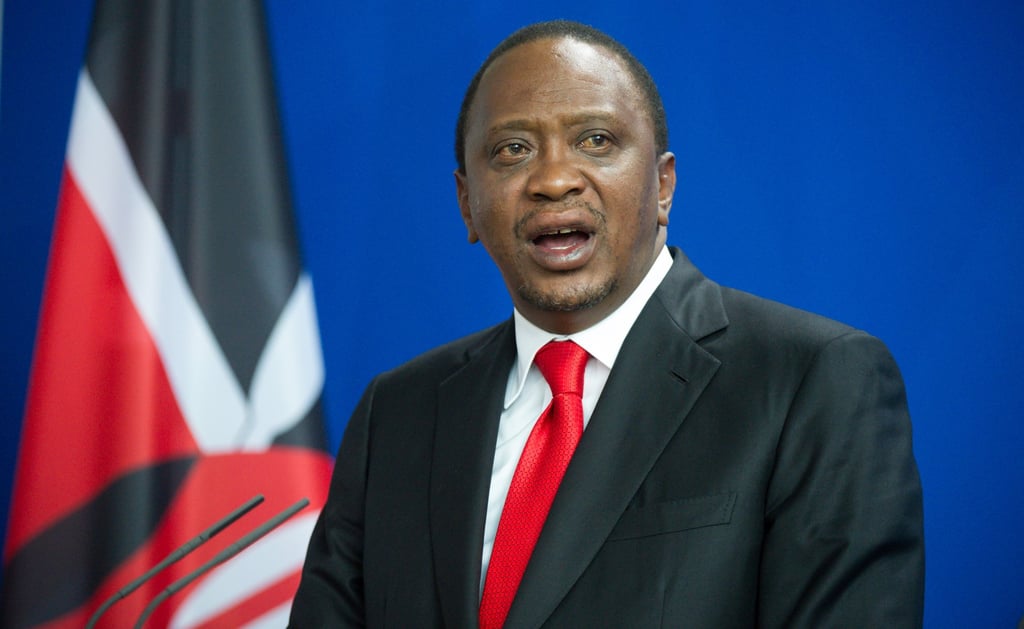

The Nairobi Expressway opened to public use on a trial basis on Saturday, ahead of an official launch next month. The tollway is expected to ease traffic flows in and out of Nairobi’s city centre by reducing traffic congestion on Mombasa Road, which runs alongside it. The deal to build the expressway was struck in September 2018 during the Forum on China-Africa Cooperation (FOCAC) in Beijing, when Kenyatta met Chinese President Xi Jinping.