Beyond education: how millennial parenting is influencing Gen Alpha

As millennials push against the traditional symbols of success, Prudential Hong Kong’s PruNextGen platform prepares families for the future

Many parents face the challenge of providing an optimum environment in which their children will thrive, seeking ways to discover, nurture and support their individual personalities and interests.

Millennials, aged between 27 and 40, are now parents and raising their children in their own unique way. More than 90 per cent of millennials, or what was once called “the me me me generation”, prioritise their Gen Alpha offspring’s happiness over success, while 57 per cent believe schools are not adequately preparing their children to become citizens of the future, according to a study by Research World.

This seismic shift in parenting attitudes has a profound effect on family planning. Prudential’s second annual “Financial Wellbeing Tracker” noted similar findings. “We see that there are some significant changes in the mentality of this generation,” says Ivan Choi, Prudential’s chief customer and marketing officer. “In my generation, parents wanted their children to be doctors, bankers, engineers and lawyers, but we see a paradigm shift.”

The tracker assessed the financial outlook, aspirations and goals of Hong Kong residents, with an emphasis on parents raising Gen Alpha children (born between 2010 and 2024), who cited rising costs of education, well-being and intense competition among their top concerns. The survey found that 90 per cent of Gen Alpha parents believe that a non-conventional, interest-based approach to learning, whether academic or not, will benefit the overall development of their children, while 89 per cent expect advances in technology to provide their children with new career opportunities.

“We’re interested to see what the parents of Gen Alpha are thinking,” Choi says. “It’s important for us because we want to connect with them emotionally. We want to bring to life these shifting attitudes and play a role.”

As part of its efforts to equip the next generation for a brighter future, Prudential Hong Kong has launched PruNextGen, a value-added services platform operated in collaboration with leading educational and wellness institutes. The platform offers specially designed programmes, with an emphasis on creative thinking, financial literacy, communication skills and mental well-being.

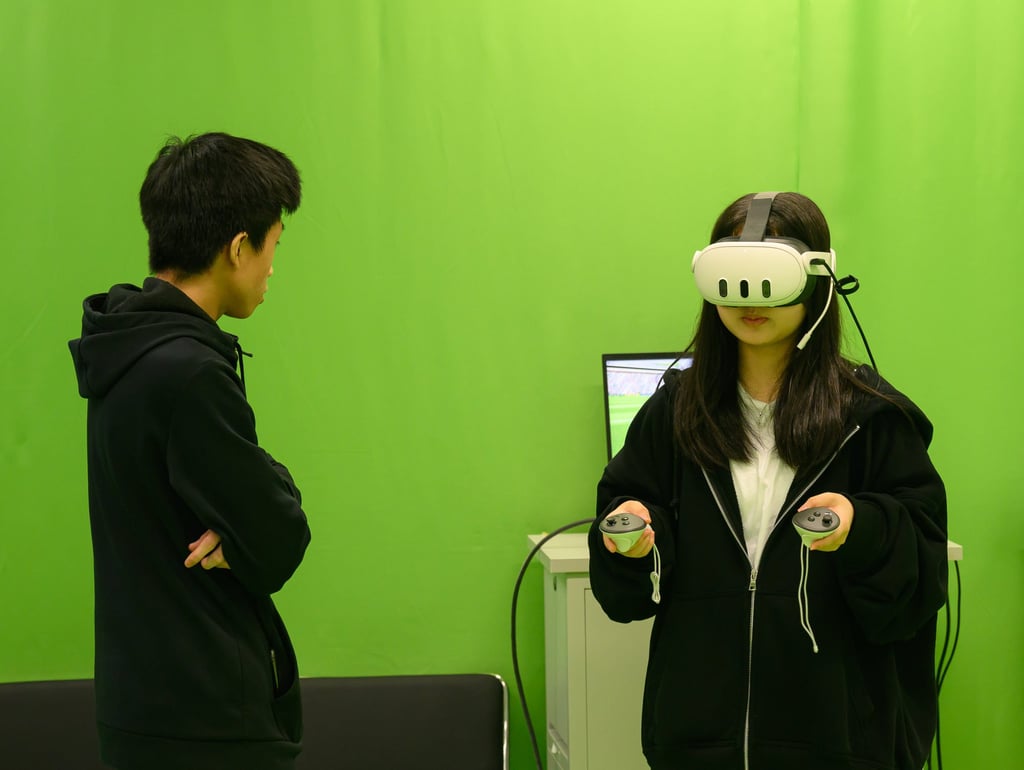

The “PruNextGen Future Institute” is at the heart of the PruNextGen initiative, providing personalised signature programmes that draw on the expertise of educators and speakers in fields including psychology, e-marketing, digital technology and financial management. In April, 40 Gen Alpha children attended the first-of-its-kind programme, “NextGen Visionary Ventures”, an interactive five-day workshop designed by HKU School of Professional and Continuing Education. The workshop comprised two sessions, with topics ranging from youth financial management, career planning strategies and the importance of integrative reflection to digital communication, personal branding, building an online presence and financial psychology.

Participants explored these subjects through various activities, including group discussions and presentations, as well as Lego Serious Play, an experiential process that uses Lego bricks to stimulate innovative thinking. In addition, participants visited the Hong Kong Monetary Authority to gain an insight into the city’s financial system, and the Hong Kong office of Google, where staff shared their experiences of working in the tech sector.

Choi says Prudential’s initiatives will help parents unlock greater possibilities for their children’s potential by providing them with the essential soft skills for the future workplace, even if that future is still being defined. “It’s all about how you collaborate with people, how you lead and how you imagine and create new possibilities,” he says. “We know there is a big wave of artificial intelligence that will impact every aspect of our lives and future career choices. They are not as confined or straightforward as in the past, and it will not be a linear career. We need an unconventional approach; we need the notion of unconventional dreams.”

To that end, the PruNextGen initiative is collaborating with complemental premier educational organisations in Hong Kong, including Arch Education, Britannia Education and Crimson Education, to offer free online courses that will help children acquire competencies such as soft skills, critical thinking, public speaking and AI. Additionally, the programme offers consultations to help children learn more about themselves and further refine their education goals.

While the Financial Wellbeing Tracker provides valuable insight into parents’ aspirations for their children, it also revealed a surprising lack of financial preparedness, Choi says. The survey found that while almost 95 per cent of respondents expect to continue providing financial support to their children to the age of 25, only 37 per cent are saving for their future. Notably, more than 60 per cent of surveyed parents expect to rely on savings to support their children, although most believe the legacy will not last beyond two generations.

“Parents often put a lot of emphasis on their children’s development and can lose sight of how to prepare themselves financially,” Choi says. “There is also a gap between what they think they should do versus what action they have taken; in part, because there has been a lack of the right solutions for them.”

To fill this gap, the insurer has launched the Prudential Entrust Multi-Currency Plan, which it says comprises elements that resemble a trust. Designed to help customers achieve multiple financial goals – such as helping to build up an education fund for children, saving for retirement, and the flexibility to pass on wealth and legacy to children – the plan offers what Prudential says are two Hong Kong market firsts: a “FlexIncome Option” in which a long-term income stream can be paid directly to a designated recipient, and a “FlexLegacy Option” that can be set up to release percentages of legacy benefits at certain milestones, such as those designated by age or pivotal events such as university graduation and marriage.

“Parents are not prepared for their children’s financial future because there’s a lack of innovation in the market,” Choi says. “The Prudential Entrust Multi-Currency Plan is a groundbreaking product that answers the needs of the parents. The product and PruNextGen services are closely knit and stay true to Prudential’s intention to support parents in every aspect.”

Disclaimer from Prudential:

“Elements that resemble a trust” refers to the product features offered by the FlexLegacy and FlexIncome Option under this plan, it does not mean that this insurance plan is equivalent to setting up a trust. Terms and conditions applied.

“Hong Kong market first” refers to the product features offered by the FlexLegacy and FlexIncome Option under this plan, and is based on a comparison of multi-currency savings insurance plans offered by major life insurance companies in Hong Kong as of January 6, 2025.

Information relating to insurance plans and PruNextGen are provided by Prudential. All privileges, services and activities are subject to terms and conditions. Please contact Prudential financial consultant for details.

The privileges, services and activities are provided by product or service suppliers who are independent third-parties. Please contact our financial consultants for more details. Prudential Hong Kong Limited (“Prudential”) is not the supplier of the privileges and / or services and / or activities, and is not the agent of the product and/or service supplier. The use of these privileges and / or services and / or activities shall be subject to all terms and conditions as stipulated by individual suppliers. Prudential shall not be held responsible or liable in any way in relation to the products and/or services of these privileges and / or services and / or activities (including but not limited to their quality, supply and use). Prudential shall not be responsible or liable in any way whatsoever for any loss or damage directly or indirectly resulting from any use or misuse of these privileges and / or services and / or activities. In the event of any dispute, please contact the product or service suppliers directly to resolve the matter. Prudential and the product or service suppliers reserve the right to revise, suspend, or cancel the terms and conditions at any time without prior notice. Prudential and the product or service suppliers shall have the absolute discretion to make the final decision.