Advertisement

China’s multi-trillion-dollar ‘time bomb’ imperils global markets: US House

- Ratings agencies S&P Global and Moody’s accused of failing to reflect risk posed by mainland’s local government financing vehicles

Reading Time:2 minutes

Why you can trust SCMP

54

Robert Delaneyin Washington

Ratings agencies S&P Global and Moody’s drew fire at a US congressional hearing on Wednesday for failing to reflect the risk of a multi-trillion-dollar “time bomb” that China’s local government financing vehicles pose for global financial markets.

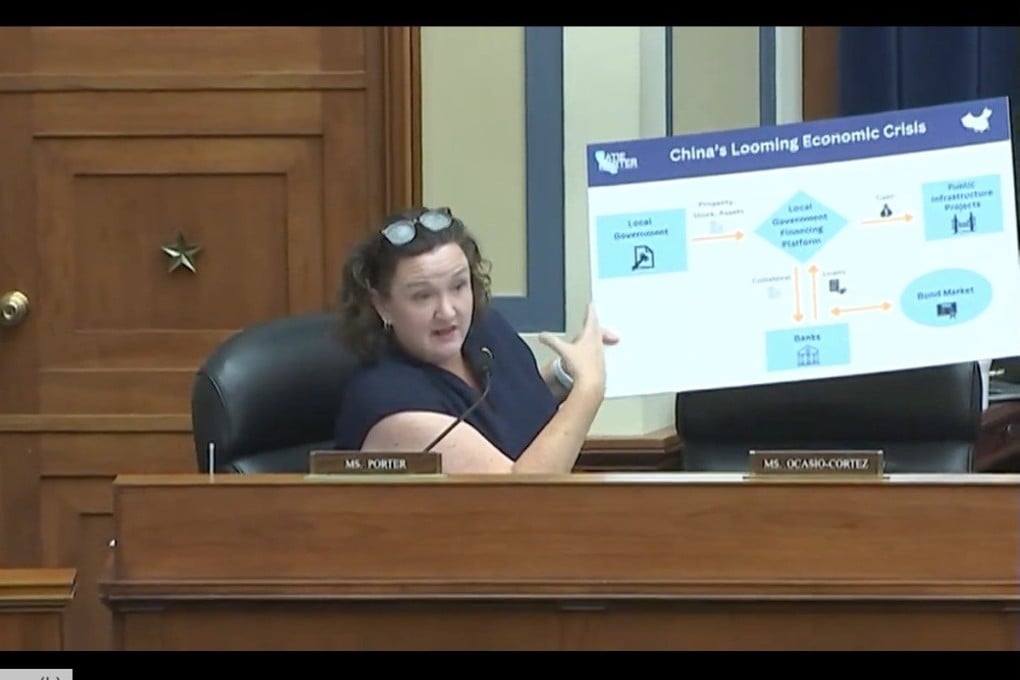

Grilling witnesses at a House Oversight committee hearing, California Democrat Katie Porter won praise from witnesses called by the panel’s Republicans, including Washington’s former World Bank representative Erik Bethel, for highlighting a challenge that China’s property market downturn has caused for the country’s LGFVs.

These firms borrow on behalf of provinces and municipalities to finance roads, ports, and other infrastructure projects, using leases on land controlled by the government authorities as collateral, Porter said.

Advertisement

This was a risky proposition, she added, given that China’s property prices have been stuck in a steep decline.

With property built on the leased land falling in value, Porter explained, the situation was comparable to the global financial crisis of 2007-2008, which was sparked when the value of debt backed by subprime mortgages and other risky assets collapsed.

Advertisement

Advertisement

Select Voice

Select Speed

1.00x