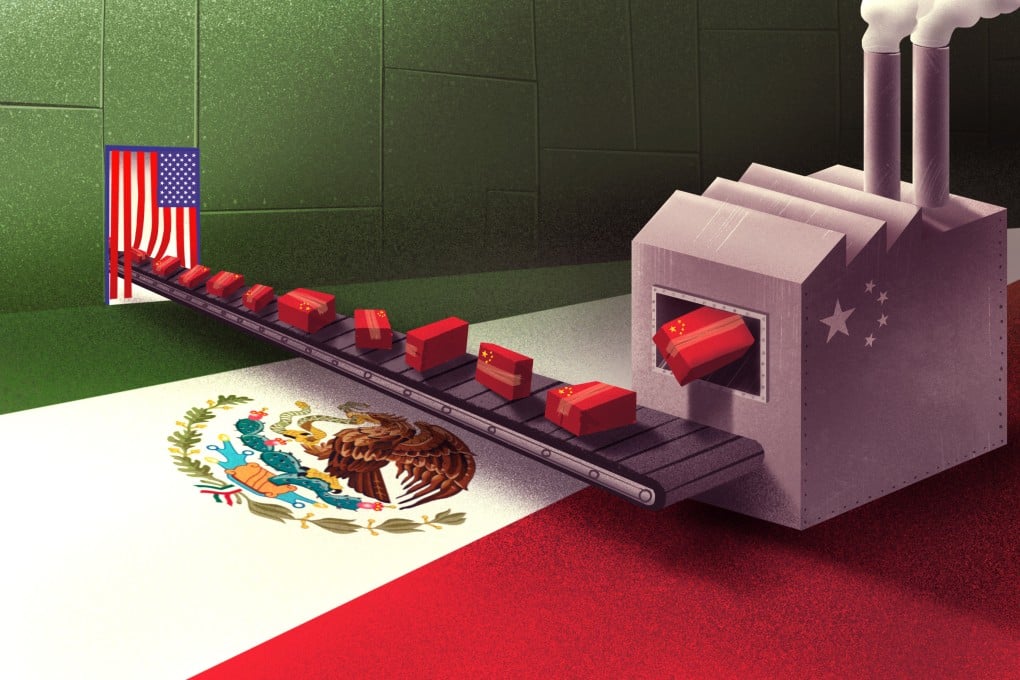

China has made Mexico a premier investment destination. Is it a US detour, or something more?

- Investment in Mexico by Chinese companies has increased in recent years, and the timing suggests heightened US trade restrictions are a factor

- The country has appeal outside its role as a bypass, however, with a relatively inexpensive labour force, high urbanisation and growing middle class

Though sidestepping Washington’s tariffs has been a prime incentive for Chinese manufacturers to boost their investments in Mexico, the United States’ southern neighbour offers far more than an alternate route into the world’s richest country – as well as its fair share of risk, analysts warned.

In the subsequent two years, value went up annually at a rate of 14 per cent, according to China’s General Administration of Customs (GAC).

China’s exports of auto components to Mexico have also increased by volume, up 2.6 times in 2023 compared to the eve of the US-China trade war in 2017.

These figures are in alignment with the global tendency toward “nearshoring”, where manufacturers relocate their business operations or production to a nearby country or one close to a major market.