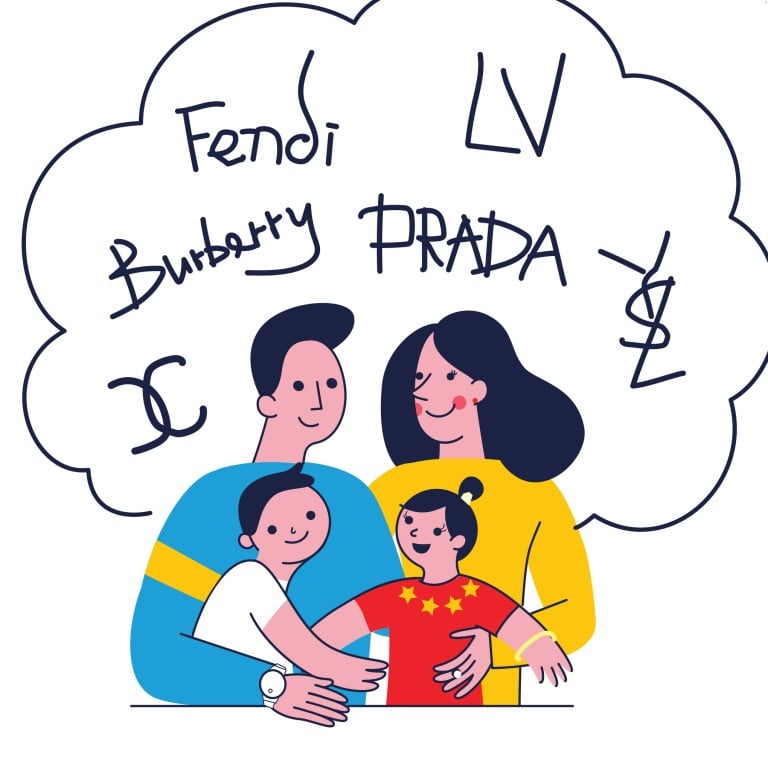

How luxury brands are responding to the end of China’s one-child policy

Companies mindful of the shifting dynamics caused by the end of the one-child policy are taking steps to understand the ways in which consumer trends are likely to change

Chinese authorities announced the end of the one-child policy in October 2015, allowing families to have two children. In the summer of 2018, China’s parliament erased “family planning” policies from the new draft Civil Code, indicating that by 2020, the government would relax birth restrictions, ending the family planning policy.

Although it is too early to measure the impact of the policy change on the luxury sector, should brands incorporate these projected game-changing consumer trends into their long-term blueprints?

Analysts are expecting several demographic disruptions. Amrita Banta, managing director of Agility Research & Strategy, tells STYLE that “[ending] the one-child policy will change the consumption habits of the affluent class in China and will have a positive impact on the overall economy”.

First, a higher fertility rate could provide an opportunity for the luxury industry. Bigger families with young children means increased consumer spending and the development of generations of future buyers. Those toddlers and children who grew up in a world of privilege, educated to appreciate opulence, are poised to become luxury consumers.

Second, successful luxury brands are poised to reconfigure their business model according to key opportunities. By embracing niche segments such as baby-care products, toys and games, eco-friendly personal care products for expecting mothers, and children’s apparel, luxury brands can achieve mass market appeal. Banta says that studies conducted by Agility Research & Strategy show that “the birth of a child is a pivotal moment for women, which induces a profound change in the mindset. Luxury purchases become less impulsive and more planned, and brands’ practical aspects (How safe is it? Does it reflect my new image? Is it durable? What impact does it have on the environment?) become more relevant.”

The birth of a child is a pivotal moment for women, which induces a profound change in the mindset

Indeed, as millennial consumers mature and start embracing parenthood, they move from individualism to a family-oriented collectivism. Child expenses are likely to be prioritised to the detriment of impulse buying, and this could incur substantial damage to luxury brands that do not understand their demographic. Undeniably, this adjustment will compromise contrasting niche segments, bringing them negative growth. And Banta points out that “certain luxury industries will benefit more than others” from the changes.