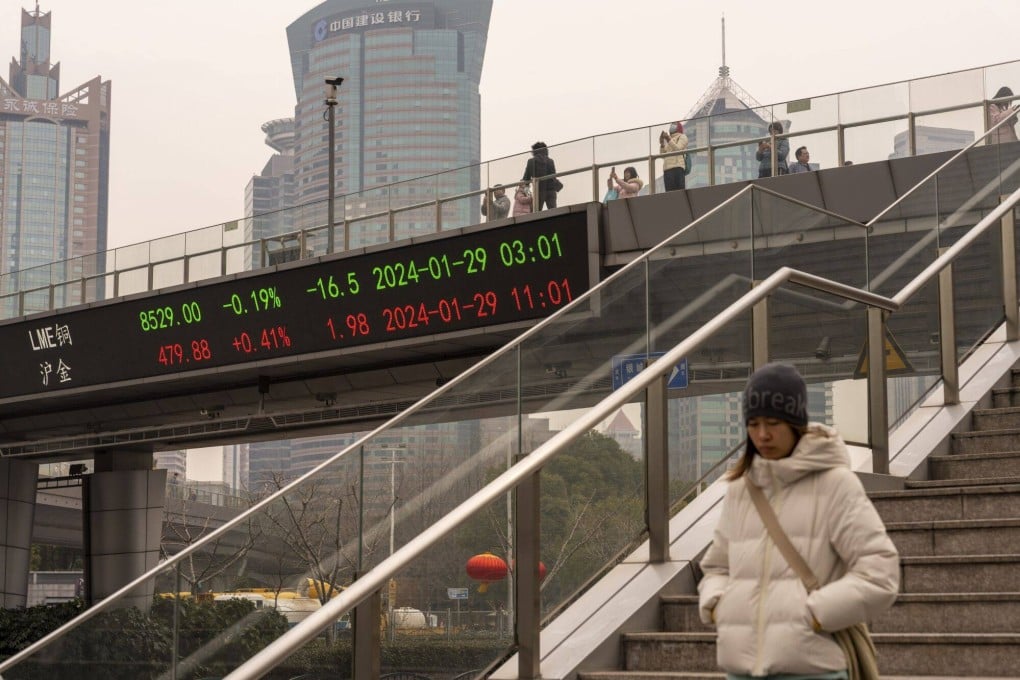

China’s new financial regulator pledges transparency to bring investors back from the brink

- The Central Financial Commission, a newly established arm of the Communist Party, has promised regulatory predictability in a recent article

- Reassurance comes as foreign investors leave China in droves, with FDI figures at record lows as policy environment looks uncertain

China’s new financial regulator has made fresh pledges to increase regulatory transparency, stability and predictability, the latest of several attempts to restore investor confidence following a stock meltdown and high-profile personnel changes.

“[We’ll] strengthen the interconnection of domestic and overseas financial markets and better facilitate cross-border investment and financing,” the commission said in its article, which detailed how to make China a “financial superpower”.

These signals are being sent at a time when foreign investors, including greenfield capital and portfolio holders, are hesitant to decide their next move and worried over the future of China’s policy choices.

The world’s second-biggest economy achieved 5.2 per cent gross domestic product growth in 2023, but market sentiment has remained low thanks to a protracted property industry slump, beleaguered employment figures and ballooning debts held by local governments.

Foreign investors have turned to other markets in the past year amid these factors and heightened geopolitical tensions, pushing the country’s annual net receipt of foreign direct investment (FDI) to a 30-year low in 2023.

According to data released by the State Administration of Foreign Exchange on Sunday, direct investment liabilities – a measure of both FDI inflows and outflows – rose by US$33 billion last year over 2022. This was a drop of 82 per cent year on year, and the lowest annual level for the investment metric since 1993.